- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: K1’s Partner’s Share of Investment in Pass-Through Entities

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1’s Partner’s Share of Investment in Pass-Through Entities

Hi,

I’m using Home and Business edition. I got a K1 and got stuck at Z - Section 199A Information. Some questions:

1) This K1 doesn’t have the to total amount that I can enter in Box, Z - Section 199A Information. What number should I enter?

2) I totalled up all the amount from K1’s Statement A (Rental Income, W-2 Wages, and UBIA of Qualified Property) but I’m not sure what to do with the pages after that (Partner’s Share of Investment in Pass-Through Entities)?

3) I’m living in California and this K1 includes K1 for other states. Do I need to file for these states too and how?

Thanks,

Stanely

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1’s Partner’s Share of Investment in Pass-Through Entities

1) This K1 doesn’t have the to total amount that I can enter in Box, Z - Section 199A Information. What number should I enter?

2) I totalled up all the amount from K1’s Statement A (Rental Income, W-2 Wages, and UBIA of Qualified Property) but I’m not sure what to do with the pages after that (Partner’s Share of Investment in Pass-Through Entities)? In box 20 enter nothing. Easiest is to scroll down to section D1 in the worksheet. check any that apply -PTP, Aggregate , SSTB. Even though this section says shareholder or PTP this is where the partnership info is entered. enter the 199A income (not all income is 199A) the amount should be specified on the k-1 box 20 also enter wages and UBIA on appropriate lines. in section D2 check Box A yes.

3) I’m living in California and this K1 includes K1 for other states. Do I need to file for these states too and how?

as to question 3 can't say. every state has it's own reporting requirements.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1’s Partner’s Share of Investment in Pass-Through Entities

Note that for TurboTax Online users who need to enter box 20 code Z info from a K-1, you'll use the step-by-step interview screens to make your entries. See the instructions later in this post.

For the K-1s for other states, more information is needed to answer your question. For example, the state K-1s included, the state in which the partnership is based, and the state(s) in which the partnership conducts business.

Here are the instructions for entering Form 1065 Schedule K-1 box 20 code Z amounts from your Section 199A Statement or STMT:

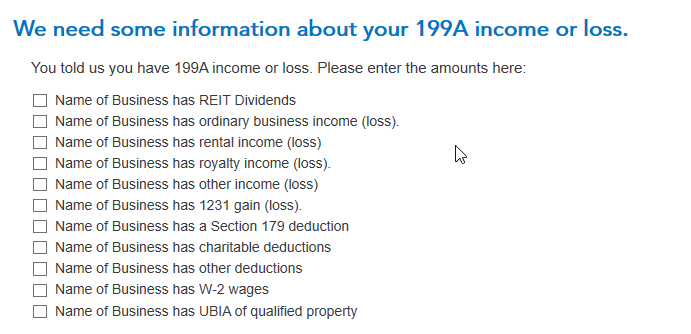

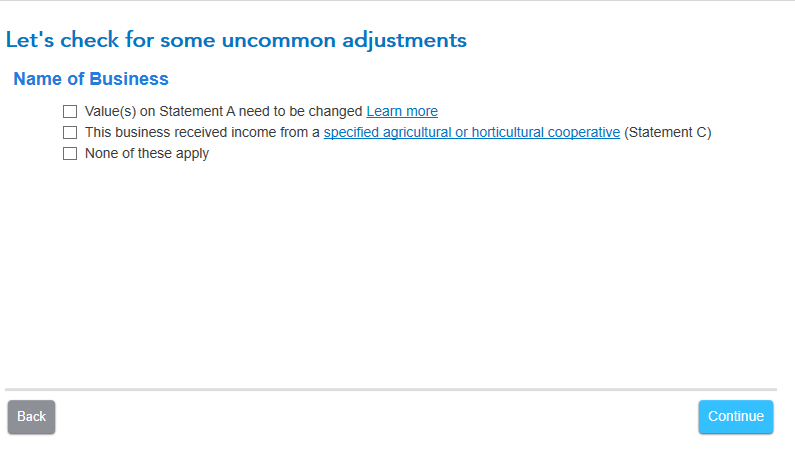

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilenearg

Level 2

colorfulcat

Level 2

likesky1010

Level 3

hqat1

Level 2

keith79797

Level 1