- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Note that for TurboTax Online users who need to enter box 20 code Z info from a K-1, you'll use the step-by-step interview screens to make your entries. See the instructions later in this post.

For the K-1s for other states, more information is needed to answer your question. For example, the state K-1s included, the state in which the partnership is based, and the state(s) in which the partnership conducts business.

Here are the instructions for entering Form 1065 Schedule K-1 box 20 code Z amounts from your Section 199A Statement or STMT:

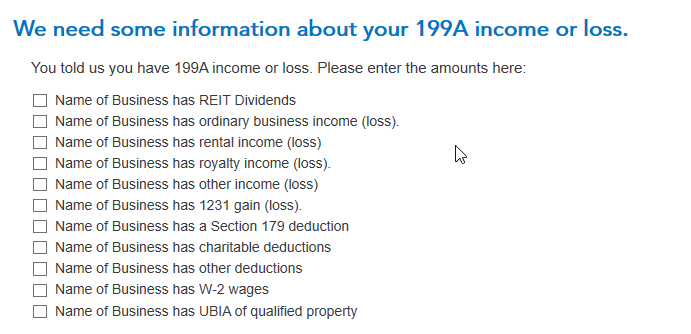

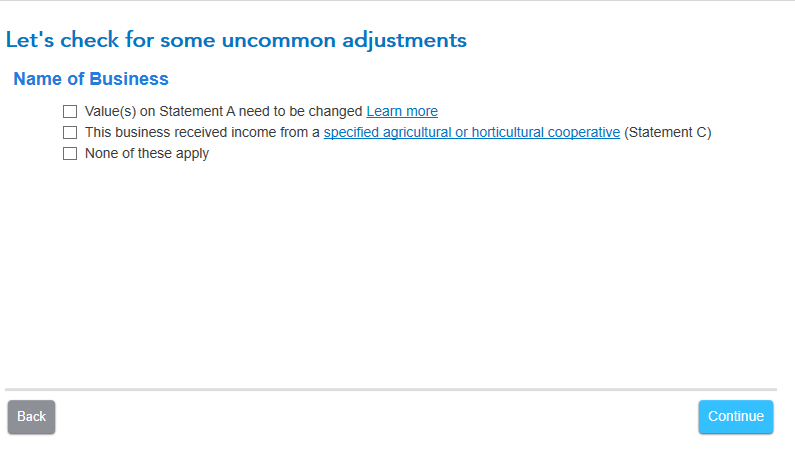

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"