- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Is the tax deadline now October 15 & does that mean we can ignore April 18?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Yes, California is extending the tax filing deadline for Californians impacted by December and January winter storms to October 16, 2023 – aligning with the IRS.

Here's more info on CA State Tax Filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

@MarilynG1 Are both the filing AND payment (I'm assuming I'll pay based on a guess from last year) deadline for Californians extended to October 16th for Federal and State taxes?

Is this something I would need to apply for? I live in one of the counties listed, but I personally was not affected.

ie, I don't have to even think about taxes until October?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Following the disaster declaration issued by the Federal Emergency Management Agency, individuals and households affected by severe winter storms, flooding, and mudslides that reside or have a business in Alameda, Colusa, Contra Costa, El Dorado, Fresno, Glenn, Humboldt, Kings, Lake, Los Angeles, Madera, Marin, Mariposa, Mendocino, Merced, Mono, Monterey, Napa, Orange, Placer, Riverside, Sacramento, San Benito, San Bernardino, San Diego, San Francisco, San Joaquin, San Luis Obispo, San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Solano, Sonoma, Stanislaus, Sutter, Tehama, Tulare, Ventura, Yolo, and Yuba counties qualify for tax relief.

The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area.

As a result, affected individuals and businesses will have until Oct. 16 to file returns and pay any taxes that were originally due during this period. This includes 2022 individual income tax returns due on April 18, as well as various 2022 business returns normally due on March 15 and April 18. Among other things, this means that eligible taxpayers will have until Oct. 16 to make 2022 contributions to their IRAs and health savings accounts.

The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at 866-562-5227 to request this tax relief.

IRS announces tax relief for victims of severe winter storms, flooding, and mudslides in California

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

I live in 92708 (Orange County). - Foutain Valley CA 92708. Am I qualified for the Oct. 16th extension automatically?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Yes. Orange county is included among the disaster areas listed by the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Thank you. I actually have a similar question: I live in Santa Clara county, which is one of the impacted area. I did some initial filing and I do owe taxes, so would it mean that:

1) I can wait until 10/15/2023 to file and pay for both federal and California taxes?

2) I can still use TurboTax to do them electronically and I won't be warned by TurboTax and won't need to pay any late penalties? I'm asking this because I see that TurboTax is still reminding me that the deadline is 04/18/2023.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Your assumptions are correct. You have the extended date to file and pay both federal and California taxes. However, you don't have to wait to file if you have your return completed. Even if you file before the deadline, your payment due date remains extended.

It takes some time to change the programming in TurboTax. This is something that is currently in progress, but you will still see the original deadline instead of the updated deadline until the programming is complete. You are aware of the change, though, so you can ignore the date that is listed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Great thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

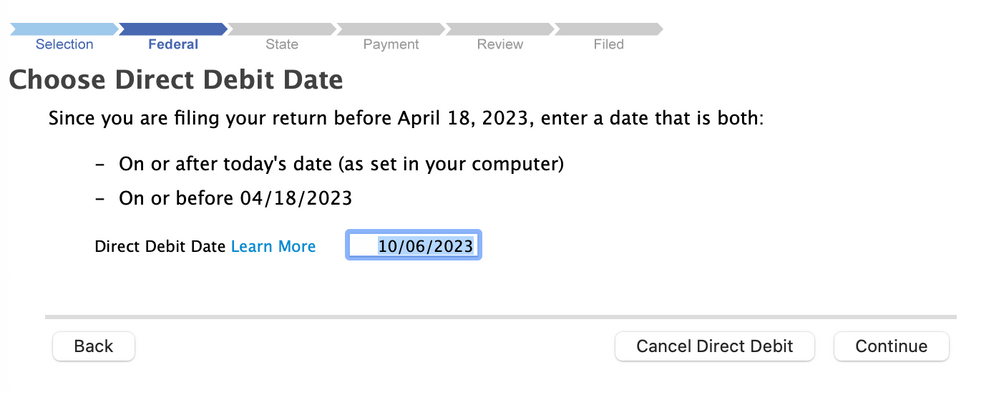

But "continue" doesn't work if you put in a date later than April 18. So, we have no choice but to submit now, and pay by April 18th, if, for example, we want to get a large state refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Can you please provide additional details, where are you in the program that the continue button doesn't work?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Turbo Tax is working to update the deadline that is shown. If you do not want to pay by 4/18/2023 and also do not want for things to update, you can set up your direct payment on your states tax website. @snowhappy9

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

if you intend to pay later and TurboTax is impeding you,

you have to select "I'll mail a check".

do not enter bank info or IRS will take you money now.

you can pay by check, or use the IRS direct pay "make a payment" page when you're ready to pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the tax deadline now October 15 & does that mean we can ignore April 18?

Hi Catina,

Just to be 100% clear, CA residents in affected counties can file on time by April 18th, but delay both their federal and state tax return payments for 2022 until October 16th, 2023?

Is the same true for 2022 contributions to IRAs?

For example, I can file my return on time before April 18th, 2023, but delay BOTH my fed/CA tax return payments and my IRA contribution until October 2023?

Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

porterhughes2002

New Member

cramanitax

Level 3

asrogers

New Member

aashish98432

Returning Member

jgilmer78

Returning Member