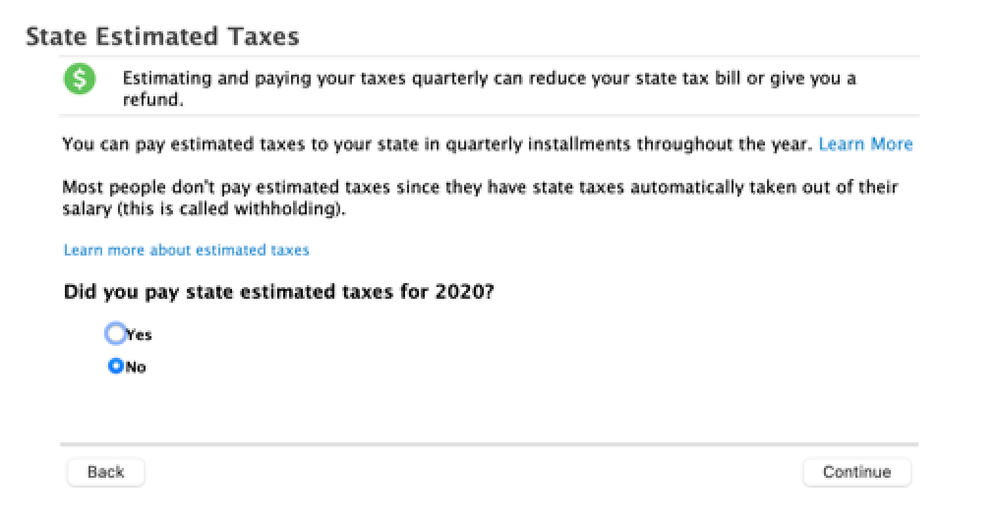

in my CA Tax return, it reports that i have entered an amount of CA quarterly estimated tax payment. This amount should be 0 . I followed the instructions

I then went back to my Fed Tax per instructions above, and click No

then went back to CA tax, and it is not fixed. ? how do i make the needed changes ?

UPDATE: I then went back to the Form 540NR and found the entry on line 82.

Questions

how was this line calculated since i don't recall entering this anywhere in my Fed return. ?

What's the correct way to fix this since , for me, it should be zero, otherwise, my refund will be "larger" than what I had paid in taxes for 2020 ?