- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: If you have received a letter from the IRS asking for for...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

I have the same issue. The instructions released by TT do not help at the moment. It says I have to wait until late February to use the Turbo Tax Online function for 2019! Looks like my refund will be delayed at least a month or two!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

"Amend Using Turbo Tax Online" is not available until late February! Is there a work around for this issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

@SteveOpp wrote:

"Amend Using Turbo Tax Online" is not available until late February! Is there a work around for this issue?

No. But do not amend too soon. You have 3 years to amend.

You should *wait* until your return has been processed and you receive your refund or conformation that any tax due has been paid. (If you file an amended return while you first return is being processed it can cause extended delays for both returns if two returns are in the system at the same time). In addition, if the IRS makes any change on your original return, you might end up having to amend the amendment – a sticky process that can take a year or more).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

Hi, nothing comes up on document for me to review. Just wants me to buy something. TIA Joe

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

For 2019 use these instructions to generate a Form 8962:

- Sign In to Turbo Tax

- Click Tax Home, in the upper left. Scroll down to Your Returns and Documents

- If you do not see options under that heading, look to the right and click on Show

- Make sure the correct year is underlined in blue

- Select Add a State and then

- Click on the Federal and then

- Click on Deduction and Credits in the upper portion of the page.

- Scroll down and click on Medical, Show More.

- Choose Affordable Care Act (Form 1095-A) by clicking on Start or Revisit

- Enter your 1095-A form and generate an 8962 form.

- Click through the ACA section

- Select Tax Tools, on the left menu

- Select the Print Center

- Print, save, or preview this year’s return and click in the box to select federal returns

- Click on View or Print Forms to print the forms you need

- You can view the forms from here and select just to print the pages with

- Form 8962 and Form 1040 (if needed)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

I do not know what to do I am very worried about this should I amended

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

No, don’t amend your return, just follow the instructions that LindaB1993 has provided above. Above all, just follow the IRS’s instructions.

Try not to worry. The IRS just sees, from its records, that you should have filed Form 8962 with your return. That’s all that it means at this point.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

Hi,

This is very helpful information. The one issue I am having while following the steps is that it does not have the option to amend on turbo tax online. The only option it shows is for downloading the turbo tax desktop even for previous years, or is it the same thing and that is just another part of the steps? @DeanM15

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

@yb1 wrote:

Hi,

This is very helpful information. The one issue I am having while following the steps is that it does not have the option to amend on turbo tax online. The only option it shows is for downloading the turbo tax desktop even for previous years, or is it the same thing and that is just another part of the steps? @DeanM15

Form 1040X is estimated to be available on 02/27/2020

On the Tax Home web page when the Form 1040X for amending a 2019 tax return becomes available there will be a link - Amend (change) return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

What is going on this year with the refunds I have filed my taxes with TT so many times no problem and now nobody knows anything.......so sad and scary. I did received a letter nothing else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

I just received that one letter say do not do anything and it has been like that no changes at all "is being processed " nothing else. What should I do just wait?????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

It may be that your return is just under review. Follow the instructions in the IRS letter.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

do I need 8962 form for 2019 taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

If you received a form 1095-A or are listed as covered by a Marketplace policy (under the Affordable Care Act , aka, "Obamacare"), then, yes, you need to add the 8962 to your return.

You do that by entering the form 1095-A to your return, from which TurboTax will generate the 8962. If you don't have the 1095-A, then visit or contact your Marketplace for a copy.

Once you have your 1095-A, you can see how to add or create the 8962 by visiting this TurboTax FAQ on creating the 8962.

If you received a letter from the IRS requesting a form 8962, then please be sure to follow the instructions in the letter - for example, normally the IRS does not want you to amend your return (even if Turbotax thinks you are to get the form created) - they generally just want the 8962 itself. Be sure to follow the instructions in the letter carefully.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My files say accepted but I got a letter in the mail saying my federal return won't be processed until I send in a 1095?

@DeanM15 wrote:TurboTax changed the location for the entry of the Form 1095-A when Congress lowered the penalty for not having health insurance to $0.00.

For 2019 use these instructions to generate a Form 8962:

- Sign In to Turbo Tax

- Click Tax Home, in the upper left. Scroll down to Your Returns and Documents

- If you do not see options under that heading, look to the right and click on Show

- Make sure the correct year is underlined in blue

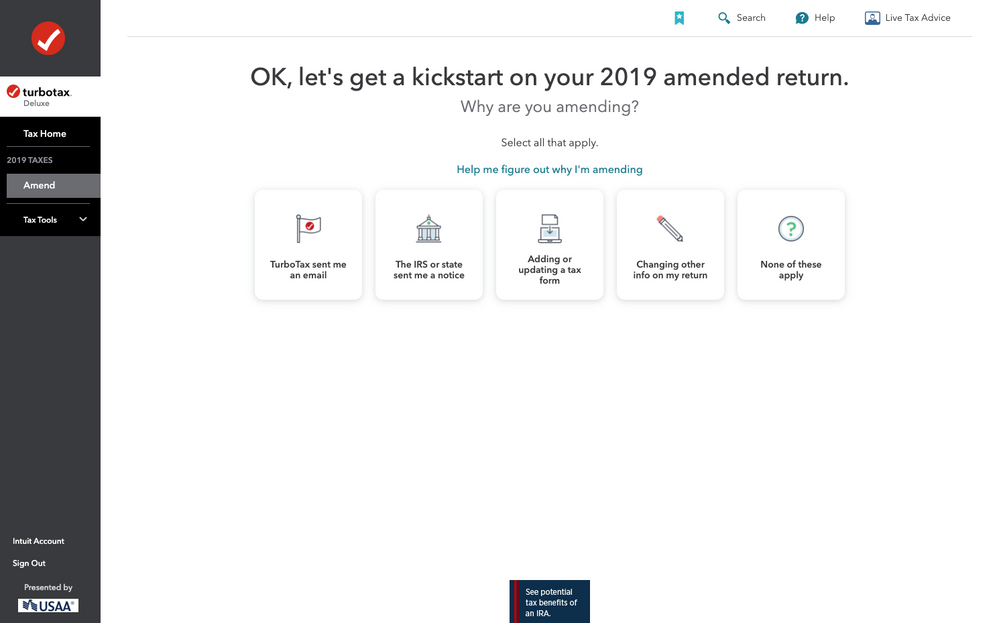

- Select Amend (change) return and then Amend Using Turbo Tax Online

- Do not click continue on the “We’ll help you change (amend) your return” screen. Simply go to the left menu and

- Click on the Federal and then

- Click on Deduction and Credits in the upper portion of the page.

- Scroll down and click on Medical, Show More.

- Choose Affordable Care Act (Form 1095-A) by clicking on Start or Revisit

- Enter your 1095-A form and generate an 8962 form.

- Click through the ACA section

- Select Tax Tools, on the left menu

- Select the Print Center

- Print, save, or preview this year’s return and click in the box to select federal returns

- Click on View or Print Forms to print the forms you need

- You can view the forms from here and select just to print the pages with

- Form 8962 and Form 1040 (if needed)

I don't see an option for 'federal' for lines 6 and 7.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Meldenillo

New Member

bmtransue

New Member

amending

New Member

ronscott2003

New Member

kacib230

New Member