- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Yes, after you enter the 1099-DIV information, there is a page titled "Tell us if any of these uncommon situations apply to you" and you can check "I need to adjust these dividends." and then enter the adjustment on the following screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Can you answer each of my questions separately please? I already know what you said. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Divorce is a dissolution of marriage or termination of marital status. During the divorce process, you can file separately or head of household (with qualifying dependent), if you

were separated more than 6 months.

If a divorce decree has been granted, and you received a joint tax form, you either report the full amount on your income tax or your spouse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Can you answer each of my questions separately please? I already know what you said. Your answer does not really answer any of my questions. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Yes, you can complete your tax return to include the dividends whether or not it is from a joint account. You can include only half of the amount if you want to do that as well.

If the 1099-DIV shows your social security number you can nominee the other half to your other spouse. Follow the steps below.

After entering the full amount on your return, follow these steps:

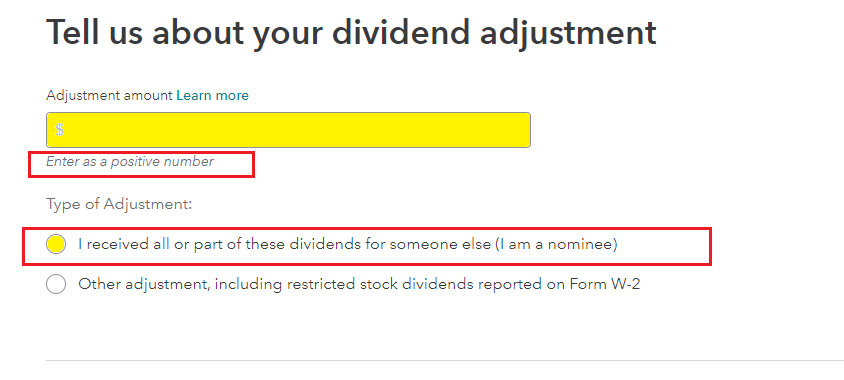

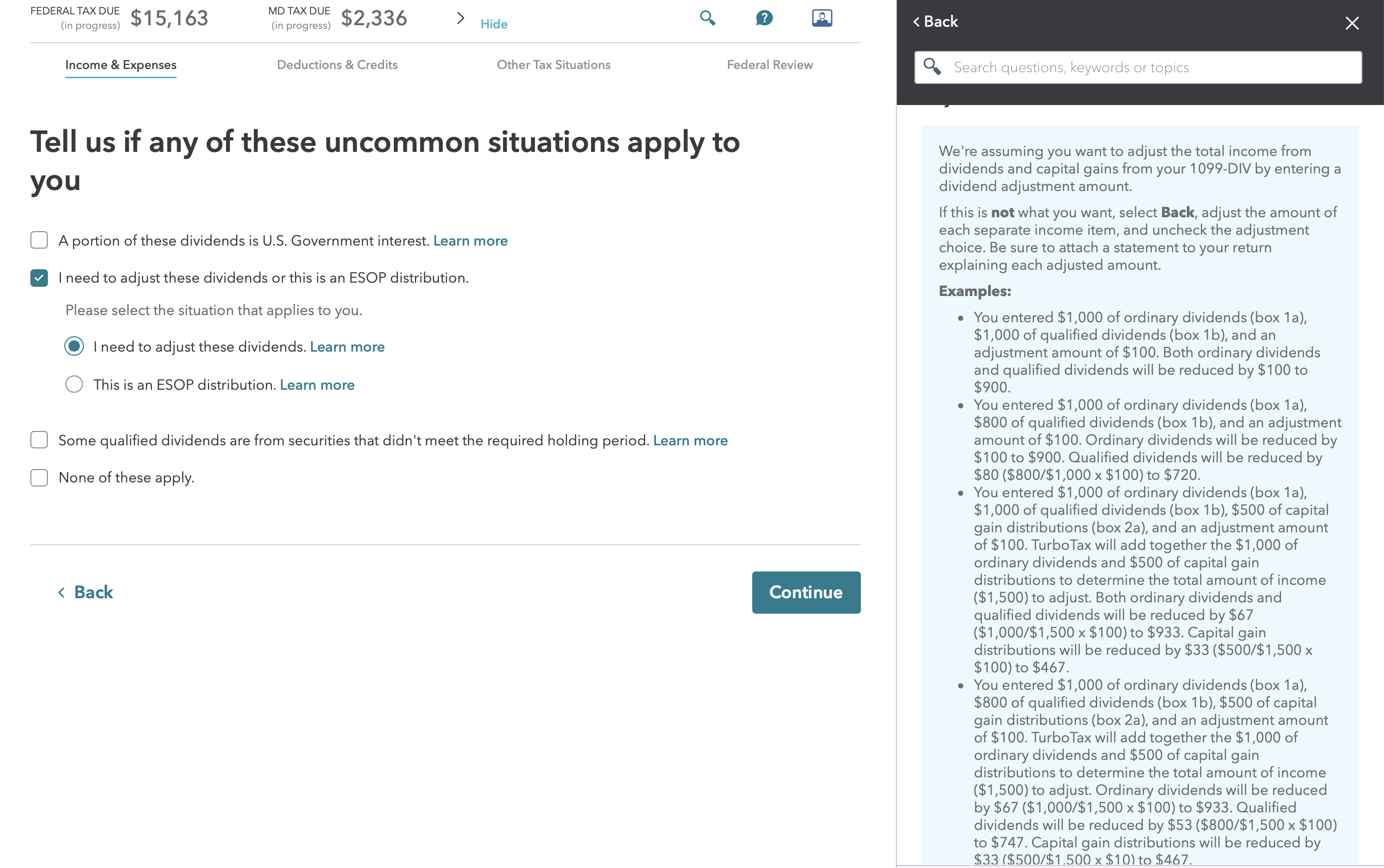

- After you click Continue when you have finished entering the information from your Form 1099-DIV, the next screen is titled “Tell us if any of these uncommon situation apply to you”

- Select “I need to adjust these dividends” > select again I need to adjust these dividends by checking the box

- Continue

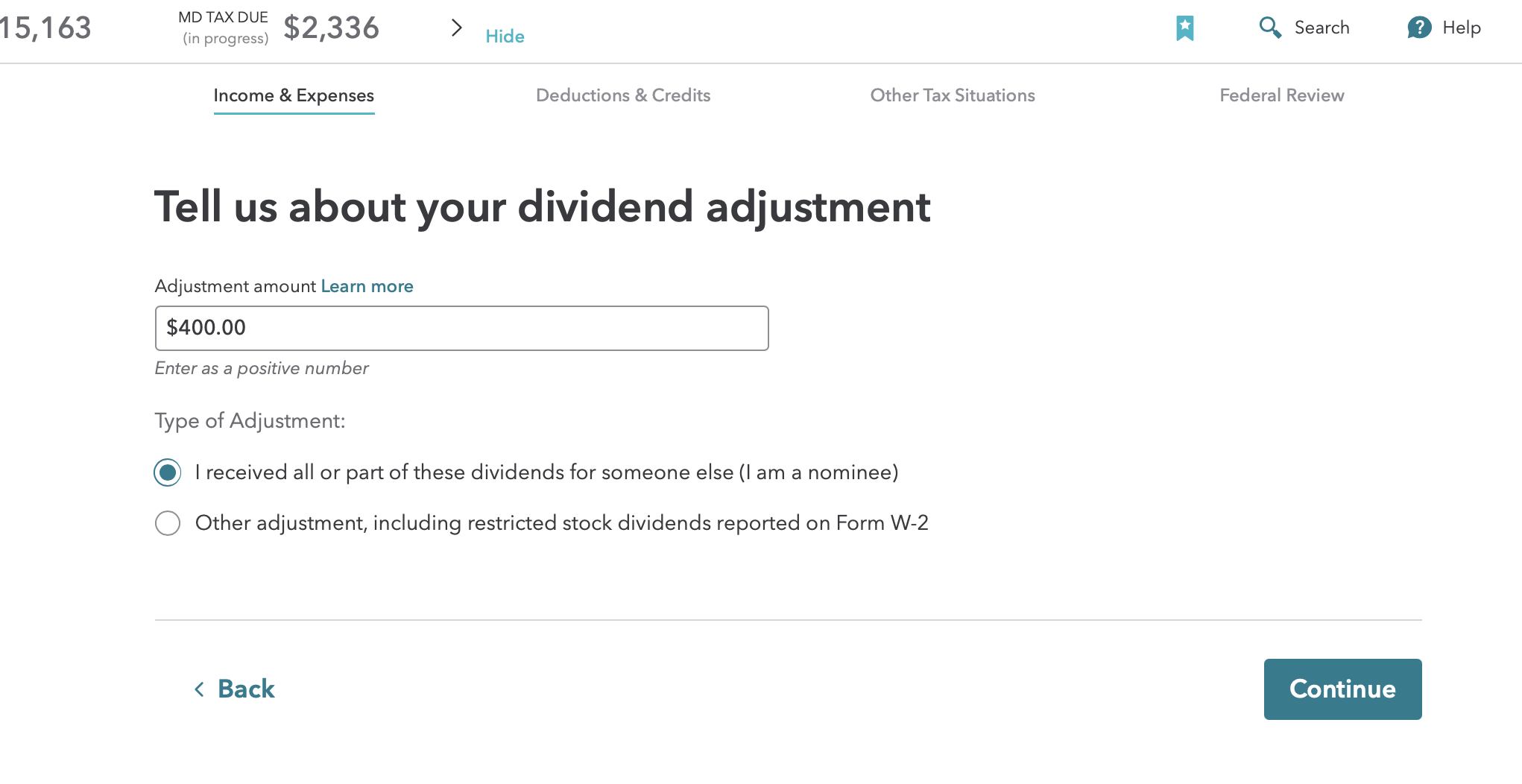

- Then you will see a screen titled “Tell us about your dividend adjustment”

- Enter the amount as a positive number and the reason for the adjustment. This will make the proper entry on your Schedule B.

- Review the images below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Same question, but do you have to do anything further to notify the IRS who is paying the other half? I.e., even though it was a joint account, only one SSN is associated with the account. So, for 1099-DIV income and 1099-B proceeds do I simply follow the extra step of specifying what portion I owe and that's it, or do I have to fill out some other form saying who is paying the rest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Follow the extra step (adjust the dividends) and notify the other recipient that they must report their share on their return.

The "extra step" is to enter the amount of the dividend that belongs to the other party. It is entered as a positive number (see sample screen shots below).

If you received dividends as a nominee, you must give the actual owner a Form 1099-DIV (unless the owner is your spouse) and file Forms 1096 and 1099-DIV with the IRS.

For more details, see the General Instructions for Certain Information Returns and the 2020 Instructions for Form 1099-DIV - Internal Revenue Service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

Hello,

I am a nominee for 1099-DIV and I must divide all boxes by 50%. I've already filed a 1099-DIV form to the other person. I'm very confused about how to apply the adjustment. Please consider the following example: Let's say on my 1099-DIV, I have $1,000 in box 1a, $1,000 in box 1b, $10,000 in box 2a and $500 in box 11. Total is $12,500; the half of which is $6,250; and this is the amount I filed a 1099-DIV for other person. Will I put $6,250 in the adjustment amount section? According to the examples, If I do so my net result will not be $6,250 (50%) in the end due to complicated calculations TurboTax does to reduce the amount. How to overcome this problem? Also, how box 11 and 12 are adjusted? Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I divorced during 2019 but have a 1099[Div form for a joint account do I just complete my tax return with half of the amount?

From a related post by gregglee:

"In TurboTax manually enter the 1099 DIV in two parts. One contains only the CG entry (for tax return this means only LT CG). The other contains only the Dividend entries (which for tax return includes DIV and ST CG). Make the correct adjustment in each part. I append the 1099 "received from" name with CG and DIV to avoid duplicate names."

You could do the same for the tax-exempt dividends. This treatment would allow you to confirm the results before you finalize your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

irunalot

Level 2

Raph

Community Manager

in Events

Raph

Community Manager

in Events

Raph

Community Manager

in Events

flagflingr

New Member