- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

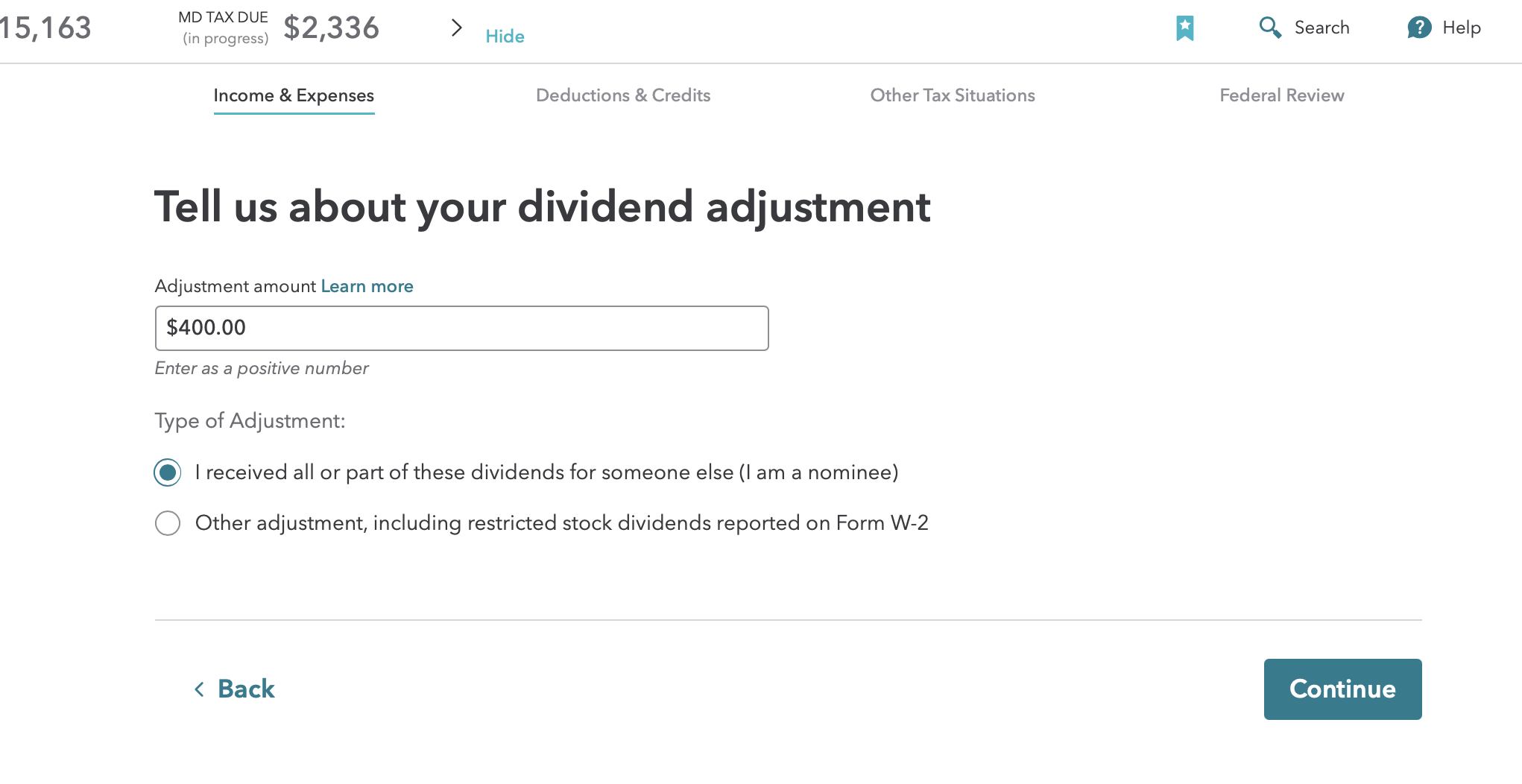

Follow the extra step (adjust the dividends) and notify the other recipient that they must report their share on their return.

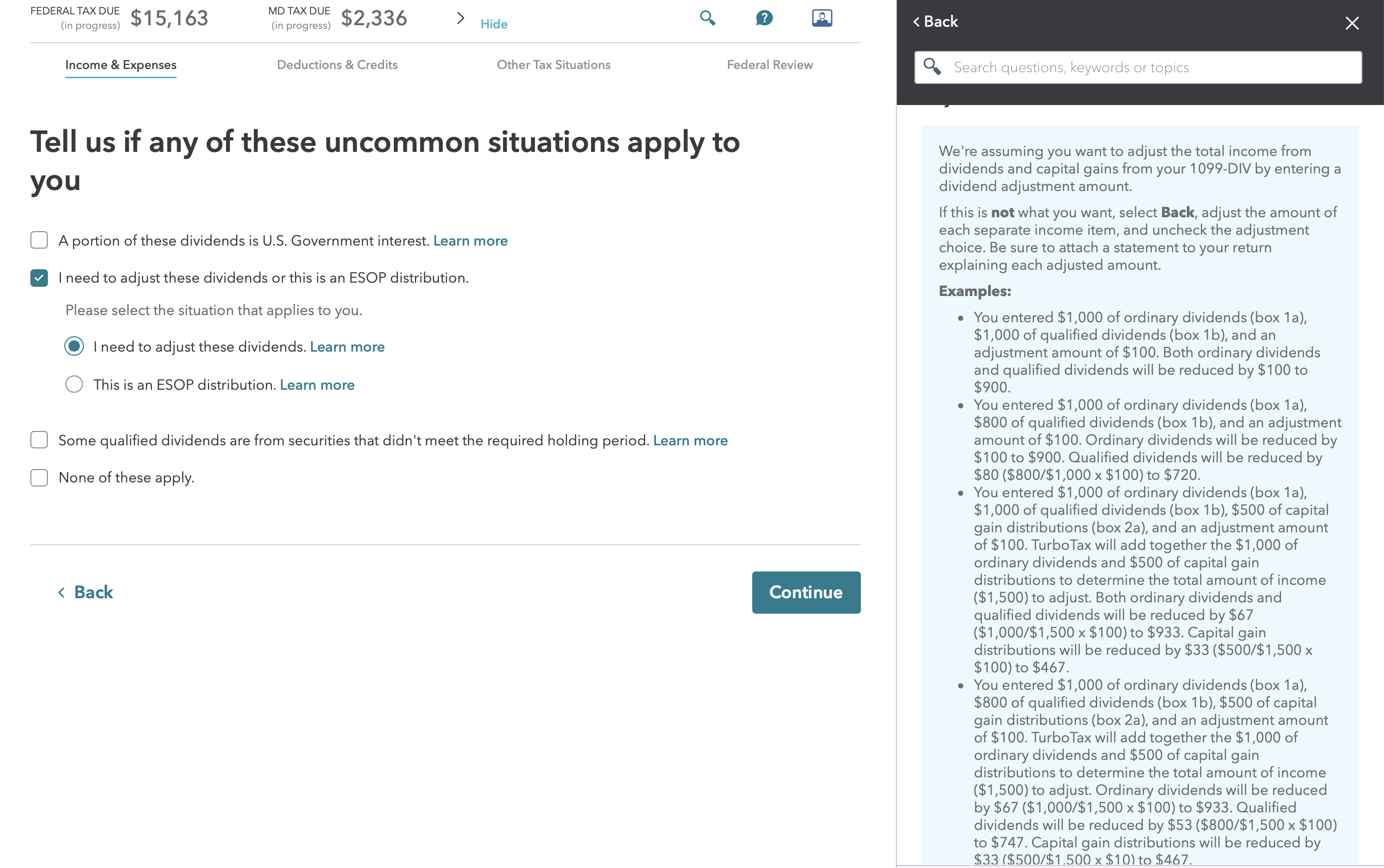

The "extra step" is to enter the amount of the dividend that belongs to the other party. It is entered as a positive number (see sample screen shots below).

If you received dividends as a nominee, you must give the actual owner a Form 1099-DIV (unless the owner is your spouse) and file Forms 1096 and 1099-DIV with the IRS.

For more details, see the General Instructions for Certain Information Returns and the 2020 Instructions for Form 1099-DIV - Internal Revenue Service

March 21, 2021

9:12 AM