- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, you can complete your tax return to include the dividends whether or not it is from a joint account. You can include only half of the amount if you want to do that as well.

If the 1099-DIV shows your social security number you can nominee the other half to your other spouse. Follow the steps below.

After entering the full amount on your return, follow these steps:

- After you click Continue when you have finished entering the information from your Form 1099-DIV, the next screen is titled “Tell us if any of these uncommon situation apply to you”

- Select “I need to adjust these dividends” > select again I need to adjust these dividends by checking the box

- Continue

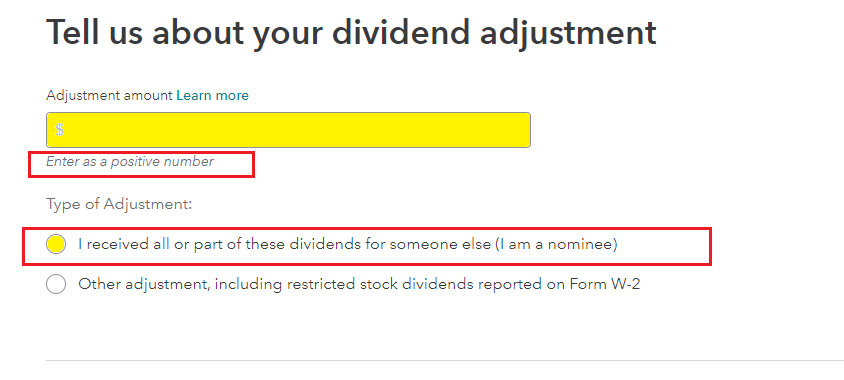

- Then you will see a screen titled “Tell us about your dividend adjustment”

- Enter the amount as a positive number and the reason for the adjustment. This will make the proper entry on your Schedule B.

- Review the images below

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 23, 2021

9:05 AM