- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I notice that my filing status looks as if my son file hoh and not me the adult am I miss rea...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

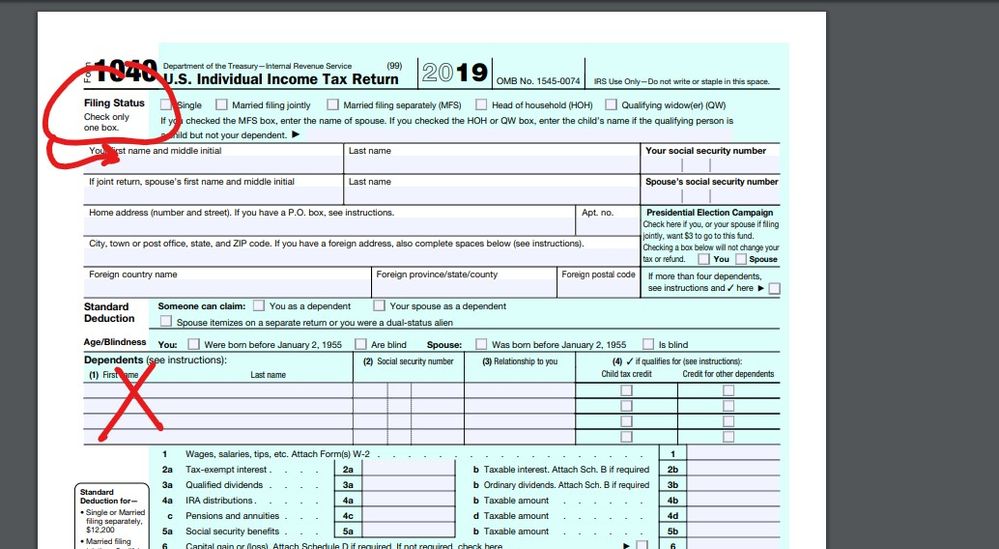

I notice that my filing status looks as if my son file hoh and not me the adult am I miss reading this return form

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I notice that my filing status looks as if my son file hoh and not me the adult am I miss reading this return form

Did your son file his own tax return as Head of Household and include you on his tax return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I notice that my filing status looks as if my son file hoh and not me the adult am I miss reading this return form

The filing status applies to the taxpayer. If this is your tax return the Head of Household classification belongs to you.

On the other hand it is possible that if your son supports you (including other conditions) that he could claim Head of Household.

The key is that the TAX STATUS belongs to whoever the tax return is prepared for.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I notice that my filing status looks as if my son file hoh and not me the adult am I miss reading this return form

The HOH filing status belongs to the taxpayer & spouse NOT to the dependent ... so who is listed as the taxpayer on your son's return ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rebecca-williams

New Member

asrogers

New Member

anthonybrewington21

New Member

user17558933183

Returning Member

karljian

Level 2