- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I need to know how to allocate the exemptions and tax breaks manually on an injured spouse fo...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to allocate the exemptions and tax breaks manually on an injured spouse form. Turbo tax is setting the exemptions as 0, but we have a family of 5.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to allocate the exemptions and tax breaks manually on an injured spouse form. Turbo tax is setting the exemptions as 0, but we have a family of 5.

TurboTax is correctly setting the exemptions amount to 0.

Starting with the 2018 tax return, claiming personal exemptions was eliminated from the Federal tax return due to the Tax Cuts and Jobs Act. There is no longer a deduction on your return for personal exemptions, so you cannot allocate them between you and your spouse.

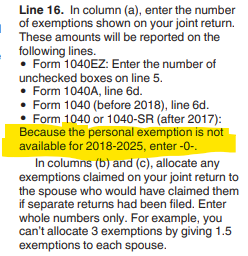

Thus far, Form 8379 still shows the line for exemptions, but the IRS instructions for that form say to enter '0'. Here is a link to the full document: Instructions for Form 8379

See the excerpt below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to know how to allocate the exemptions and tax breaks manually on an injured spouse form. Turbo tax is setting the exemptions as 0, but we have a family of 5.

Thank you for the reply. I appreciate it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

helloerinamanda

Level 1

skampbel

New Member

jstroebel

Level 2

TechieGal

Level 3

alazy

New Member