- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I live in Pa. but get my pension from okla. Turbo tax is trying to apply my Oklahoma pension ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Pa. but get my pension from okla. Turbo tax is trying to apply my Oklahoma pension to Pennsylvania

I receive my pension from Oklahoma and Turbo tax insist on applying it to Pennsylvania. I didn’t earn a dime in Pa.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Pa. but get my pension from okla. Turbo tax is trying to apply my Oklahoma pension to Pennsylvania

Where do you live? Pennsylvania? You generally report pension income in the state where you received it, not the state in which you contributed the money to it.

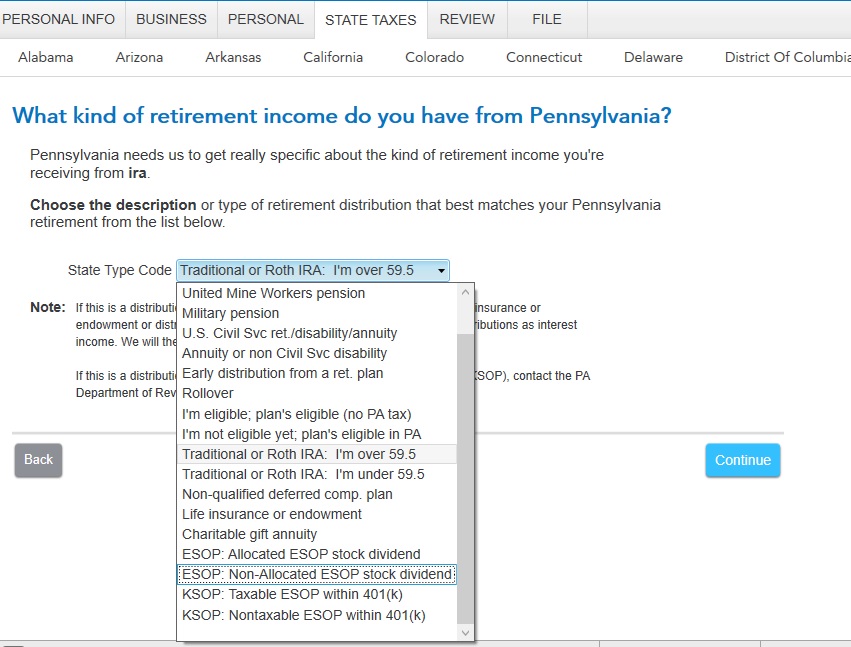

Note, however, that Pennsylvania does not tax a lot of retirement income. That's why you are asked to describe each 1099-R that you received.

You may want to contact your retirement plan administrators to see if the plan is considered a "qualified plan" for Pennsylvania purposes. See this discussion of the taxation of retirement plan distributions at the Pennsylvania Institute of Certified Public Accountants. (The state website does not have as clear an explanation).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilenearg

Level 2

ajs813

Returning Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

sjcbens

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Lukas1994

Level 2

rodiy2k21

Returning Member