- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I got free stocks through Webull's promotion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Once the free stocks are sold, then report them under investments with -0- cost.

Unless trading is your livelihood, this is done under the Wages & Income tab under Investment Income.

Scroll down to Investment Income and Show More to find the applicable category, Stocks, Mutual Funds, Bonds, Other (1099-B) even if Form 1099-B was not received.

If you did not receive Form 1099-B, continue through the interview as if you had received Form 1099-B.

At Now, we'll enter one sale on your 1099-B, from the sales section drop-down, select short or long-term did not receive 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Hi KathrynG3,

I've been following all of your comments on this topic and I want to start by thanking you for helping everyone with this complicated mess. I noticed you answer has changed since 2019. 2019 taxes filed in 2020 you were recommending a different way to deal with this issue. Now for 2020 taxes filed in 2021 I see you recommending this new method using a 1099-B (even though he received a 1099-misc). So I just want to confirm with you the correct way for me to file my taxes with my specific situation.

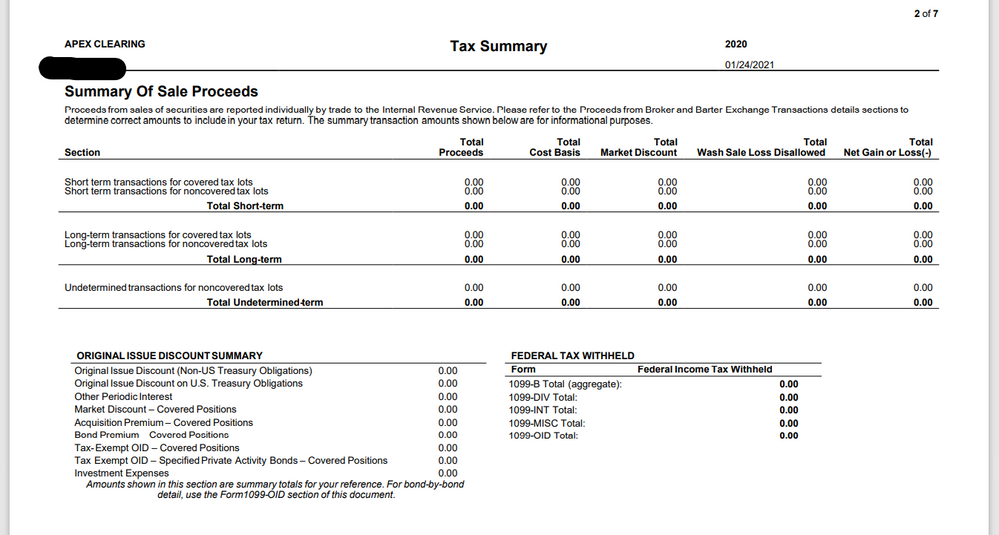

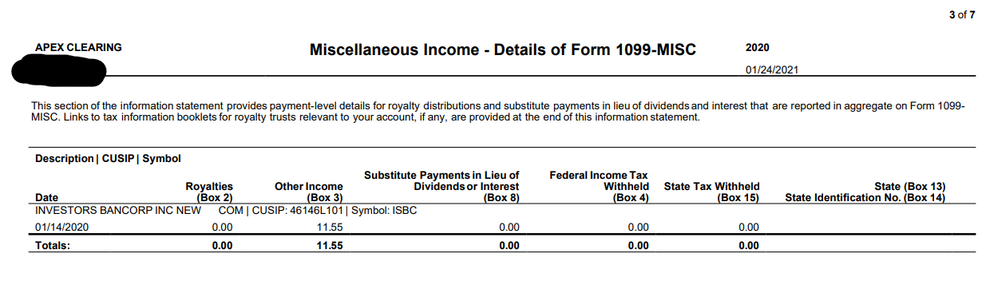

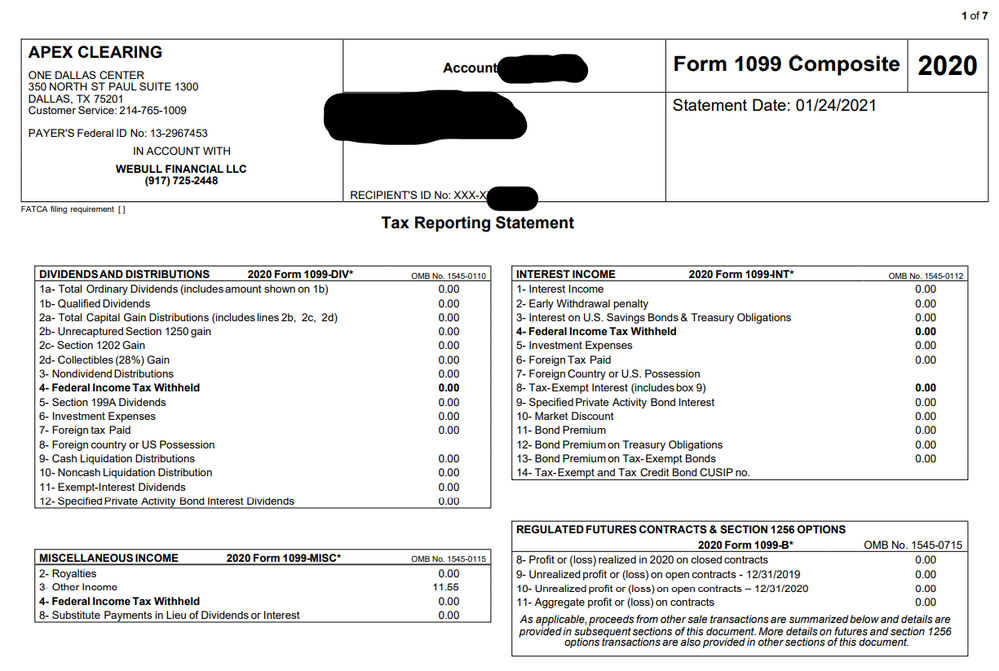

I received from Webull a form 1099 Composite. That includes 1099-DIV,INT,B, and MISC incomes if applicable. This may explain why many users experience difficulty importing their information from Webull. In my case I only have 1099-MISC income to report.

At any rate, here's my specific scenario. I was given two free stocks in 2020. One was ISBC and one was Sprint. When I turn to the "details of form 1099-MISC" page I find only the ISBC in "Other Income Box 3" valued at $11.55. This matches the only income the show on the Composite 1099 page as well. I did not sell this stock until later in 2021.

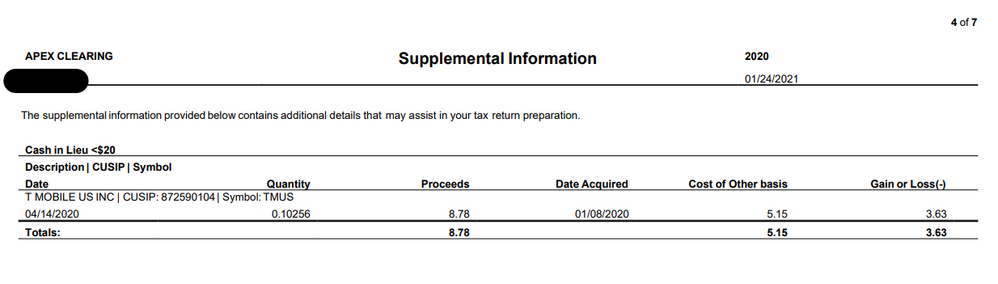

As for my Sprint stock. Sprint merged with T-Mobile in 2020 and they paid me cash in lieu of stock. So I no longer have a share of stock in either company. It is shown on the next page, "Supplemental Information". It shows it was acquired 01/08/2020 and cashed out 4/14/2020. Proceeds were $8.78 with a cost basis of 5.15 giving me a net $3.63 gain.

I'm confused why the ISBC share of stock that wasn't sold yet is listed on my 1099-MISC box 3, but the Sprint stock that was cashed out is not listed anywhere for me to report. Could you please give me your expert advice as to how I should deal with report

I tried entering it in the 1099-MISC section and as others have encountered it wants me to start entering all this business information. I didn't feel this was appropriate and deleted the 1099-misc and business information that was entered.

Thanks, Derek

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Hi Derek,

You're welcome-we are happy to help!

Yes, it is acceptable to report Form 1099-MISC as an investment sale for free stock in some cases.

Your cash in lieu can use this method to report your $8.78 sale, $5.15 basis and $3.63 gain.

- To confirm the $5.15 cost basis, calculate the cash in lieu cost basis as the dollar amount of the basis for all shares received including the fractional share owned in Sprint before the merger to T-Mobile when you were paid Cash in Lieu. Take this per share basis and multiply that per share by the fraction of a share being reported.

For the amount received on Form 1099-MISC, to avoid the self-employment and business related questions, report it in the Less Common Income/Other Reportable Income section by following these steps. Since it was received in 2020, it is reported as income. This will create cost basis for next year when it was sold.:

- From the left menu, select Federal.

- At Wages & Income, scroll all the way down to Less Common Income and click Show More.

- Select the last listed option for Miscellaneous Income 1099-A, 1099-C, click Start.

- Next, select the last listed option Other Reportable Income.

- Did you receive any other taxable income? click Yes.

- Other Taxable Income: Enter your description including Webull, and Form 1099-MISC as received, the amount and click Continue and Done.

- Disregard the comment "Do not enter income from Form 1099-MISC here" because this is meant to guide taxpayers reporting typical 1099-MISC income. Your case is less common and this is how to report it in TurboTax.

When reporting the sale in 2021, use the amount reported in 2020 as income as your cost basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Hi Kathryn,

Concerning the Sprint to T-Mobile cash in lieu, there was only one share. No fractional anything to have to figure. What you see on page 4 is it. Not sure how to report this though, because they didn't include it on any of the 1099's?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

The Cash in Lieu can be added separately. While you could report the Cash in Lieu as Other Income, it actually makes more sense in your case to report the Cash in Lieu in the Short-Term section of Schedule D with Box C selected.

- To do this in TurboTax, follow these steps:

- Inside TurboTax, in the search box, enter investment sales.

- Follow the prompts from the summary page to add more sales and enter this transaction by following the prompts.

- Answer yes, from Form 1099-B. Enter it as one sale at a time.

- Enter in the sale proceeds and cost with Box B selected, short-term, not reported.

- This is not listed on your APEX Clearing, but could have technically been in the Undetermined transactions in noncovered tax lots section. By entering it with Box B checked, this cash will be properly reported.

The cash in lieu I saw listed showed a quantity of 0.10256, and I presumed this was a fractional share and perhaps the cost basis could be increased. However, this is not going to have a tax impact on your return and it is completely fine to enter it as received without any recalculation.

You could also make a case for checking Box C, since the broker only included the Cash in Lieu as supplemental information. Either Box B or Box C is acceptable to report the transaction as not reported to the IRS. The tax impact is the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Once you do that, do you delete form 1099-Misc that was originally imported?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

To clarify, what did you get the 1099-Misc for?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Webull’s free stocks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

So I keep getting the instance where my 1099 misc wants me to report somewhere else…like a schedule c, but this was not a self employed job. These were 2 free Webull stocks that I sold and it was reported as other income in box 3. I keep getting a review alert and taken in circles. This is all I need to do to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

I followed your instructions and on the page Other Taxable Income it says "Do NOT enter income reported on Form 1099-MISC"

I'm confused

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Please follow these steps to enter the 1099-MISC:

Under Wages and Income, scroll down to Income from 1099-MISC.

- Enter the 1099-MISC exactly as printed, and then Continue.

- Enter "promotional bonus" under "Other".

- Describe the reason for this 1099-MISC:

- Select None of these apply, then Continue.

- Select No, it didn’t involve work….. and Continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Hello, I also got free stocks on Webull in 2021, but i have not sold them at all, i did get a 1099 composite and it appears as other income in 1099 MISC for $16.80 total. Can I just follow your steps from 1-6 and use " Free stocks from Webull LLC and a 1099 MISC was received"for the description and 16.80 for the amount and then click continue and done.

also , i invested in 500 dlls in crypto last year and i does not show up in the 1099 composite is that normal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

Yes, you can enter the 1099-MISC for the stock reward as Other Income as outlined by @ColeenD3 above.

It is normal that your purchase of an investment did not appear on your 1099. It is not taxable and therefore does not need to be reported on a 1099 or on your tax return. It is only taxable income when you sell the investment for a gain or a loss or the investment gives you interest or dividends.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got free stocks through Webull's promotion

I followed ColeenD3 advice, however, there is a question after the last "Continue"...

Did the Free stocks from WeBull involve an intent to earn money? Yes..... or No....

Obviously, I invested to make money, however, if I answer "Yes" it goes into the Schedule C rabbit hole.

If I answer "No" here will this be acceptable?

Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

optca50

Level 3

ethanroth9112

New Member

MKW31

Level 1

4Cordelia

Level 1

4Cordelia

Level 1