- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi KathrynG3,

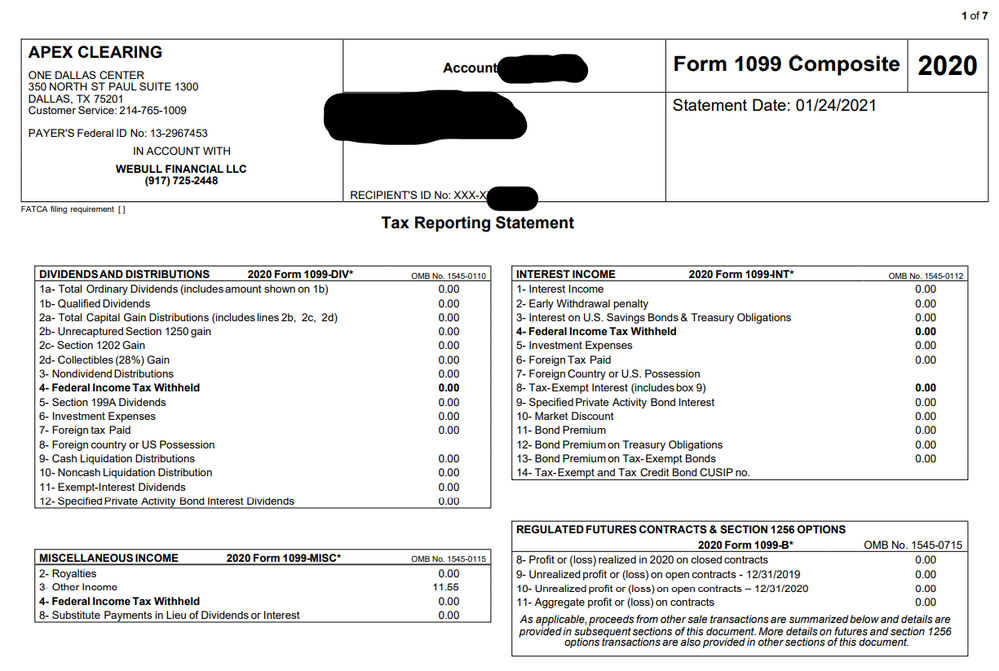

I've been following all of your comments on this topic and I want to start by thanking you for helping everyone with this complicated mess. I noticed you answer has changed since 2019. 2019 taxes filed in 2020 you were recommending a different way to deal with this issue. Now for 2020 taxes filed in 2021 I see you recommending this new method using a 1099-B (even though he received a 1099-misc). So I just want to confirm with you the correct way for me to file my taxes with my specific situation.

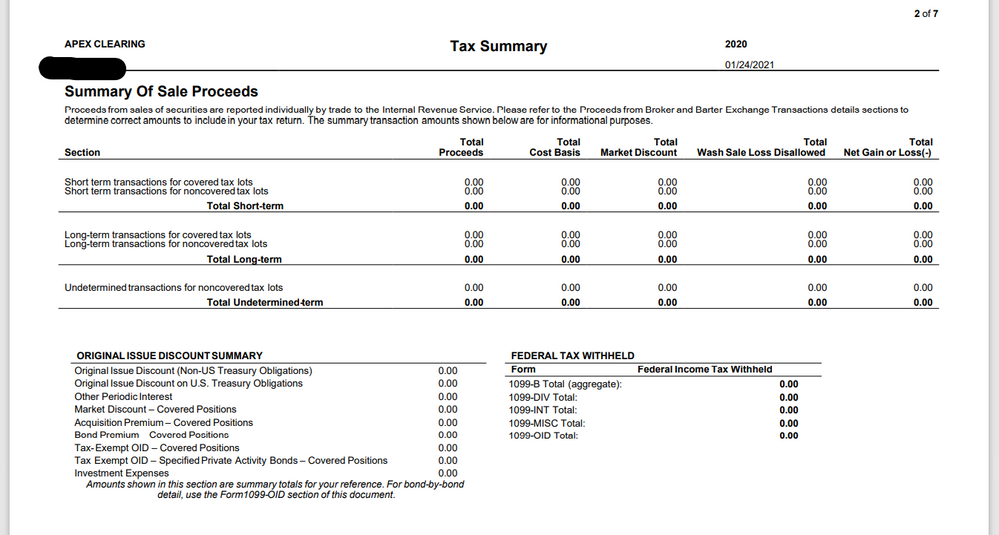

I received from Webull a form 1099 Composite. That includes 1099-DIV,INT,B, and MISC incomes if applicable. This may explain why many users experience difficulty importing their information from Webull. In my case I only have 1099-MISC income to report.

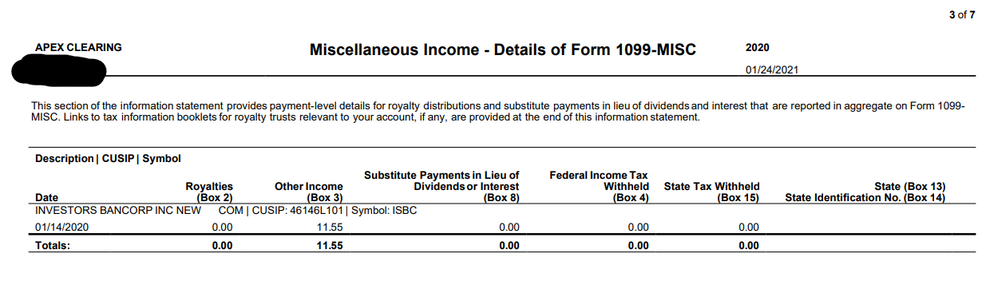

At any rate, here's my specific scenario. I was given two free stocks in 2020. One was ISBC and one was Sprint. When I turn to the "details of form 1099-MISC" page I find only the ISBC in "Other Income Box 3" valued at $11.55. This matches the only income the show on the Composite 1099 page as well. I did not sell this stock until later in 2021.

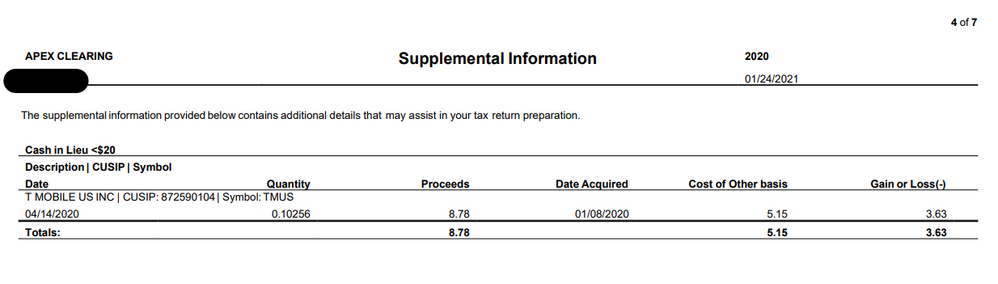

As for my Sprint stock. Sprint merged with T-Mobile in 2020 and they paid me cash in lieu of stock. So I no longer have a share of stock in either company. It is shown on the next page, "Supplemental Information". It shows it was acquired 01/08/2020 and cashed out 4/14/2020. Proceeds were $8.78 with a cost basis of 5.15 giving me a net $3.63 gain.

I'm confused why the ISBC share of stock that wasn't sold yet is listed on my 1099-MISC box 3, but the Sprint stock that was cashed out is not listed anywhere for me to report. Could you please give me your expert advice as to how I should deal with report

I tried entering it in the 1099-MISC section and as others have encountered it wants me to start entering all this business information. I didn't feel this was appropriate and deleted the 1099-misc and business information that was entered.

Thanks, Derek