- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I answered a question wrong and it said call xxx-xxx-xxxx and mention info sharing what do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I answered a question wrong and it said call xxx-xxx-xxxx and mention info sharing what do I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I answered a question wrong and it said call xxx-xxx-xxxx and mention info sharing what do I do?

If you are referring to talking somebody at the customer service department, please click here: TurboTax contact

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I answered a question wrong and it said call xxx-xxx-xxxx and mention info sharing what do I do?

I am filing for myself. I don’t understand why I had to call the 888# and say “Info sharing”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I answered a question wrong and it said call xxx-xxx-xxxx and mention info sharing what do I do?

I’m filing a 1099MISC for myself and small business and it asked me to call[phone number removed] and I don’t know why... please help me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I answered a question wrong and it said call xxx-xxx-xxxx and mention info sharing what do I do?

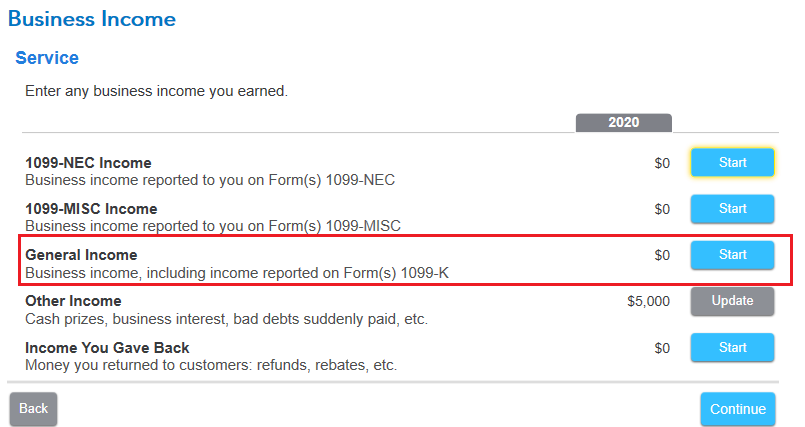

It depends on exactly what you entered. Since you are filing the Form 1099-MISC as income for your small business, it may be a solution to delete this form. Next add the income to your business as though it was cash receipts. This will include the income on your business and allow you to continue to complete your return.

For tax year 2020, nonemployee compensation that was previously reported on Form 1099-MISC is now reported on Form 1099-NEC.

If you choose to delete the form and entering the income without the document. The entry is a convenience and not required by the IRS, you should keep the document with your tax files.

When you are signed into your TurboTax account follow the steps below.

- Search (upper right) for Schedule C > Press Enter > Select the Jump to... link > Review

- Select Business Income > Delete this form using the trash can beside the entry

- Enter this as a cash payment of business income by selecting Other self-employed income, includes 1099-K, cash, and checks

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I answered a question wrong and it said call xxx-xxx-xxxx and mention info sharing what do I do?

I had a similar message - kept asking if I was filing for a child but when I selected, "No" had me call the number/mention "info sharing".

Turned out I'd accidentally entered my birthdate as 2018 (any birthdate between 2003 & now would put you under 18 yrs old, so makes sense). I was able to go to "My Info" and "Edit" my personal details, in this case my birthdate - worked like a charm.

Hope this helps.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hojosverdes64

New Member

jenniferbannon2

New Member

Questioner23

Level 1

DX77

New Member

ddi92234

New Member