- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It depends on exactly what you entered. Since you are filing the Form 1099-MISC as income for your small business, it may be a solution to delete this form. Next add the income to your business as though it was cash receipts. This will include the income on your business and allow you to continue to complete your return.

For tax year 2020, nonemployee compensation that was previously reported on Form 1099-MISC is now reported on Form 1099-NEC.

If you choose to delete the form and entering the income without the document. The entry is a convenience and not required by the IRS, you should keep the document with your tax files.

When you are signed into your TurboTax account follow the steps below.

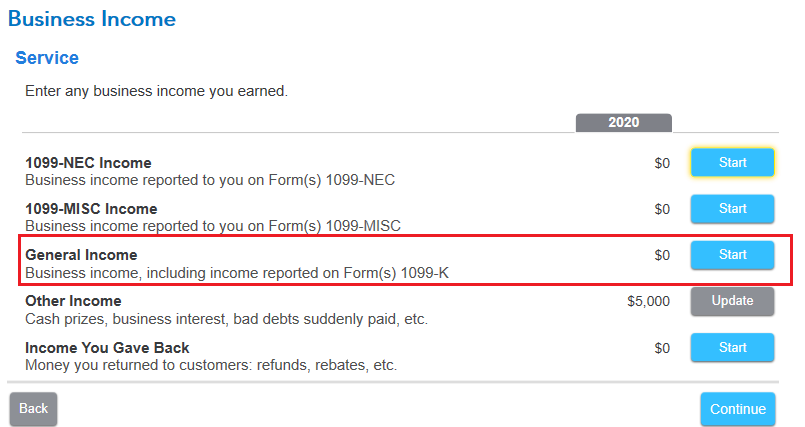

- Search (upper right) for Schedule C > Press Enter > Select the Jump to... link > Review

- Select Business Income > Delete this form using the trash can beside the entry

- Enter this as a cash payment of business income by selecting Other self-employed income, includes 1099-K, cash, and checks

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 10, 2021

7:39 AM