- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to enter rental property sale and partial home sales exclusion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter rental property sale and partial home sales exclusion

I lived in my main residence since 2007. I rented it all out in 2017 because of out-of-state job relocation. Home was rented for 4 years and was sold one month after rental termination.

1) How do I enter the sales info in Turbo Tax?

2) Will I have partial home sales exclusion since I occupied the property 11 months out of the 60 months (5years) before I moved out?

Thanks for your answers.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter rental property sale and partial home sales exclusion

It depends. If you meet the requirements below then you will be allowed a partial exclusion on the home. Keep in mind that you will pay tax on any gain attributable to the depreciation expense and then a partial gain will be calculated if the gain is higher.

Does Your Home Qualify for a Partial Exclusion of Gain?

If you don't meet the Eligibility Test, you may still qualify for a partial exclusion of gain. You can meet the requirements for a partial exclusion if the main reason for your home sale was a change in workplace location, a health issue, or an unforeseeable event.

Work-Related Move

You meet the requirements for a partial exclusion if any of the following events occurred during your time of ownership and residence in the home.

-

You took or were transferred to a new job in a work location at least 50 miles farther from the home than your old work location. For example, your old work location was 15 miles from the home and your new work location is 65 miles from the home.

-

You had no previous work location and you began a new job at least 50 miles from the home.

-

Either of the above is true of your spouse, a co-owner of the home, or anyone else for whom the home was his or her residence.

Any depreciation allowed or allowable (the 4 years it was rented whether or not you took advantage of the deduction) during the rental period will be recaptured and will be taxable limited to the actual amount of gain on the sale.

Carefully answer the questions in the asset section of the rental activity.

- Answer - No, I have not always used this item 100% of the time for this business.

- Answer - No, Special Handling Required?

- Begin to answer the questions about the Home Sale

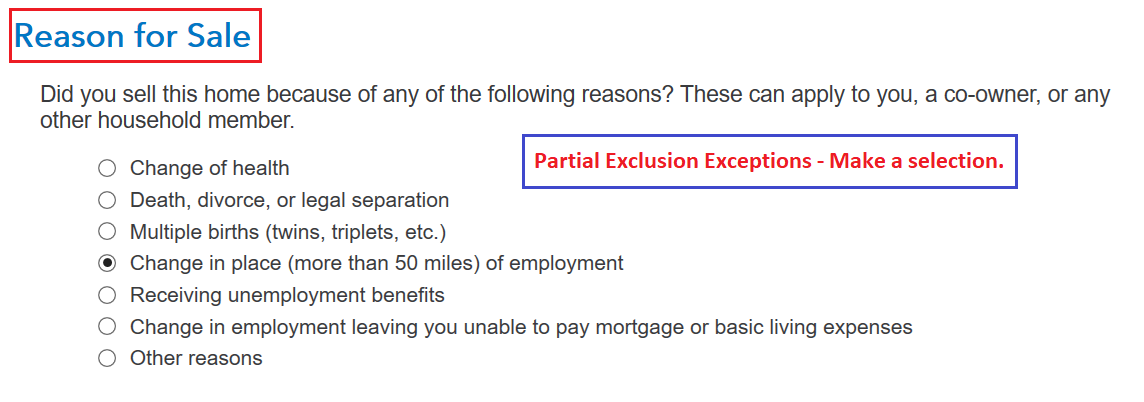

- Make sure to answer the 'Reason for Sale' by selecting 'Change in place (more than 50 miles) of employment (see image below)

- TurboTax will do the rest once this has been completed

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter rental property sale and partial home sales exclusion

Thanks for the answer.

For the question, "Was this asset included in the sale of your main home?", if I answer no, there are no following questions to enter how many months out of 24 total months (prior to final sale) I lived in house; if I enter yes, there are following questions to enter how many months out of 24 total months (prior to final sale) I lived in house. But it seems to me that the answer should be "no" since this was no longer my main home (I lived more than 50 miles away in another main home) when I sold it. Any thoughts?

Also, for the depreciation recapture, does it mean that if, for example, I lost $ 50K on the sale (sales price - price I bought property for, not accounting for depreciation) and I claimed total depreciation of $ 20K, I will need to pay tax on $ 20 K ? (In other words, depreciation recapture does not care whether I sold the property at a loss).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter rental property sale and partial home sales exclusion

If you say YES, the sale was included in the sale of your main home, TurboTax should ask how many months you lived there in the last 5 years, to qualify you for a partial home sale exclusion.

If you didn't start renting it until 2017, you did live in it in 2016 (this may qualify you for a partial exclusion if you have a Gain).

However, be sure you actually have a loss. If you purchased the property for 100K, depreciated 20K, the cost basis of the home is now 80K. If you sold it for 90K (less than you paid, but more than the current Cost Basis), you actually have a Gain of 10K, for example.

When you enter the sale in the Rental Section, TurboTax will calculate the Cost Basis for you to enter in the Home Sale section (look for Form 4562).

If you do have a loss, click this link for more info on Selling Rental Property at a Loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

noodles8843

New Member

mjtax20

Returning Member

ribatelfath

New Member

keithl1

Level 2

meade18

New Member