- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

Hi, I have received a Schedule K-1 1065 form and I have entered the K-1 numbers in Turbotax.

However, within the K-1 form package, there is a page called "SALES SCHEDULE" with a table, and a column called "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" and it says that the amount should be entered onto FORM 4797 PART II, LINE 10 and FORM 8949 COLUMN G.

How do I generate the Form 4797 with Turbotax and enter the value I have on my Sales Schedule? I have entered my K-1 info (boxes 1 to 20) but it did not generate a Form 4797.

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

Entering the info without winding up with duplicate 1099-Bs is tricky. This link goes into depth on different scenarios (complete vs partial sales, short vs long term) and how to get the entries right. Once done, TT will produce the 4797 and report the Ordinary Income there.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

Thank you so much for your response. I went through all of the 22 pages of the link you posted and I might need to go through it again as I am a novice in MLP and K-1 reporting. I actually did not know about Schedules K-1 Forms 1065 before I received some in the mail, and after I had filed my 2020 tax returns based solely on the 1099-B that I received from my broker. Now, I realized that I did not handle this the way I should and I am trying to amend my returns before the deadline.

I really appreciate all your effort in responding to everyone's personal situations with their K-1 ans Sales Schedules in the other discussion. This is immensely helpful, especially for novice investors like myself who had the misfortune to invest (even small amounts) into MLPs...

I will follow your instructions and try to amend my returns like this. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

@Fou65000 You're welcome! I stumbled into the original problem (how to enter a sale without double counting) 7 years ago, thought I'd post about it once, and then the thread snow-balled. I'm glad its helping.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

It's a shame that in 2021, Turbotax has not made this K-1 reporting more straightforward. At least, when it generates a Form 8949 with box B checked from the uploaded 1099-B, it could alert the person on the fact that there should be K-1 forms to enter and basis costs to adjust before filing the while thing...

Anyway, thanks for your help on this. I will try to work on my return based on all the info you have provided but in case I have a specific question related to my situation, should I ask it here or on the other thread (and adding to the snowball)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

@Fou65000 Either is fine. I get emails when mentioned in a thread.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

Hello, I am working on reporting the K-1 and the sale of one MLP. I bought and sold all the shares in 2020, nothing left.

I purchased the shares of this MLP on 4 different dates: 4/17/2020, 4/22/2020, 5/11/2020, 6/5/2020 and there was a reinvestment on 5/12/2020 (0.99 unit).

I sold all the shares (including the reinvestment unit) on the same day: 6/10/2020.

On my 1099-B however, there is only one line for all these transactions with a blank for the acquired date and 6/10/2020 for the sold date.

On my Schedule K-1 Form 1065, in the sale schedules, there is also only one line, like on my 1099-B with the same sale date 6/10/2020. I also have an ADJUSTMENT TO BASIS and an ORDINARY INCOME in the table.

My question is: during the K-1 TT interview for this MLP, on the "Enter Sales Dates" page, how should I enter the dates? For the Purchase Date, should I enter the first date only (4/17/2020) and ignore the other dates? And 6/10/2020 for the Sale Date?

For info, before this, in the previous pages, I checked the boxes This partnership ended in 2020 and then Complete disposition.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

@Fou65000 In the K-1 section, I'm assuming you do not want the K-1 to create its own 1099-B (since you have one from the broker) and you're following the approach outlined in the other thread I provided. So in that case, just enter 'various' for Purchase Date. 6/10 for the sale date is fine. TT is using those dates to figure out a holding period, but that won't matter since you're handling the 1099-B elsewhere.

Alternatively, if you want TT to create the K-1, you'd have to use one of your short-term Purchase dates so TT knows its short-term. There is no way to enter multiple dates into the K-1 interview.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

Thank you for your answer. Your are correct for your assumption.

However, on my 1099-B, there is a blank for the "purchase date" (because there are multiple purchase dates). So if enter "various" for Purchase Date in the K-1 interview, the 1099-B won't provide the actual purchase dates. That's why I figured I could enter the first purchase date (the date when I first purchased shares of this MLP).

In the 2020 Transactions Schedule attached to my K-1 though, there is a table with the Buy and Sell dates for each unit of this MLP and I believe this is transmitted to the IRS so they would know what are the "various" purchase dates. Am I thinking right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

@Fou65000 Nothing you enter in the K-1 will change or affect the 1099-B. When you update the 1099-B, you'd enter 'Various' there as well. The IRS doesn't care that there were multiple dates -- only that the correct short term vs long term totals are provided.

While the partnership sends copies of the K-1s to the IRS, I don't know if the Transaction Schedule is part of that filing. Regardless, the IRS isn't going to reconcile dates. Multiple short (or long) term transactions are frequently added together on 1099-Bs, so 'Various' is a standard entry.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

I understand, thank you.

If I may, I have another question related to dates.

For another MLP, I have 2 different purchase dates in 2020 and one unique Sell date also in 2020 (when I sold all the shares at once).

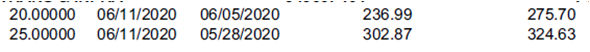

On my 1099-B, there are 2 lines to report the sales:

However, on my K-1 Sales Schedules, everything is grouped in 1 line and I have a CUMULATIVE ADJUSTMENTS of 2$ (No Ordinary gain).

My question is: how should I adjust the cost basis on my 1099-B? Can I simply add 2$ to any of the cost basis of the two lines (to 275.70 or 324.63)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

@Fou65000 As a general rule, you'd just spread the adjustments proportionally. So if your short term adjustments worked out to be $10/share, a 20 share lot would pick up $200, and a 100 share lot would pick up $1000.

The same approach would work for the $2, but nothing will be affected if you just lump it into one.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

Ok, I see what you mean.

Many thanks for your kind help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

A last question please, for 2 MLPs, I had a Form 926 "Return by a U.S. Transferor of Property

to a Foreign Corporation". attached to my K-1 package.

On both forms, it states that Cash was the only property transferred and Partner's Share of Amount Transferred is 0$ everywhere.

I guess, since 0$ have been transferred as far as I am concerned, I don't need to file forms 926?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax "GAIN SUBJECT TO RECAPTURE AS ORDINARY INCOME" from K-1 1065 Sales Schedules/Form FORM 4797 PART II, LINE 10

Form 926 isn't something I've dealt with before. Probably best to post a separate question to the forum to get someone with some expertise.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 4

alvin4

New Member

cmallari

New Member

s d l

Level 2

meade18

New Member