- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I understand, thank you.

If I may, I have another question related to dates.

For another MLP, I have 2 different purchase dates in 2020 and one unique Sell date also in 2020 (when I sold all the shares at once).

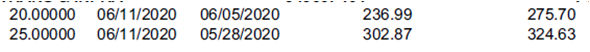

On my 1099-B, there are 2 lines to report the sales:

However, on my K-1 Sales Schedules, everything is grouped in 1 line and I have a CUMULATIVE ADJUSTMENTS of 2$ (No Ordinary gain).

My question is: how should I adjust the cost basis on my 1099-B? Can I simply add 2$ to any of the cost basis of the two lines (to 275.70 or 324.63)?

April 20, 2021

1:17 PM