- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to correctly enter the K-1 data for Energy Transfer Partners

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

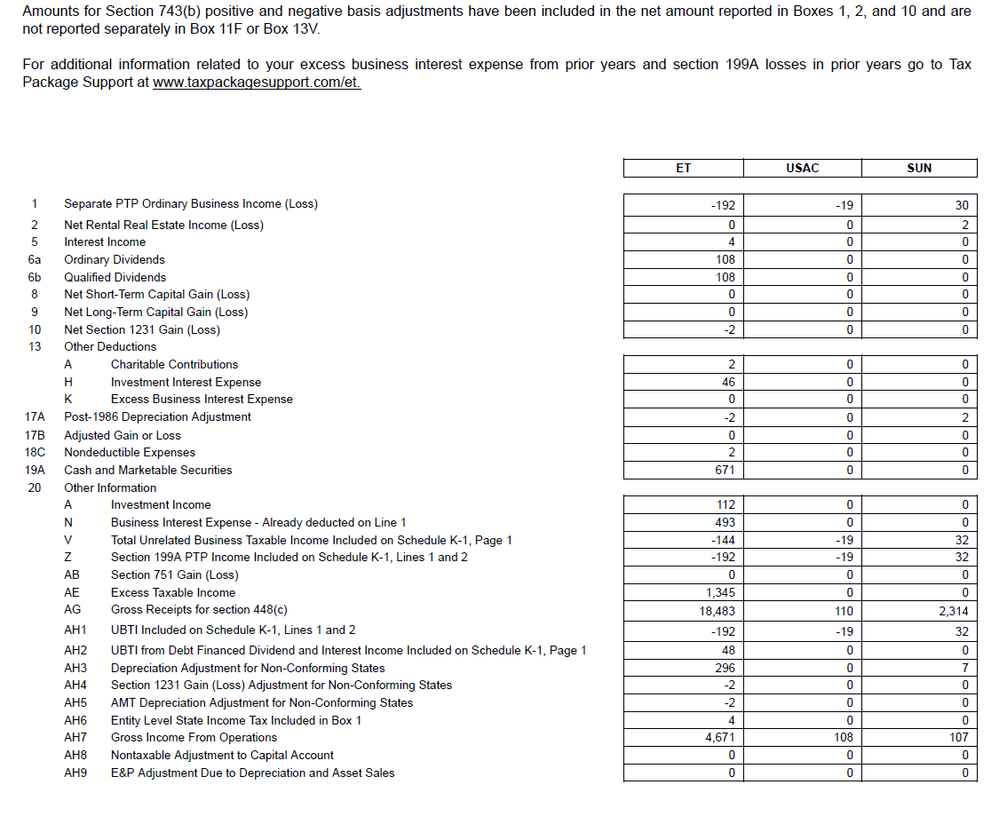

I understand about entering the first entry (ordinary business income (loss). But I'm not sure about the rest of the entries. If I go to the K-1, I find a Net Section 1231 Gain (Loss) on Box 10 of the K-1. I also find a Other Deductions in Box 13, with codes A and H. Do I fill the boxes in with this data, or only if the data is found in Box 20.

After I complete the first K-1 for the primary company (Energy Transfer), I go to the second company reported on the K-1.

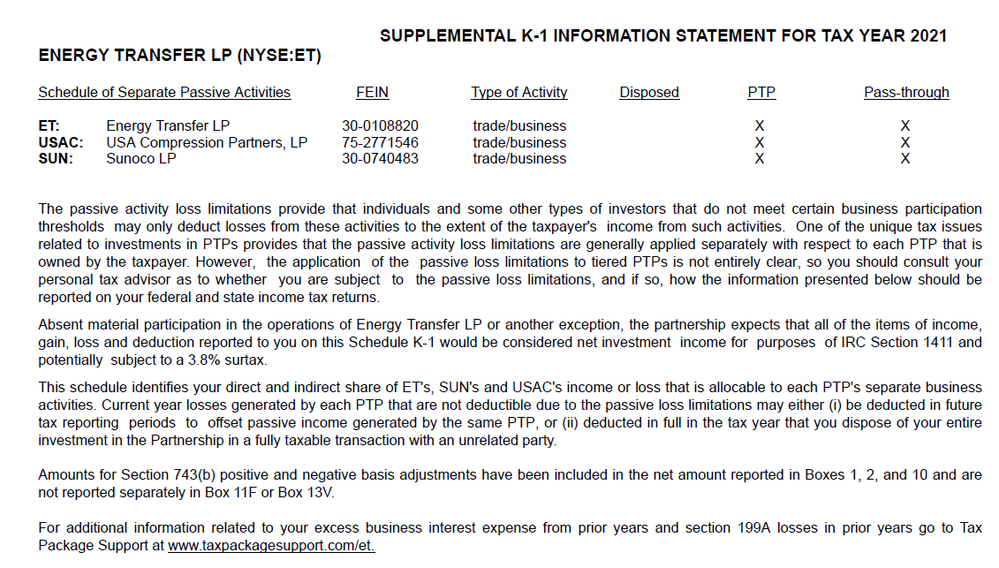

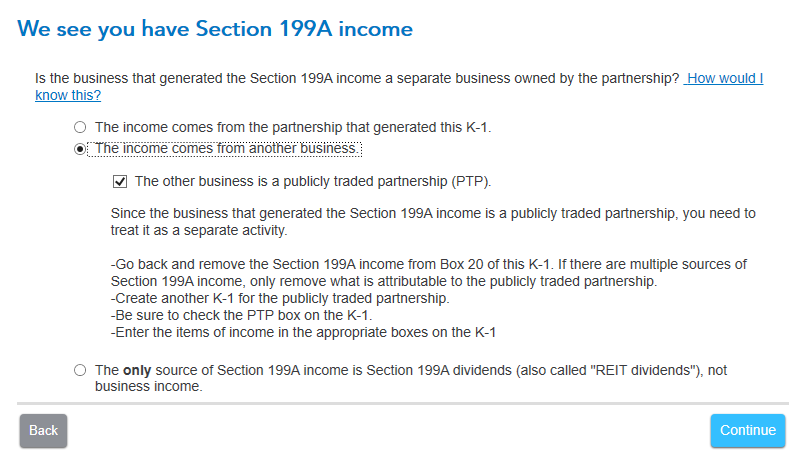

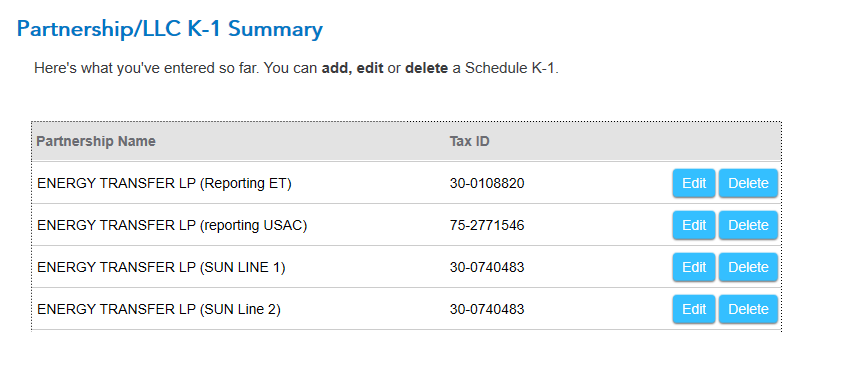

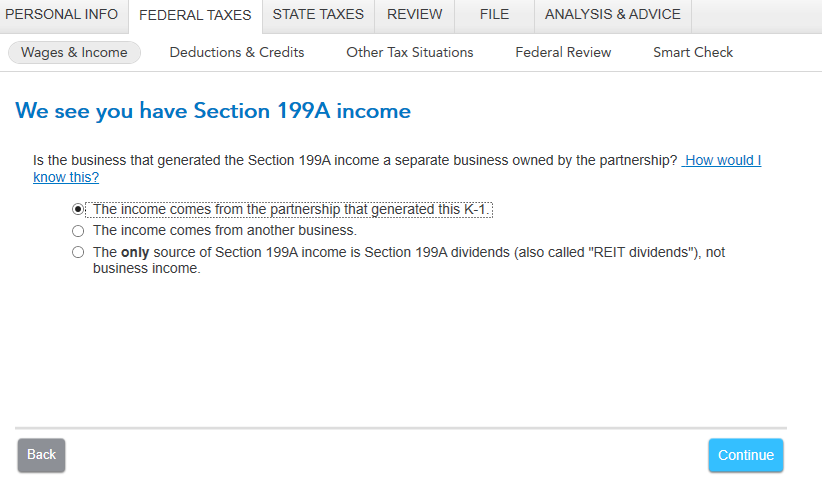

I use their Tax ID. There is less data in the various boxes for the investments owned by ET, but there is some data present. The investments also have Box 20 Code Z data. The confusion comes when I get to the section where TurboTax states I have section 199A Income. Do I answer this as "The income comes from the partnership that generated this K-1", or "Does this income come from another business (which is a PTP.

Energy Transfer held positions in two other MLPs, and provided their Tax ID on the Statement. So how do I treat this? As vague as the question is, it seems you could answer either way.

Here is a screen shot of the primary page. On my 2020 K-1, there was "See Statement" printed across the entire face of the main page. On the 2021 K-1, it doesn't do that. For 2020, I broke the data into four entries (SUN had box 1 and Box 2 data).

So am I on the right track? I'd like input. There has been a lot of discussion on MLPs, but without images it was hard to understand.

Thanks to anyone that will help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

I will page @nexchap for this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

@poncho_mike You're definitely on the right track. On your specific questions:

- For USAC, you'd check that "the income comes from the partnership..." That line is just used by TT to connect the QBI income you're entering to the USAC K-1. Checking the other box causes TT to try to create a brand new partnership form, which isn't what you want.

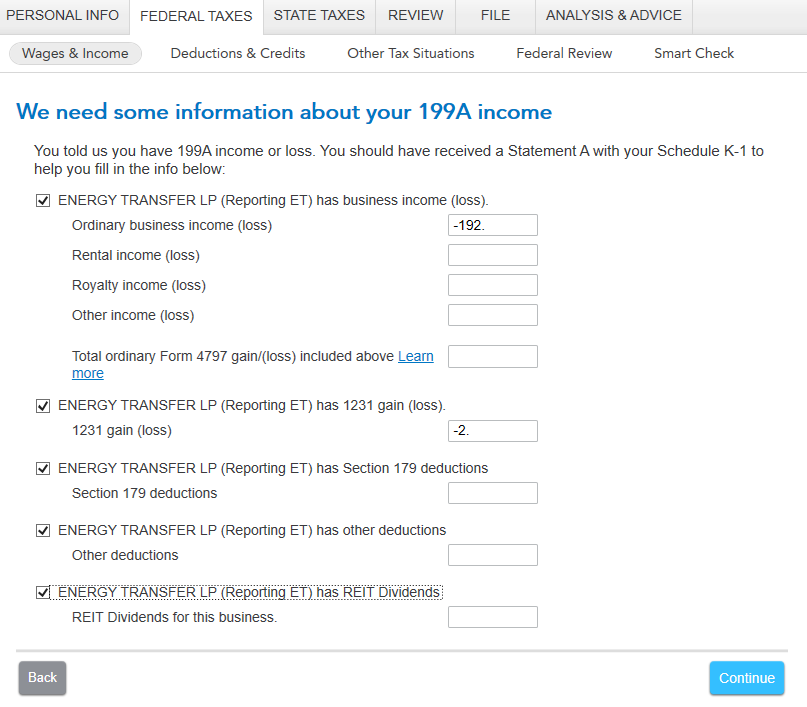

- As to what to enter "199A Income" screen I'll preface this with noting that I'm not a CPA. I'm confident about the handling of the first line (business income (loss)), but less so about the other lines. If you're in a situation where the handling of those numbers is going to make a significant impact on your taxes, its probably worth hiring outside expertise. With that said:

- The business income (loss) lines are handled just as you've been doing. Note that when you sell, and have "Ordinary Income", it will be entered on the "Other Income" line

- I enter the 1231 gain (loss) info, and 179 deductions, if they appear on the K-1.

- For "other deductions", I only enter items from the K-1 if I actually took the deduction elsewhere on my return. So for example, if you itemize and took the $46 interest expense deduction, then I'd include it as a 199A deduction to reduce the QBI you're adjusting. But if you didn't itemize, you didn't get that deduction and shouldn't enter it here.

Hope that helps!

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

you need to create 3 k-1's one for each of the PTPs shown on the supplemental schedule use their EIN then enter the amounts shown for each on the respective k-1. this is necessary since each PTP stands on its own and the profit reported for SUN (lines 1 and 2) can not be offset by the loss from the other 2

you can ignore the k-3

you can also ignore the following lines - Turbotax doesn't use them and they have no effect on your taxes.

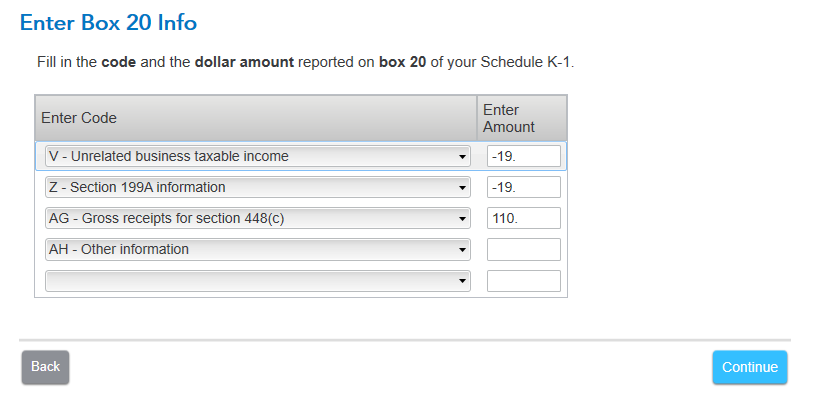

line 18c, line 19A, and all the info on line 20 except for line 20Z which is entered separately on each of the k-1s

this is the199A which is -192 for ET

199A -19 for USAC

199A 32 for SUN

in addition since the 1231 is a loss that's 199A also.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

I want to acknowledge @nexchap , @Mike9241 , and @Anonymous_ for your help.

I understand now what TurboTax is looking for with the Section 199A income. Your explanation makes sense. On the MLPs owned by ET, I was noting the income came from a different company than the one that generated the K-1, which was then prompting me to create additional K-1s.

Again, thanks for all of your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

@nexchap @Mike9241 @Anonymous_

I'd like to get your opinions on filing online for Federal vs sending in a paper return. I've always sent in paper returns, I felt it was a little more secure than having all of this tax data in the cloud. What are your thoughts? Last year it took forever to get my refund, so I'm considering filing online for the Federal return.

Also, I remember seeing in one of the answers that you need to file the K-1 with your tax returns. Is that for Federal or State? I didn't send in a K-1 last year for the MLPs I own.

Again, thanks for all your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

@poncho_mike I've never worried about the security aspect but haven't been able to file electronically with MLPs because of the need to also file form 8990 (if you have EBIE) and Sec 751/754 statements (the K-1 tells you if you need to add that verbiage). I think I could still file electronically and follow up with those supplemental forms by mail, but haven't wanted the hassle.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

as to that 751/754

I'm retired but when I was active, I worked with different size CPA firms. never once did a see a 751/754 statement included with the individual's return with regard to a PTP though they are technically required. never once did I hear of a taxpayer being assessed a penalty for failure to include the statement.

this is from reg 1.751-1(a)

(3) Statement required. A partner selling or exchanging any part of an interest in a partnership that has any section 751 property at the time of sale or exchange must submit with its income tax return for the taxable year in which the sale or exchange occurs a statement setting forth separately the following information -

(i) The date of the sale or exchange;

(ii) The amount of any gain or loss attributable to the section 751 property; and

(iii) The amount of any gain or loss attributable to capital gain or loss on the sale of the partnership interest.

my contention is that the info is provided by reporting the sale on form 8949 (item i and iii) and form 4797 (item i and ii)

I have nothing authoritative to back up my contention.

a section 754 election is made by the partnership. There is nothing in the regs that say anything has to be filed by the partner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

What is EBIE?

I got no errors when I printed the final copy of my tax return. I saw nothing about any additional forms. Do I need to file form 8990 if I take the standard deduction?

To be honest, I was not expecting the amount of paperwork incurred by owning a MLP. I bought a stock that I was hoping would pay a decent dividend stream for retirement, and I ended up with a paperwork nightmare.

Thanks,

Mike

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

there is a lot of paperwork with any PTP especially now that the IRS has expanded foreign reporting to encompass a 20-page k-3. the amounts you receive are not dividends and are not taxable unless they reduce your tax basis (for you to compute because Turbotax doesn't) to a negative amount. if you think entering the k-1/k-3 data is mind-boggling wait until you dispose of it.

by the way, there should be a supplemental schedule because ET is really 3 Partnerships and under the tax laws each is supposed to be reported separately - probably a lot of taxpayers ignore this. so the one k-1 you got is supposed to end up as 3 k-1s in your return.

the k-3 you can ignore unless you are not a US citizen or own more than 10% of ET.

EBIE is excess business interest expense.

note if 13K is zero you do not file form 8990. leave the line blank

line 13 Code K. Excess business interest expense. If the partnership reports excess business interest expense to the partner, the partner is required to file Form 8990. See the Instructions for Form 8990 for additional information.

Turbotax, as you know, does not do form 8990.

EBIE has nothing to do with whether you take the standard deduction or itemize. so yes you are supposed to file 8990 which would also require filing by mail since there is no way to attach a manually prepare form to the e-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

@Mike9241 I really appreciate your assistance.

I created three separate K-1s and input them into Turbotax. I used the main ET data for the address, but used the EIN of the individual companies. I thought ET only owned investments in the other two entities. Are you saying they are businesses wholly owned by ET?

Code 13K shows up on the K-1, but the value entered is zero. I'm assuming the dollar value is low enough that the amount shows as zero.

I have only owned ET for about two years, so I still have a positive basis in the investment. This was an initial investment, I was planning to add more but the K-1 complexity scares me.

Since there is a zero in Code 13K, do I need to file a Form 8990?

Before submitting this thread, I read some other answers to similar questions related to MLPs. Is there any reason I would need to send the K-1 in with my tax return?

Mike

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

@poncho_mike No need to submit the K-1. The partnership sends it to the IRS. Also no need to submit 8990 with a $0 for EBIE

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

the reason for the 3 k-1's is that each entity is treated as an MLP/PTP and thus each needs to be reported separately.

The terms "master limited partnership" and "publicly traded partnership" are used interchangeably about a publicly traded company that chooses to be treated as a partnership under tax regulations. However, there are some minor differences. Not all MLPs are PTPs because some are not publicly traded (though most are).

save yourself some time in the future don't bother to enter lines that show zero. in effect, if nothing is entered on a line it is assumed to be zero.

you do not send the k-1

the most likely reason line 13K is zero is because ET has zero EBIE for the year. every one that I've seen has reported zero on that line

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

I want to thank everyone for their help. Since you guys seem to have more experience with MLPs, I would like your input.

I currently own a stock named Pembina Pipeline Corporation (PBA), which pays good dividends currently at 6.2%. I have owned it for quite some time. I planned to retire in 2021, but with Covid I was able to work from home, so I hung around a little longer. My plan was to start building a portfolio of dividend stocks for the income. I was not prepared for the added complexity of dealing with the K-1.

What are your thoughts about owning MLPs in general? ET is currently yielding 8.73%. I'm not exactly sure how this dividend is being taxes? Is it receiving qualified dividends tax treatment, or is much of the dividend a return of capital and not taxed until I sell?

Thanks for your help.

Mike

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

@poncho_mike I won't attempt to give investment advice, but just so you know what you're getting into: In a partnership, you have to track capital at risk and basis. They're not the same, and the tax rules change when one goes below $0, and then change again when the other goes below $0. TT doesn't provide any help with tracking either of those, or walking you through the tax consequences. But it will file the return if you can figure out how to enter everything correctly.

Right now, you're in the easy phase where they're both greater than $0. But each cash payment you receive from an MLP, along with virtually every other tax related number on the K-1, changes both capital at risk and basis (typically lowering them). Without getting into all the intricacies of what changes in the other two regimes, your dividends will eventually get taxed as long-term capital gains in the year you receive them.

As to whether you should keep these in your portfolio, it really depends on how much effort you want to spend learning the intricacies of the tax code (or just hiring someone to prepare your taxes). Its very doable, but not simple. And its definitely not like anything else you can randomly invest in and handle with a 1099-DIV.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HollyP

Employee Tax Expert

user17577754113

New Member

brokewnribs20

New Member

Jeff-W

Level 1

Rockpowwer

Level 4