- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly enter the K-1 data for Energy Transfer Partners

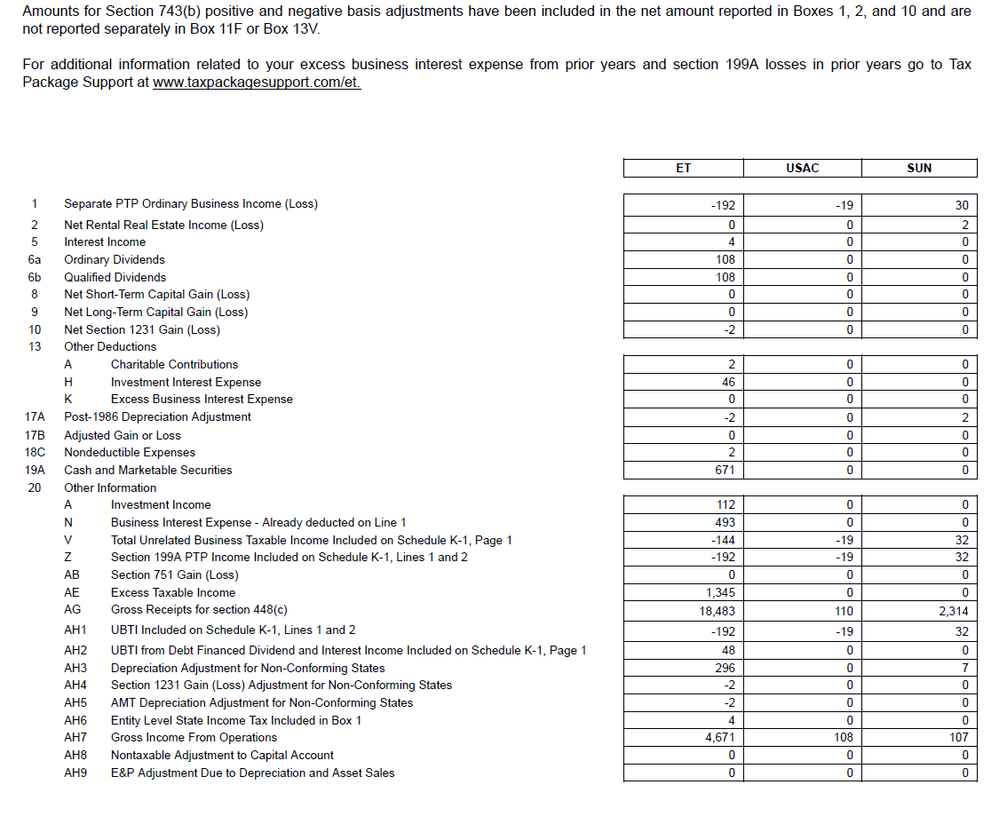

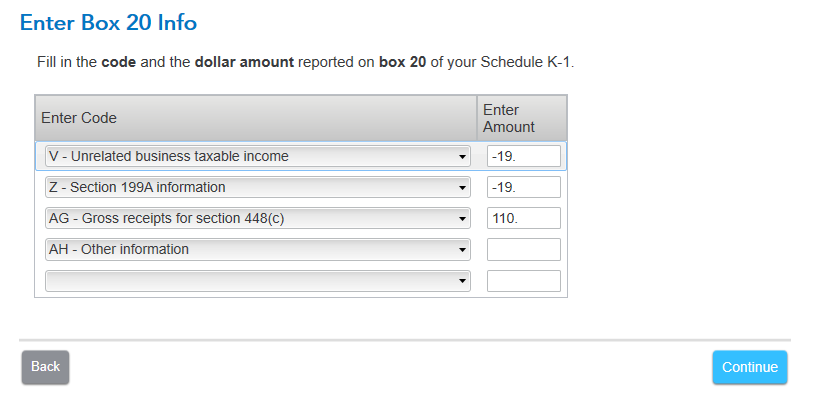

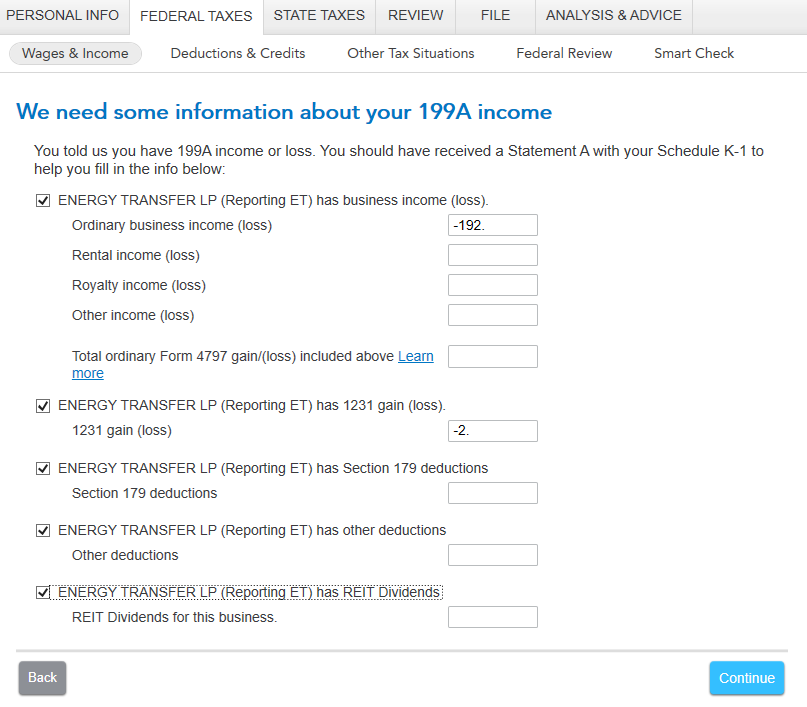

I understand about entering the first entry (ordinary business income (loss). But I'm not sure about the rest of the entries. If I go to the K-1, I find a Net Section 1231 Gain (Loss) on Box 10 of the K-1. I also find a Other Deductions in Box 13, with codes A and H. Do I fill the boxes in with this data, or only if the data is found in Box 20.

After I complete the first K-1 for the primary company (Energy Transfer), I go to the second company reported on the K-1.

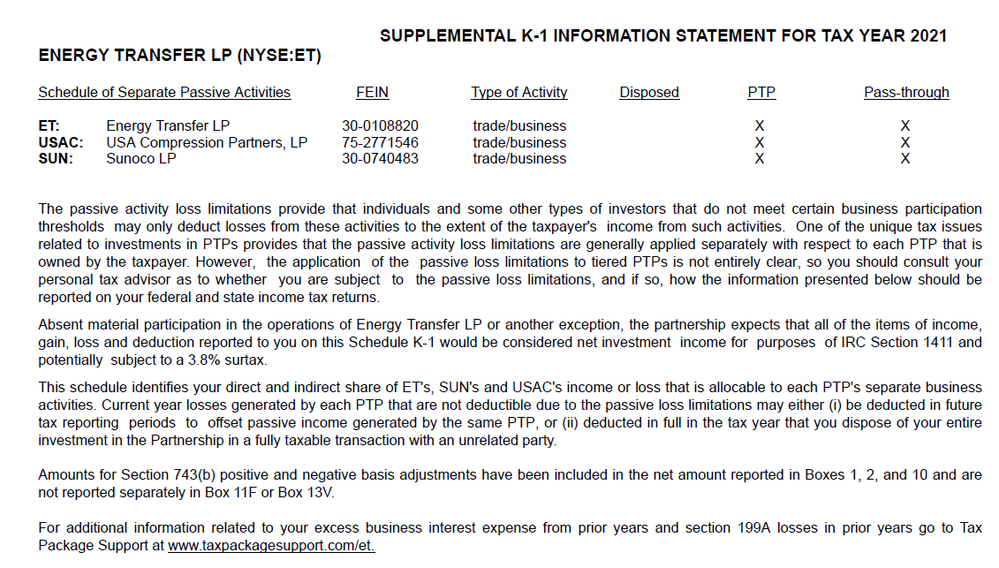

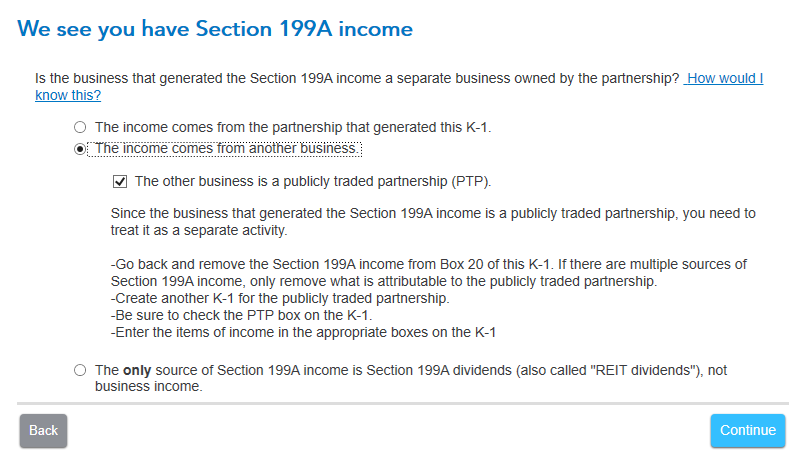

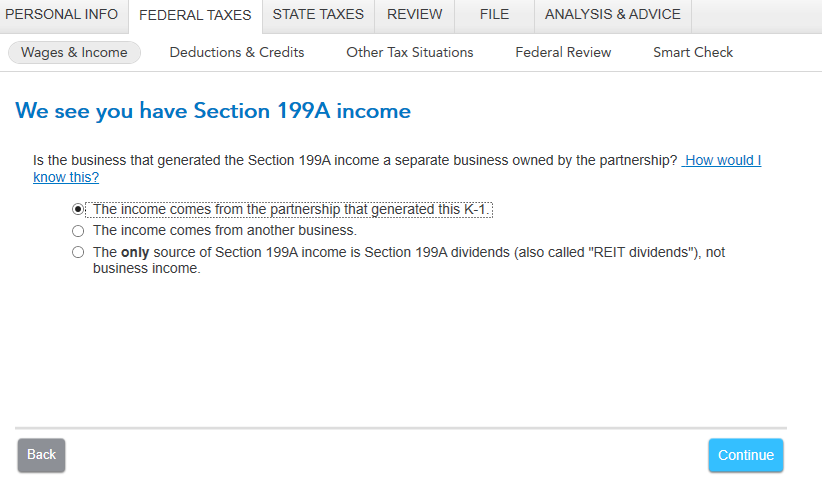

I use their Tax ID. There is less data in the various boxes for the investments owned by ET, but there is some data present. The investments also have Box 20 Code Z data. The confusion comes when I get to the section where TurboTax states I have section 199A Income. Do I answer this as "The income comes from the partnership that generated this K-1", or "Does this income come from another business (which is a PTP.

Energy Transfer held positions in two other MLPs, and provided their Tax ID on the Statement. So how do I treat this? As vague as the question is, it seems you could answer either way.

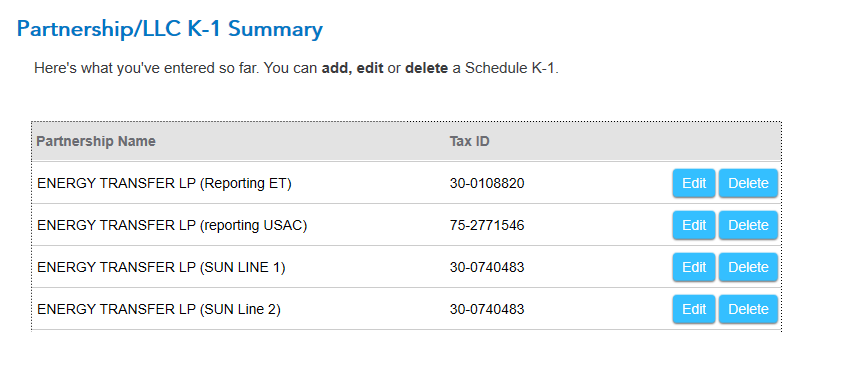

Here is a screen shot of the primary page. On my 2020 K-1, there was "See Statement" printed across the entire face of the main page. On the 2021 K-1, it doesn't do that. For 2020, I broke the data into four entries (SUN had box 1 and Box 2 data).

So am I on the right track? I'd like input. There has been a lot of discussion on MLPs, but without images it was hard to understand.

Thanks to anyone that will help.