in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I modify the AMT carryover amount. I go to deductions and credits. and amt but it just...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify the AMT carryover amount. I go to deductions and credits. and amt but it just has the old number with no way to edit it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify the AMT carryover amount. I go to deductions and credits. and amt but it just has the old number with no way to edit it.

Click on Start or Revisit next to Credit for AMT paid in a prior year and follow the instructions on the screen. You will need your 2020 tax return to complete this section.

Timing items are income or deductions that are reported for AMT on a different timeline than your regular taxes, the most common ones being incentive stock options (ISOs) and intangible drilling costs connected with an oil or gas activity. In these cases, sometimes income tax is paid faster or deductions are postponed over multiple years. Examples include depreciation and passive activity losses.

If you paid AMT for any of the following common reasons, you probably don't qualify for this credit:

- High income (e.g., $523,600 for single filers and $1,047,200 for married filing jointly)

- High income and a large number of dependents

- High income and exercise of ISO’s or “private activity” bonds

- Large amount of property taxes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify the AMT carryover amount. I go to deductions and credits. and amt but it just has the old number with no way to edit it.

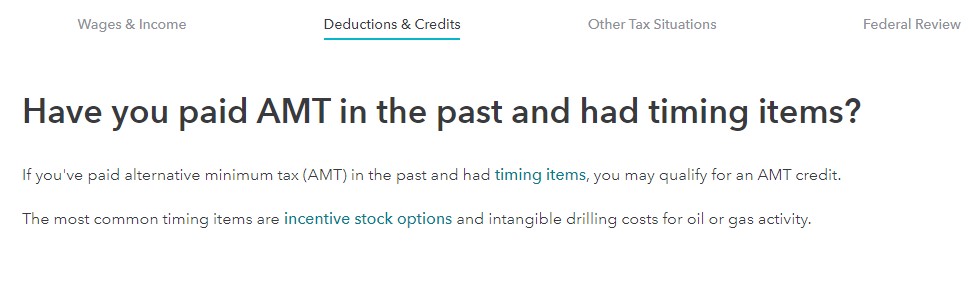

Thank you but I do not have that option. I follow those steps and then I just get this page. I can't edit it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify the AMT carryover amount. I go to deductions and credits. and amt but it just has the old number with no way to edit it.

To clarify, has your 2021 program carried over from your 2020 account the proper credit?

What makes you think the amount is incorrect?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify the AMT carryover amount. I go to deductions and credits. and amt but it just has the old number with no way to edit it.

I originally entered an estimate to see how it would affect my deductions to make a decision at the end of last year. I did not use turbotax for last year's taxes. I just need to be able to clear this amount out. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify the AMT carryover amount. I go to deductions and credits. and amt but it just has the old number with no way to edit it.

You should be able to edit your entry. See How do I enter my prior year alternative minimum tax credit Go back in and delete/correct your entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I modify the AMT carryover amount. I go to deductions and credits. and amt but it just has the old number with no way to edit it.

Thanks. That doesn't work. There's no way to edit it. I was able to clear out the field by workign with TT support. By going to tools-->"Delete a form" and deleted the form. However now I can't add anything for the amount at all it just says

"It turns out you don't qualify for this credit"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Gauntless

Level 1

ssolfest

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

heretofore0

New Member

Raph

Community Manager

in Events

Jenlynnsmith85

New Member