- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do i file the recovery rebate credit since i wont br getting my second stimulus check aut...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

TurboTax will ask you If you got your stimulus payment after you enter in the rest of you information. Then just answer the questions to complete the Recovery Rebate Credit on your 2020 Tax Return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

you have to file a 2020 tax return, which you can do for free if you are eligible at filefree.intuit.com. There is no separate form for the recovery rebate credit, it is simply part of the 2020 tax return,

but suggest waiting until the end of January - there are still a lot of payments flying around and fixes coming from the IRS.... may save you some work. The IRS won't accept a tax return until Jan 27 in any event.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

Where do I enter this information? It seems like it should be under federal review, but there is no section in federal review that asks me about stimulus. I have turbotax deluxe downloaded on my laptop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

In TurboTax Deluxe Desktop click the "Federal Taxes" tab at the top. Then "Federal Review" under that. The first page that pops up should be asking about stimulus payments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

it is not giving me the correct amount. should be 1st one 2400 for married and 500 each dependant, 2nd is 1200 married and 600 each dependant. For us that equals 4700. It is only doing me and my husband not our dependant. Its says 3600. How do I change this as we have not recieved either the first or second stimulus.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

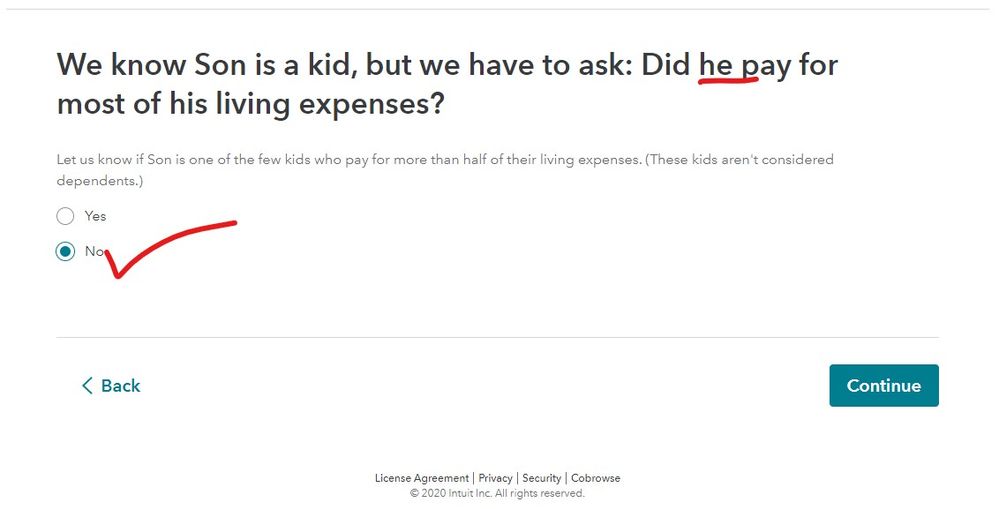

The child must be under 17, a dependent, qualified for child tax credit and you must have all been in the US. It is easy to hit a wrong answer by accident. See the full rules for eligibility at Economic Impact Payments. Please review your answers if you are not getting credit that you are entitled to receive. I have seen people mark that they were outside the US several times. Look and look again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

I did and it told me i have received all of mine but i didn't i did get 1200 the first time and 600 the second but i hava a daughter who is turning one now we had her feburary 2020 before the pandemic and i didn't get the 600 for her on the first check and i didn't get the 500 for the second so thats 1100 im missing and i have already filed with turbotax what do i do??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

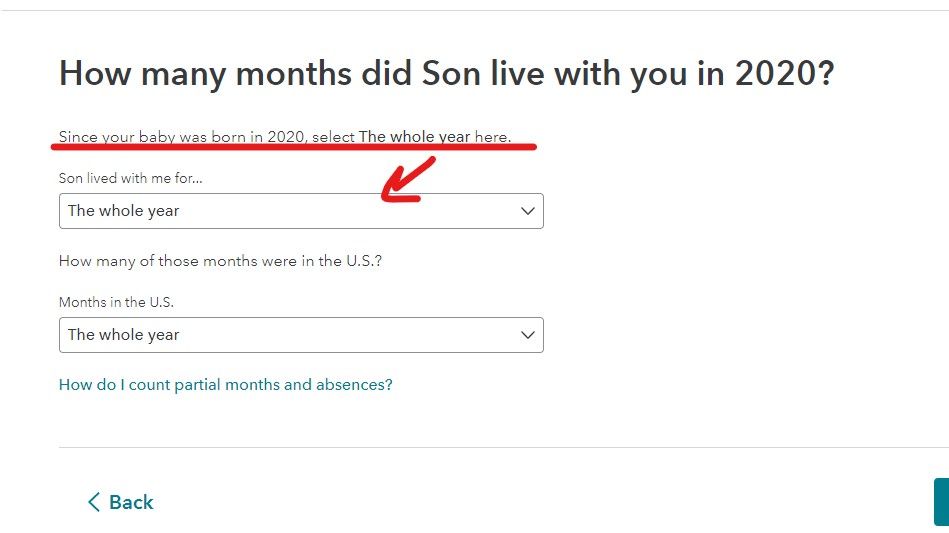

If you had a child in 2020 then return to the dependent section and make sure you entered the WHOLE year when asked how long they lived with you AND that the CHILD did not provide more than 1/2 of THEIR support ... answer either of these wrong and the stimulus will not be added.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

Your daughter that was born February 20 did not qualify for the first stimulus check. She did qualify for the second check. When you entered her on your tax return, her social security number must have been correct and she needed to meet all of the conditions and all of the questions needed to answered correctly. Go through your return taking careful note of the examples that Critter-3 just posted.

Since you have already filed your taxes, you can only make changes to them if they are rejected when the IRS starts accepting returns on February 12. If they are accepted, then wait until the processing is complete and then use TurboTax to file an amend so that your stimulus for your daughter is included in your amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

ANY child born in 2020 is eligible for BOTH stimulus payments no matter when they were born.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

So, I did that after the stimulus website said I had to, and the amount came back as 1800 instead of 600. Did I do something wrong on the automated form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

@kettlebrew You should have received $1,200 for each taxpayer on your return plus $500 for each dependent under the age of 17 for the first stimulus check, and $600 for each person I just mentioned for the second check. If you received less than that, then the difference is the amount still due you which should be included with your refund when you file your 2020 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

Where do I enter TurboTax to enter for the Rebate Credit??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

If you didn't receive the full amount for your first or second-round stimulus payments, you can claim the Recovery Rebate Credit when you file your taxes this year.

We'll make sure you get the money you qualify for by double-checking the amount and quantity of stimulus payments you received. Here’s how:

- Enter all of your federal return information as you would normally. During the Federal Review, we’ll check if you meet eligibility requirements for the stimulus payment. If you meet the requirements, you'll see a It looks like you qualified for the stimulus, did you get any payments? screen. We'll ask a few questions about any payments you've already received and then let you know if the Recovery Rebate Credit applies.

- If you need to make any changes to your stimulus credit responses, search for stimulus and select the jump-to link at the top of the search results to return back to the section. Enter your updated info and Continue.

It’s important that you enter the correct amount of each stimulus payment you received.

Eligibility rules for the Recovery Rebate Credit

Why am I not getting the Recovery Rebate Credit for my child or dependent?

Why isn't the stimulus question showing when I'm trying to claim my Recovery Rebate Credit?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hickmond38

New Member

janaly304

New Member

elliottulik

New Member

prettytwin32

New Member

kirkpatricklisa69

New Member