- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

I all readi file my 2020 taxes and received my refund but i forgot to add my 2second stimules check how do i file to get my payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

If you did not receive your second stimulus payment then you will have to file an amended return to claim the Recovery Rebate Credit. Please see FAQ How to amend a tax return for instructions.

Also, if you received Notice 1444 in the mail but have not received your payment as mentioned in the notice, then you need to request a trace Please see How do I request a payment trace to track my first or second Economic Impact Payments?

- After entering all your information click "Federal Review" at the top of your screen.

- On the screen "Let's make sure you got the right stimulus amount" click "Continue".

- You will be asked about the amounts of first round and second round stimulus payments you received. If you did not receive a payment enter "0".

- TurboTax will then calculate the amount of stimulus payment remaining that you are still entitled to get.

- Any stimulus amount remaining due to you will show as a credit on line 30 of the 1040.

If you filed your return but forgot to include the second stimulus payment that you had received and therefore claimed the wrong Recovery Rebate Credit amount then the IRS most likely made an adjustment to your refund. Check line 30 for the Recovery Rebate and the total refund amount on line 34 of Form 1040. Please see IRS Recovery Rebate Credit Q D2 What happens if I claim the incorrect amount? for additional information. If not then you will need to amend your return (1040X) and send the funds back to the IRS. Please see FAQ How to amend a tax return for instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

I received stimulus #1 and #3 but didn't get #2 for $600. I didn't file 2019 because I didn't work, on ssdi. I had to verify who I am on 3-11-21. I wondered why I didn't get it all on #3 deposit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

I'm not sure why you didn't receive the 2nd. stimulus check, you will have to prepare a tax return in TurboTax to receive it.

When you prepare your tax return for 2020 in TurboTax, you will be prompted to enter how much you received for your stimulus and then the program will calculate the amount of stimulus due you based on your income, number of dependents and payments already received. If any additional stimulus is due you, it will be used to reduce your 2020 income tax liability, and the balance will be refunded to you.

You will see the options when you are done entering your tax information and proceed to the review process.

You can file a tax return in 2020 to get your stimulus check, even if you aren't required to otherwise.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

I qualified for the 1st (got it) and 2nd (didn't get it but IRS site didn't know anything about it) based upon my 2019 AGI. However, I know I won't qualify for 2020 3rd stimulus due to my 2020 AGI but how do i apply for the recovery credit for the second, as turbo tax did not ask me anything about stimulus payments. The IRS site says i am eligible. How do i do that in Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

You should file your 2020 income tax return. If you did not receive the second stimulus payment, you can claim a Rebate Recovery Credit on your 2020 income tax return.

The Recovery Rebate Credit will be calculated based upon your input and is based upon your 2020 income tax return.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

When you prepare your 2020 income tax return, be sure to do the following to ensure the credit is calculated correctly on your income tax return.

- In the Federal section, select the Federal Review interview section at the top of the screen.

- This will take you to the input section for the Recovery Rebate credit.

- Be sure to indicate the actual amount of each stimulus payment you received on the page that asks if you received a stimulus payment.

- There will be two boxes and both need to be completed. Since you did not receive the second stimulus payment, please enter $0 in the second box to reflect this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

I dont see where i can get the rebate recovery questions on turbo tax in the federal taxes under federal review - at the top of the page as suggested - this is what shows up. Your area is not showing up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

To get to this section in TurboTax, follow these steps:

- Go to the search box and enter stimulus. Click the Jump to link.

- Answer Yes.

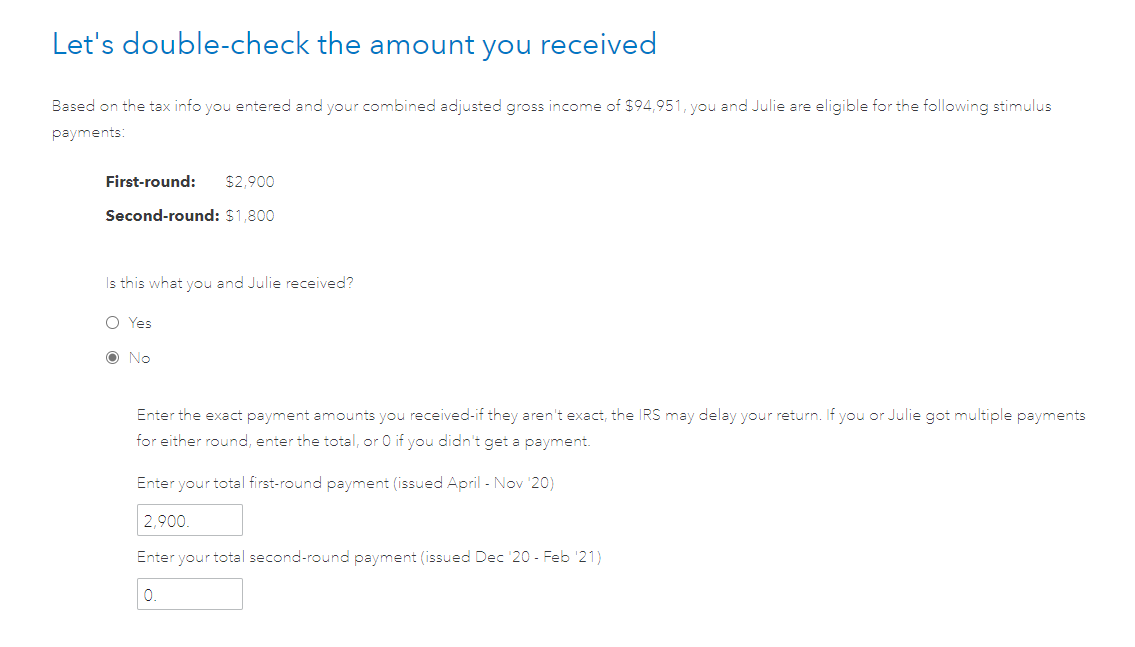

- At the next screen, Let's double-check the amount you received, answer No to edit the first-round and second-round amounts.

- Since no stimulus amount was received, enter 0 for each box. An amount must be entered in each box. When finished, click Continue.

For more information, see: How do I claim the Recovery Rebate Credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

If you did not get prompted to enter your stimulus information, that means you either:

- Filed as a dependent being claimed on another tax return, or

- have an AGI too high to claim the recovery rebate

To get to the stimulus questions in TurboTax at any time, you can search for stimulus and use the Jump to link. Generally, if you have adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns and surviving spouses, you will receive the full amount of the recovery rebate. For filers with income above those amounts, the payment amount is reduced.

After you have entered your tax information and are ready for the Federal Review, it will be the first question.

If you are trying to trigger it, you can go to Other Situations, answer any questions and click Done. The next automatic selection is Federal Review and it will ask about payments received.

If you didn't get one or both of the Stimulus payments or qualify for more it will be the Recovery rebate credit on 1040 line 30. It either adds to your refund or reduced a tax due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

i did file my tax 2020 but i did not mention i get full amount i did not get full amount for my daughter first and second so what i do where i can file a claim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file the recovery rebate credit since i wont br getting my second stimulus check automatically

I did file 2020 and accept it by IRS but I forget to add for my daughter about the First and Second Stimulus check she did not get here stimulus what should I have to do, do I have to wait for my refund or file a Amend a return 2020 please help me thanks

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

prettytwin32

New Member

kirkpatricklisa69

New Member

m-kominiarek

Level 1

ra4677004

New Member

hornbergermichael555

New Member