- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I enter a backdoor Roth IRA conversion?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

You have the $1,000 as taxable and it should not be. See step 3 above and posted again for your review and to change your entry.

- The Form 1099-R was completed correctly except you must make one Forms 1099R for $6,000 only.

- Converted to Roth should also be $6,000. This will remove the $1,000 that should not be taxable since you withdrew it before the due date of your return. If you had any earnings during the time the money was in the traditional IRA, this would be included in the 1099R.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Hi @DanaB27

my token is 970618

I am facing the problem that 4.b is exactly the amount of 4.a which is the backdoor conversion amount. In my case 4.b should be 0 since I convert to this 6000 to Roth IRA immediately after I contributed it to the traditional IRA. There is no income between these two steps. Please help. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Thank you for the token. You entered that you made the traditional IRA contribution for 2021 in 2022, is that correct? If yes, then that amount can't be converted until 2022. If you made the contribution in 2021 for 2021 then please edit your entry and don't enter that you made a contribution between Jan 1 and April 18th, 2022:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

Did you have another nondeductible contribution that you made for 2020 and therefore had a basis in line 14 of your 2020 Form 8606? If yes then you will need to enter this basis during the interview (steps 6 and 7):

To enter the 1099-R distribution/conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2020 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Hello,

My token number is 970709.

I see only a tiny amount of my backdoor conversion ($6000) is considered as non-taxable. Based on the discussion in this thread, it seems turbo-tax s using pro-rata rule to determine my taxable amount from the back-door conversion. Please let me know if my understanding is correct. I just want to make sure I am not missing anything before hitting the submit button.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Yes, only a small amount is nontaxable because you had pre-taxed funds in your traditional IRA and therefore the pro-rata rule applies. You can see the calculations on the "Taxable IRA Distribution Worksheet". The rest of your basis is listed on line 14 of Form 8606 and can be used in future distributions/conversions according to the pro-rata rule.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

The link : https://ttlc.intuit.com/community/entering-importing/help/how-do-i-enter-a-backdoor-roth-ira-convers... does not work for the Premier desktop version.

I don't see how I can reach Step 1, Question 9 as follows:

Answer the questions on the following screens, until you reach Choose Not to Deduct IRA Contributions. Select Yes, make part of my IRA contribution nondeductible, enter the amount you contributed, and Continue

I don't see the above message. Not able to proceed to step 2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

After entering your traditional IRA contribution, towards the end, you will see the screen that says Income Too Hight To Deduction an IRA Contribution. Select Continue to the next screen, you can enter the amount to make nondeductible. See the screenshot below:

@silentmaster

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

I dont see the screen you have attached.

I see the following and then the software just back to the main screen.

My steps are like this:

1- Choose Traditional IRA check box

2 - Is this a repayment or retirement distribution ? Ans - No

3- Tell us how much you contributed ? $6000

4- Did you change your mind ? Ans - No

5 - Enter Excess Amount - $0

6 - Any non-deductible contribution to IRA Account ? Ans - No

7- Tell Us the value of All your traditional IRA account. $XX.XX

8 - Income too high to deduct IRA contribution.

9 - IRA deduction summary . Your deduction $0.0.

Thats it. No other screen. @FangxiaL

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

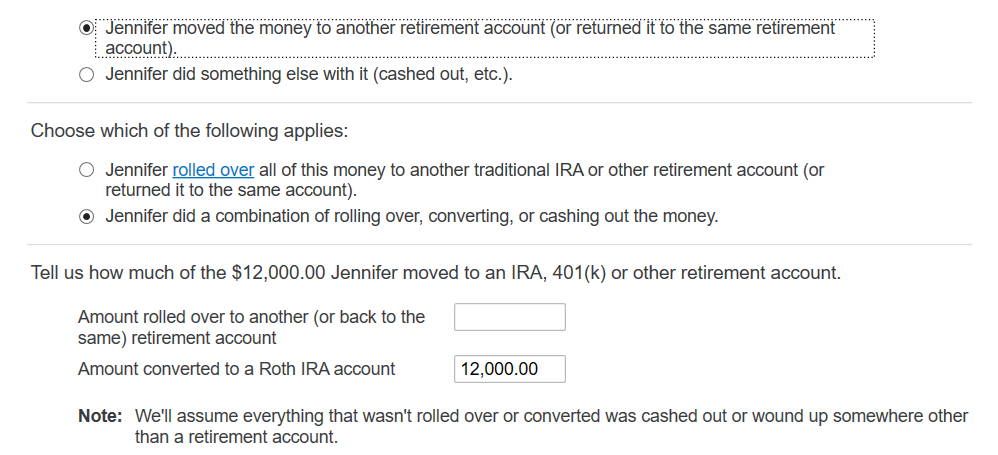

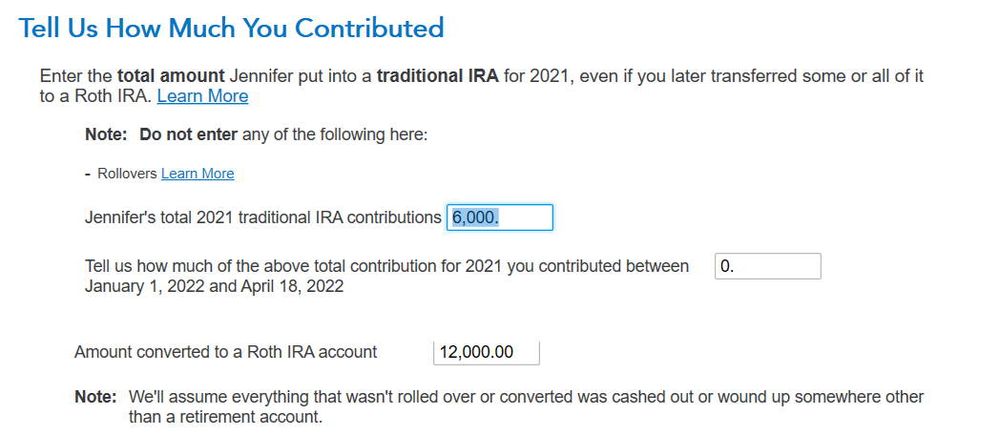

I thought I had done it correctly, but my 4a is blank and my 4b is zero. In 2021, in February and March, I made $12,000 in IRA contributions, $6000 for 2020, and $6000 for 2021.

I also just submitted my electronic return. Should I have waited until March 31?

This is how I filled it out:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

@Spouse1234 You should not be entering your 2020 contributions or conversions on your 2021 return. Those should have been entered on your 2020 return. If they were not then you need to go back and amend the 2020 return to include those amounts.

Here are the steps for entering a backdoor Roth conversion.

You need to follow the steps in order. If you have not then you should delete what you have already done and re-enter the contribution and conversion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

I believe I did file 2020 correctly. The only amount from 2020 that I am listing in the 2021 return is from the 1099-R, since the contribution was made in 2021.

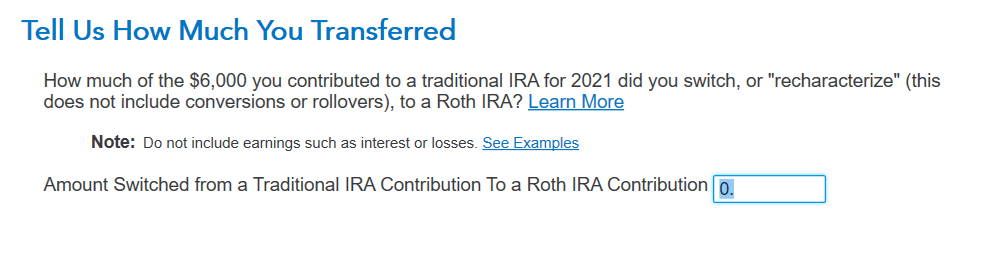

I followed those linked directions up until they didn't match up. At Step 7, On the Tell Us How Much You Contributed screen, enter the amount contributed and continue, I entered in 6000. I never say the screen that said "Did you Change Your Mind?".

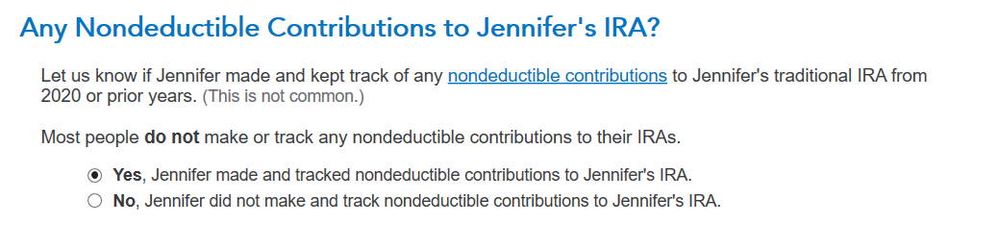

Instead, I got "Tell Us How Much You Transferred," No for Retirement Plans at Work, No for Any Excess IRA Before 2021, and then get to "Any Nondeductible Contributions..." which is different from that link which says, "Choose Not to Deduct IRA Contributions."

I chose Yes, made and tracked nondeductible contributions

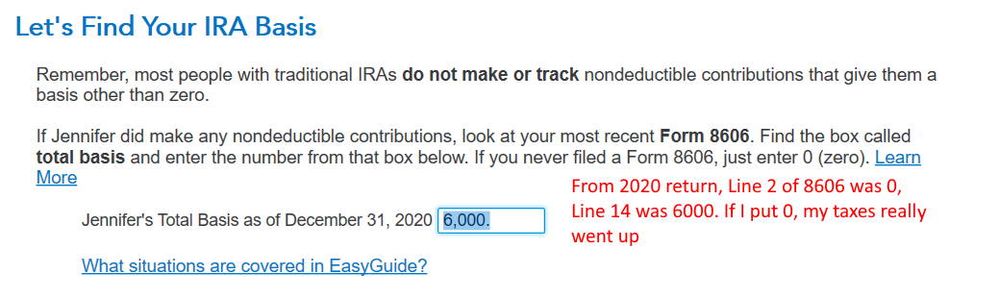

Then here is where I have the hard part. What is the total basis as of Dec 31, 2020? There was zero balance in the Traditional IRA. If Iyou sent change that from 6000 to 0, then my taxes go up a lot, but 4a then says 12,000. The link doesn't say how to answer that. Which box do I look at on Form 8606 from 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Yes, the screen names vary a bit between TurboTax Online and TurboTax Desktop but you seemed to have entered everything correctly.

Yes, if you made a $6,000 nondeductible contribution for 2020 and converted it in 2021 then you will have a $6,000 basis to carry over to 2021. You will find the basis on line 14 of your 2020 Form 8606 and you will enter this when TurboTax asks about your prior year's basis.

Please verify, that you checked the IRA/SEP/SIMPLE box when you entered your Form 1099-R for the conversion.

Yes, if you did not have any earnings and the value of all your traditional/SEP/SIMPLE IRAs was $0 at the end of 2021 then 4b of Form 1040 taxable amount will be $0.

Yes, you will not get the screen “Choose Not to Deduct IRA Contributions” if you have a retirement plan at work and are over the income limit. TurboTax will make it nondeductible automatically and you only get a warning and then a screen saying $0 is deductible. TurboTax will create Form 8606 for you to report your basis. You are done with entering your nondeductible contribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Token:973708

Still not sure I have this correct because I now get an excess message.

1099-r received was for 7k

3 - Form 5498

1st - Roth IRA conversion amount 1000, IRA type Roth

2nd - Roth IRA conversion amount 6000, IRA type Roth

3rd - IRA contributions 1000, IRA type IRA.

Now I think we need to withdrawal 1000 because we are not over 50. Is that correct?

I created 2 1099rs but not sure if that is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

I checked the IRA/SEP/SIMPLE box when I entered your Form 1099-R. I tried just now unchecking it and the amount owed goes up a A LOT.

Since I did use Box 14 of the 8606 when I entered the basis, then it seems I did everything correctly. Which is good since I filed a few days ago.

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Can you please provide more information? You contributed $6,000 for 2021 and received a Form 1099-R of $7,000 for a conversion (moving money from traditional IRA to Roth IRA)? You entered that you contributed $6,000 for 2021?

Did you make a nondeductible contribution for 2020 in 2020 that you converted in 2021? It seems as if you had a $1,000 direct contribution for 2020 (shown on Form 5498). If yes, then you should have a basis (nondeductible contribution) on your 2020 tax return Form 8606 line 14 to carry over to 2021. You need to enter this basis when TurboTax asks for the prior year basis during the interview. If you didn't enter the contribution on your 2020 tax return then please see How do I amend my 2020 return?

Why are you withdrawing $1,000 as an excess contribution? You are allowed to make a $6,000 contribution for 2021.

Please do not create two Form 1099-Rs when you received only one Form 1099-R. Please enter it as shown.

Please review the entry steps below.

To enter the nondeductible contribution to the traditional IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

- Enter the amount you contributed

- Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer the next questions until you get to “Any Nondeductible Contributions to Your IRA?” and select “Yes” if you had a nondeductible contribution before this tax year.

- If you had a basis in the Traditional IRA before then enter the amount.

- On the “Choose Not to Deduct IRA Contributions” screen choose “Yes, make part of my IRA contribution nondeductible” and enter the amount (if you have a retirement plan at work and are over the income limit it will be nondeductible automatically and you only get a warning and then a screen saying $0 is deductible).

To enter the 1099-R distribution/conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2020 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

@Spouse1234 Yes, you need to keep the IRA/SIMPLE/SEP box checked for a distribution/conversion from a traditional IRA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SAR66

Level 3

rxspoons

Level 2

sherylforster

New Member

Philimd

New Member

navipod

Returning Member