- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me ente...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

If the capital loss was for 2019, you need to use Schedule D to put in all the transactions that resulted in the capital loss. Then, TurboTax will automatically calculate the gain or loss from the transactions.

From the Income screen select "Investment Income" and then "Stocks, Mutual Funds, Bonds, Other."

TurboTax will guide you the rest of the way.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

Hmm, I didn't sell any stock or other investments in 2019. This a carryover loss that originated in 2008. Every year I use the Schedule D Worksheet then enter the $3,000 onto the Schedule D. The original amount was $40,000 and the company went belly-up. I've been using $3000 in carryover each year and have $10,000 left to use... so 2019, 2020, 2021 and 2022 will have carryovers from the original transaction.

There is no name of a person or financial institution. I've been using the Schedule D worksheet and the Schedule D form. I can't find the option where I just manually put in the amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

From my colleague MichaelL1

To enter your Capital Loss carryforward

- Click on Federal Taxes

- Click on Wages and Income

- Click on I'll choose what I work on

- Scroll down to Investments

- then the 2nd one is Capital loss carryforward open that.

Note: You enter the loss carryover as a positive amount here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

When I select "Capital Loss Carryover" it takes me to the question "Did you have any investment losses you couldn't claim in 2018?" Selection of "Yes" or "No". I selected "Yes". I then get sent to a page that says TurboTax has calculated for based on what I entered, however, I never got the chance to enter anything. It has three amounts of "$0" each for: Capital loss carryover from 2018, Capital loss used in 2019, Loss carried forward to 2020.

I never receive the option to enter it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

@vkendall1958 What version of the TurboTax software are you using? Are you using TurboTax Online or the Desktop version and which one (Deluxe, Premier, etc.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

I'm using the online version. I've spoken with 2 different live help accountants, but they were unable to fix as a well. I never got a follow up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

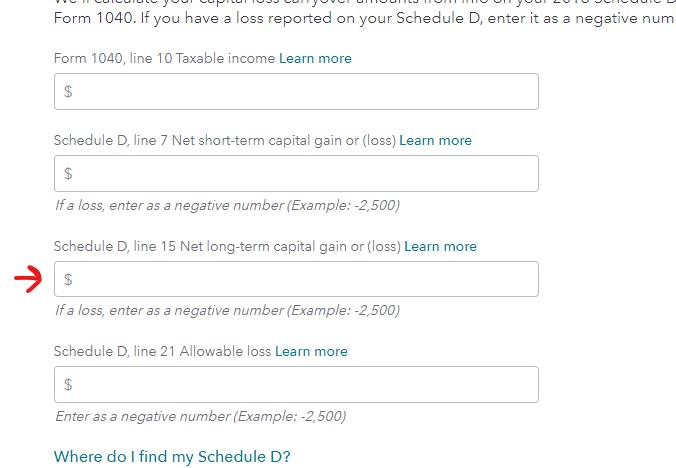

To enter this you will need to be on TurboTax Online Premier or Self Employed.

- When you scroll down to Capital Loss Carryover and select Edit

- It should show you information calculated from your 2018 return including the -3,000 used.

- You need to select edit on this page.

- On the next page It should already have your Taxable Income and allowable loss from 2018

- On the line above the allowable loss from 2018 (which should say -3,000 if not enter it)

- Long Term Capital Loss enter (-13,000) This should allow the $3,000 this year and keep you from needing to enter it again next year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

Thank you for the detailed reply. However, when I do the second step I do not get that choice:

- "It should show you information calculated from your 2018 return including the -3,000 used."

I get a screen that asks:

- "Did you have investment losses you couldn't claim in 2018? If you have more investment losses than the IRS allows for one year, you can carry any excess loss over to future years until you use it up. This is called a capital loss carryover." with a YES or NO option.

If I select YES the next screen is:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How come I can't enter the amount of a Capital Loss for 2019? The program doesn't let me enter the amount.

If you did not file with Turbo Tax in 2018, you need to tell Turbo Tax what your carryovers were:

- Go to Federal>wages and income>show all income

- investment income>Capital Loss Carryover

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JohnP12

Returning Member

JohnP12

Returning Member

g-2091999

New Member

bhargavr

New Member

ktreed

Level 2