- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

To enter this you will need to be on TurboTax Online Premier or Self Employed.

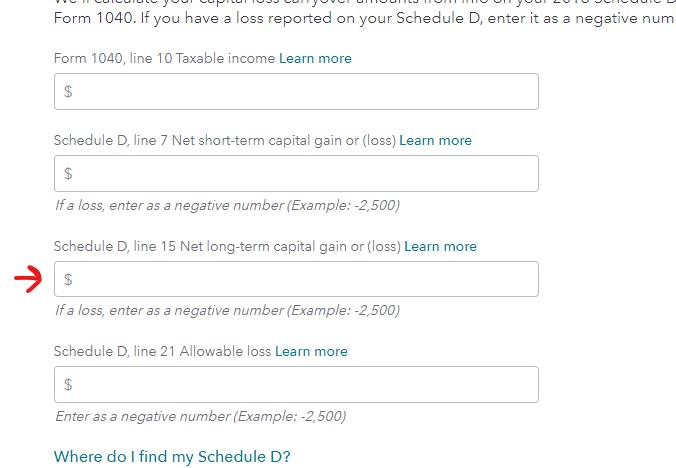

- When you scroll down to Capital Loss Carryover and select Edit

- It should show you information calculated from your 2018 return including the -3,000 used.

- You need to select edit on this page.

- On the next page It should already have your Taxable Income and allowable loss from 2018

- On the line above the allowable loss from 2018 (which should say -3,000 if not enter it)

- Long Term Capital Loss enter (-13,000) This should allow the $3,000 this year and keep you from needing to enter it again next year.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 19, 2020

7:44 AM