- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How are qualified REIT dividends computed?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are qualified REIT dividends computed?

The amount in Block 5 of my 1099-DIV is more than the qualified REIT dividends in the TT Smart Worksheet.

Topics:

posted

March 5, 2023

1:57 AM

last updated

March 05, 2023

1:57 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Best answer

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are qualified REIT dividends computed?

In answer to both of your questions;

- If there is an amount in Box 1A, 1B, and Box 5 in the 1099 DIV, If there is an mount in Box !A, then it is possible that the amount in Box 5 may be larger than the Qualified Dividends reported in Box 1B. The key factor is that the amount reported in Box 1A must be equal or exceed the REIT dividends reported in Box 5.

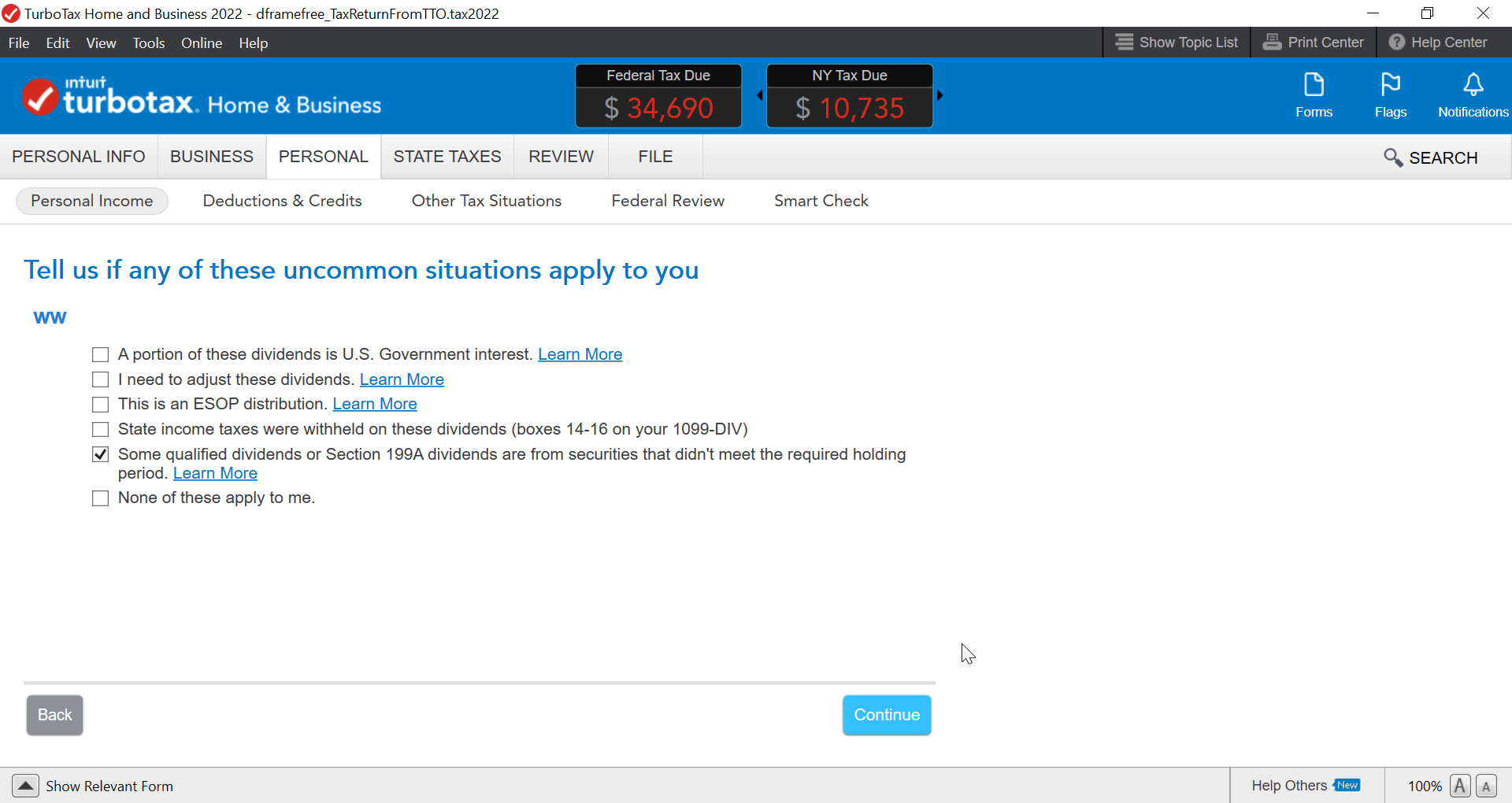

- After you report your 1099 DIV, there is a follow-up question that is titled Tell Us if Any of These Uncommon Situations Apply to You. in the selection, there is an entry for you to check that says some qualified or Section 199A dividends did not meet the holding period requirements.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 6, 2023

2:19 PM

4 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are qualified REIT dividends computed?

did you enter/import any adjustments on the 1099-Div?

March 5, 2023

9:30 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are qualified REIT dividends computed?

No, I made no adjustments to the 1099-DIV. How does TurboTax know if you've held the REIT stocks for at least 45 days?

March 5, 2023

9:14 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are qualified REIT dividends computed?

In answer to both of your questions;

- If there is an amount in Box 1A, 1B, and Box 5 in the 1099 DIV, If there is an mount in Box !A, then it is possible that the amount in Box 5 may be larger than the Qualified Dividends reported in Box 1B. The key factor is that the amount reported in Box 1A must be equal or exceed the REIT dividends reported in Box 5.

- After you report your 1099 DIV, there is a follow-up question that is titled Tell Us if Any of These Uncommon Situations Apply to You. in the selection, there is an entry for you to check that says some qualified or Section 199A dividends did not meet the holding period requirements.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 6, 2023

2:19 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How are qualified REIT dividends computed?

Thanks DaveF1006. You led me to a block I didn't know was checked.

Problem solved.

March 6, 2023

5:51 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lvsnails

New Member

lcgundo

Level 3

doyle-dreiling

New Member

daveshacho

New Member

Twaddell-3rd

New Member