- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Geothermal is still eligible. I am trying to enter a car...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

IRS Form 5695, Residential Energy Credits is estimated to be available on 01/29/19

Go to this TurboTax website for IRS forms availability - https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

As of this date the Congress has not renewed the credit for tax year 2018.

TurboTax has left the credit on the Form 5695 when viewed using Forms mode in case Congress approves the credit for 2018. The actual Form 5695 sent to the IRS when the tax return is filed will be the IRS approved 5695 for tax year 2018 - <a rel="nofollow" target="_blank" href="https://www.irs.gov/pub/irs-pdf/f5695.pdf">https://www.irs.gov/pub/irs-pdf/f5695.pdf</a>

The Residential Energy Efficient Property Credit which includes includes solar hot water heaters, solar electric equipment, wind turbines and fuel cell property is available for tax year 2018. Form 5695 is used for this credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

I have a tax credit of over $9000 that was carried over on form 5695 for two years and again it is being carried over. when and how can I get this credit ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

If you used TurboTax last year, the credit will carry over automatically to your 2019 return.

Residential Energy Credit is a non refundable credit, it will reduce you tax liability (tax due ) to 0 but it won't increase your refund.

Any unused amount will carry forward to future years.

If you didn't use TurboTax last year, follow the step to add the credit :

- Log in to your account.

- Go to Federal Taxes.

- Go to Deductions and Credits.

- Scroll down to your home and click show more.

- Go to Home Energy Credits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

i know this post is from June 2019, but i still have the same question... when will this form be available for 2019 filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

@hellafreckles wrote:

i know this post is from June 2019, but i still have the same question... when will this form be available for 2019 filing?

The 2019 Form 5695 is available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

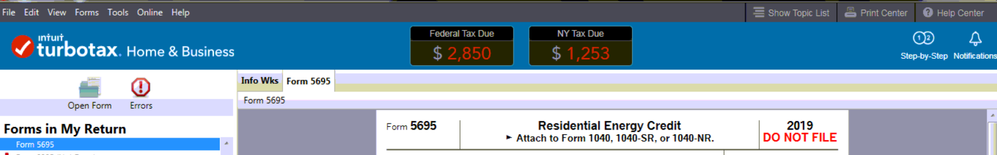

I am getting this - DO NOT FILE.

However, I my turbo tax says it's up to date (and that form says 2019 on it)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

If you are using the TurboTax CD/Download software program, open the program, from the top, under Online, select Check for Updates.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

Same question, but this time for tax year 2021....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 5695 be available?

@mjgormley wrote:

Same question, but this time for tax year 2021....

Form 5695, Residential Energy Credits for tax year 2021 is estimated to be finalized in the TurboTax program on 01/27/2022

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nex

Level 2

noodles8843

Level 1

sravwijnbergen

New Member

aashish98432

Returning Member

karliwattles

New Member