- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Good morning. I have followed the steps provided on how to report our COVID disaster disbursement and the form (8915-F) is not appearing in my taxes nor is the amount appearing in Box 4b. Any assistance would be greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

@bdbuckle wrote:

Good morning. I have followed the steps provided on how to report our COVID disaster disbursement and the form (8915-F) is not appearing in my taxes nor is the amount appearing in Box 4b. Any assistance would be greatly appreciated.

Did you follow these steps exactly -

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

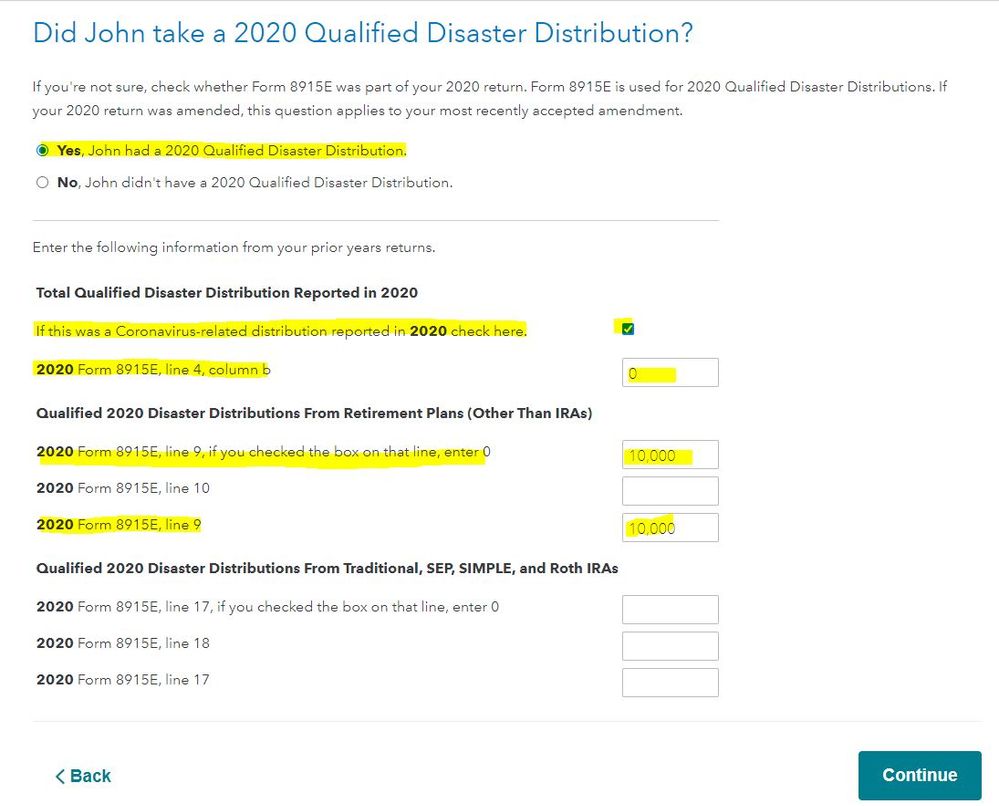

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Enter a 0

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

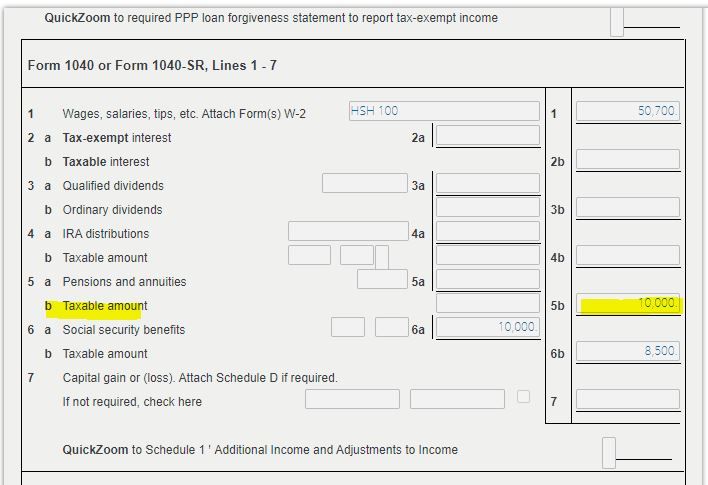

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Just spent two hours with Turbotax Rep. The online version does not support the 8915f. Had them send me a link to the home and business desktop download that supposedly has the form. The ONLINE FORM DOES NOT SUPPORT Form 8915F!!!! THIS IS FACT CHECK TRUE!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

I knew there was something up, @david4002

I've tried countless times. Nothing ever shows up in 5b at all. I wish they would just let us manually type it in. What a mess.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

@Dstonejr wrote:

I knew there was something up, @david4002

I've tried countless times. Nothing ever shows up in 5b at all. I wish they would just let us manually type it in. What a mess.

Use this procedure and make sure that you enter the 1/3 amount of the 2020 distributions as show in the procedure so that amount will be entered on the Form 1040 Line 4b or 5b -

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Enter a 0

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

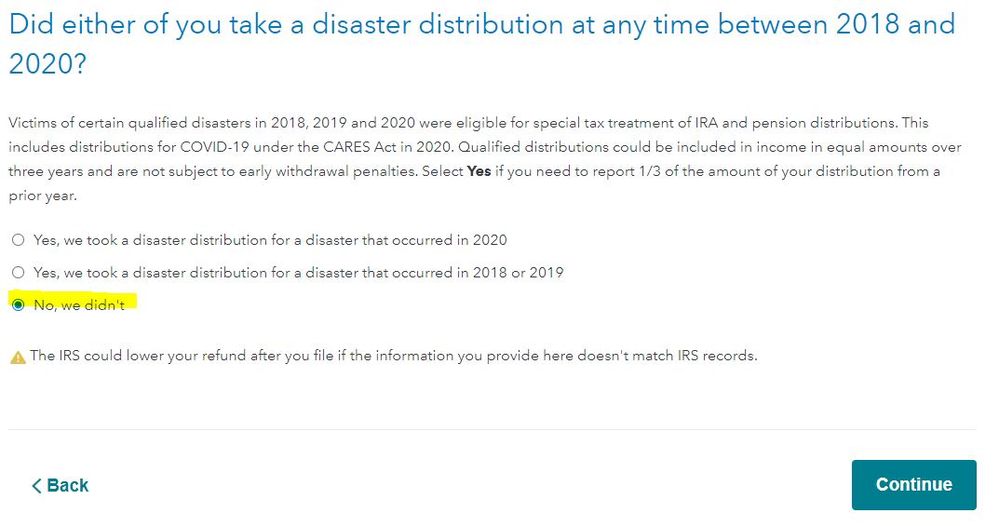

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Are you a bot? Because we have all read this. I have followed these steps to the very last letter. It doesn't work using online edition.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

@Dstonejr wrote:

Are you a bot? Because we have all read this. I have followed these steps to the very last letter. It doesn't work using online edition.

I have completed at least 20 test returns using the online editions and it has worked every time if you follow the procedure as written. If you do not then you will encounter issues like not getting the amount of the 2nd year distribution entered on the Form 1040 Line 4b or 5b. Or having to enter a FEMA Disaster number when one is not needed. Or getting into a loop going back to the Form 1099-R even after entering the distribution amounts in the 1099-R section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

I posted mine before I read your next reply. Let me try again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

Ok, it worked. Please use your reply with the pictures for anyone else that asks. The instructions "if you checked the box on that line, enter 0" is what is confusing everyone.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

When you did these steps, are you able to verify Form 8915-F is generating with your return?

I don't want to pay yet until I know that form will be included with my return. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

in the Windows software version which I purchased via Amazon online, I was able to answer the interview questions, follow the steps and when my tax form was generated the 8915-F was there with the correct amount added to my 2021 income (second year of three part distribution). In addition, my state return needed the form required in California to NOT pay this extra and that was also included in the State tax return completed. I was able to successfully complete the returns and e-file both returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

it's available now, but it isn't letting me populate some boxes (23 - 26).. anyone else having this issue? I'm just expecting my tax liability to increase when i include 8915-F, and it's not..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

This was helpful. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8915-F is available from the IRS but It is not available in turbo tax online. Why and when will it be available?

@ryanupson12 wrote:

it's available now, but it isn't letting me populate some boxes (23 - 26).. anyone else having this issue? I'm just expecting my tax liability to increase when i include 8915-F, and it's not..

If you had 2020 distribution from an IRA that was Coronavirus-related and spread the distribution over three years then you must enter the 2nd year distribution in Both boxes for 2020 Form 8915-E, Line 17. This will have the amount of the distribution entered on your form 1040 Line 4b.

See screenshot for an example (note that the screenshot is for a distribution that was not an IRA)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

5flavors

Level 3

mikemvg

New Member

fjwerth

New Member

lokkeng

New Member

sv_siri

Level 3