- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 5329 - TT only prepares form for one spouse

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

My wife and I both did 2023 Roth conversions (distribution from our IRAs into Roth IRAs). However TT only prepares and shows a Form 5329 for me and not for my wife. The one form only shows the amount of my rollover. What am I missing? Why doesn't it prepare one for her?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

Your 5329 is called 5329-T in TurboTax, right? This means it is for the taxpayer (whoever the primary taxpayer is on the return). The spouse's 5329 would be listed as 5329-S.

But I am puzzled - why do you have a 5329? This form is for calculating penalties on a large variety of tax-advantaged accounts, like IRAs. A "rollover" from a traditional IRA to a Roth IRA should not cause penalties, just a large tax bill as the traditional IRA distribution is added to your income.

Did you get a penalty on your traditional IRA distribution, like an early distribution penalty? Is it possible that your spouse did not trigger the same penalty?

What lines on your 5329 were filled in?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

The rollover amount appears on Line 2 in Part I and it has an exception code of "12" inserted on that line. I have no idea why that code was inserted and I am certain I did not input it. The form does not a T in the name, just 5329.

I think I may have found my problem though. In the Step by Step sequence for the related 1099s it asks did you move the money to another retirement account or did you do something else with the money. I checked something else but maybe it should have been the other answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

Well that didn't work. It changed the form prepared to a 5329-T but only prepared one for me not my wife. TT put my rollover amount on line L of the form, "Incorrect Early Distributions". Which it is not. And changed the result to a non-taxable rollover for both of us. Which it is not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

So I tried something else. I answered the TT question about what we did with the distribution. It then asked how much was converted to a Roth; all of it. I did the same for my wife's rollover. TT now prepares both a 5329 T and 5329 S but on both of them it puts the amount on line L, Incorrect Early Distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

Is it possible that you are either filing married separate or you added your spouse after to add this 1099-R? I don't understand why you got only a 5329 and not a 5329-T.

Also, what is Line L? There is no line L on the 5329.

The exception code of 12 is for "Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include on line 2 the amount you received when you were age 59 1/2 or older".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

No we have been married for many years and always filed jointly.

Sorry I should have been clearer about Line L. It is on the TT Smart Worksheet for the 5329 not the form itself. When I generate a preview version of my tax return it produces the normal 5329 for both my wife and I. And the code still shows as 12 line 2, part I of the actual 5329. I cannot see that I have made any entry to TT that would create that code 12.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

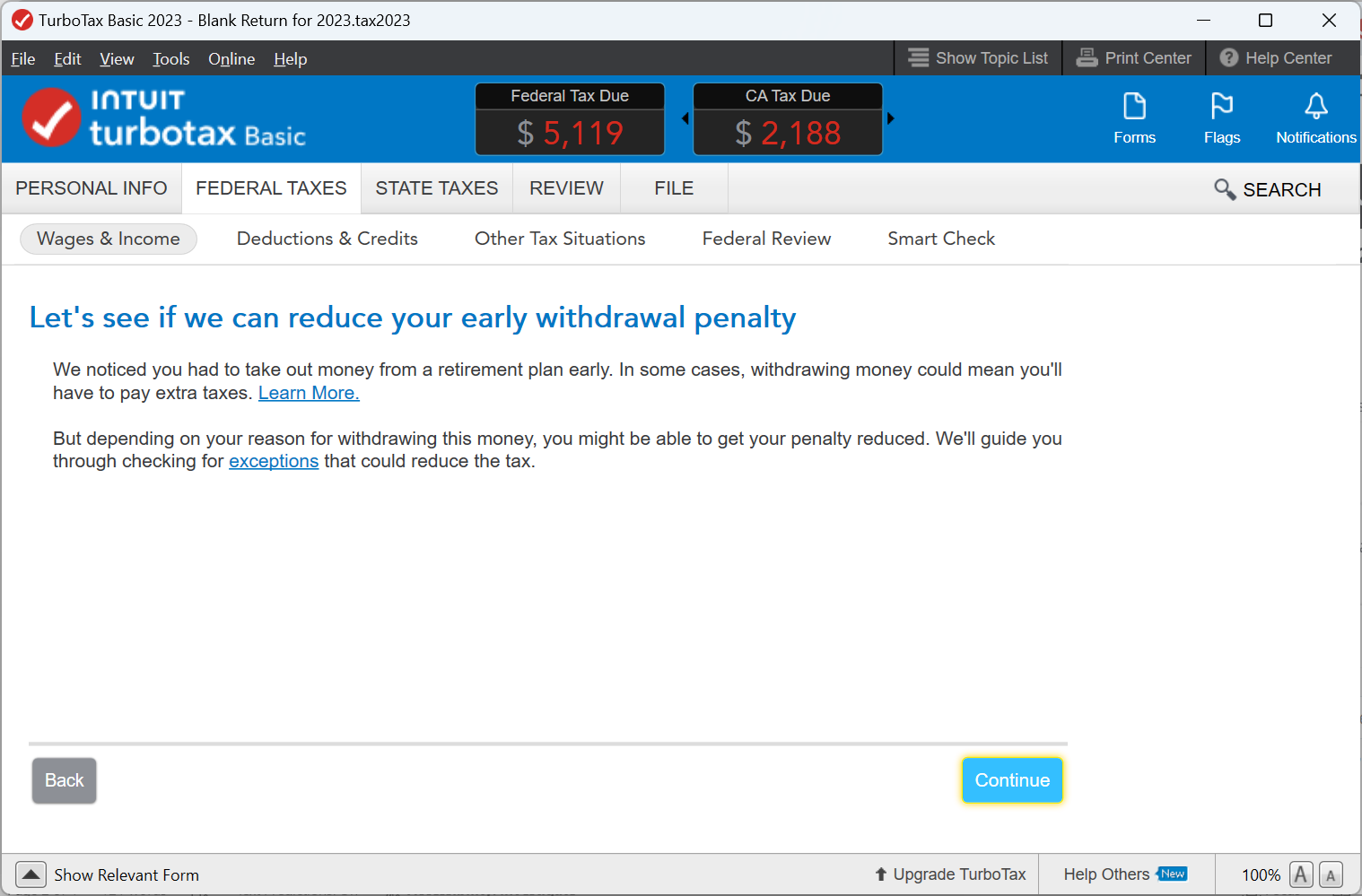

Did you see the following screen in the interview in TurboTax (this is from the desktop product, the Online product may look somewhat different).

Of course, you would love to reduce your penalty, so you hit Continue. The next screen is

You see the bottom Line? Did you make an entry for "Incorrect Early Distributions". This is how the "12" got put on Line 12 on the 5329.

If this is not what what you did, I am puzzled on how you could have gotten the results you did.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

I am using the desktop Home & Business version, but I never saw the screens you sent. So I never entered any amount in the Incorrect Early Distributions box. And I am certain we have not triggered any penalties. Just paying the taxes on the rollover.

I know my taxes are correct as I have a pretty sophisticated spreadsheet that I use for planning each year and it agrees with the TT tax calculations. So I am thinking that I should just delete the 5329s before filing since they seem to serve no purpose.

I very much appreciate you taking the time to help me solve this issue. If you have any further thoughts, I would appreciate that also. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 5329 - TT only prepares form for one spouse

Just a final follow up comment. I see that TT prepared Form 8606s for my wife and I and TT put the correct amounts on Line 16. That is the correct place for our Roth conversions.

I deleted the Form 5329s and it had no effect on the tax due, so I am going to file our return that way.

Again, thanks for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

basedday

New Member

ajs813

New Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

JimHerman

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

dkrawchu1

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

vsun

Level 1