- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Foreign rental income using 1099-Misc

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign rental income using 1099-Misc

I tried to use 1099-misc to report my foreign property rental income under $10,000 USD. It asked for an EIN which my renter does not have. TurboTax is flagging it as an error. Can I still proceed by leaving that field blank or are there a better way to go about it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign rental income using 1099-Misc

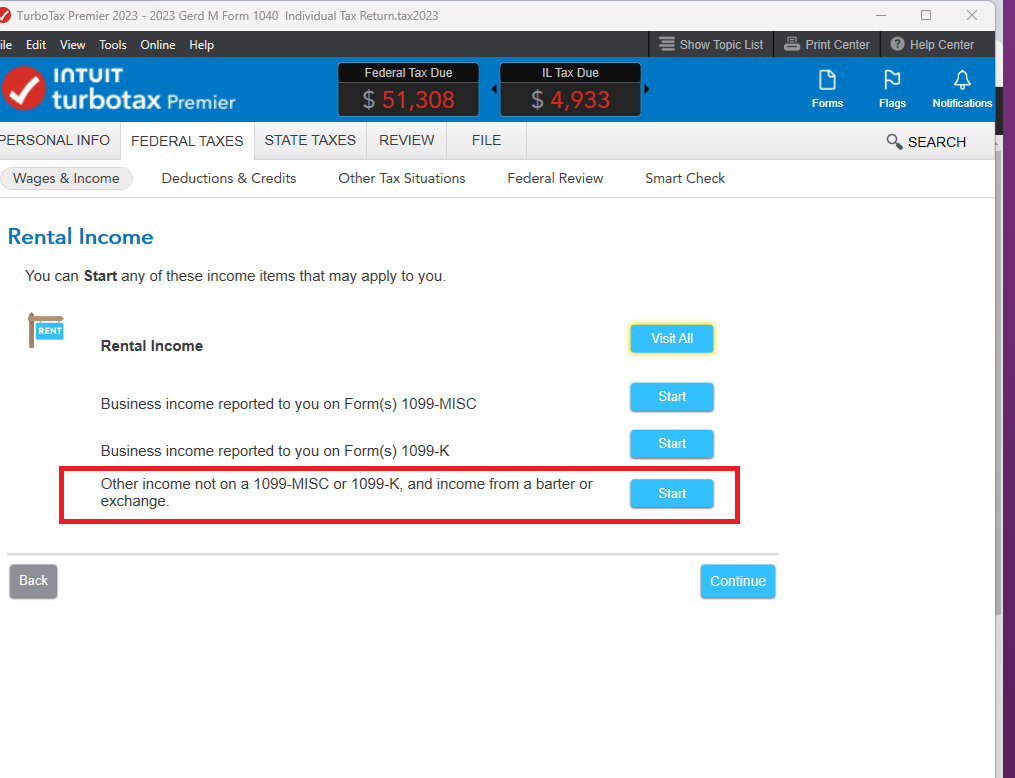

You don't have to report Rental Income as a 1099-Misc, if you didn't receive one.

You can report rental income received as cash, checks, etc.

Delete your 1099-Misc entry, and enter the Rental Income as 'not on a 1099-misc'.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign rental income using 1099-Misc

The option on the rental income foreign outside of 1099-Misc isn't there anymore. So its flagging error without an EIN for a foreign national.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign rental income using 1099-Misc

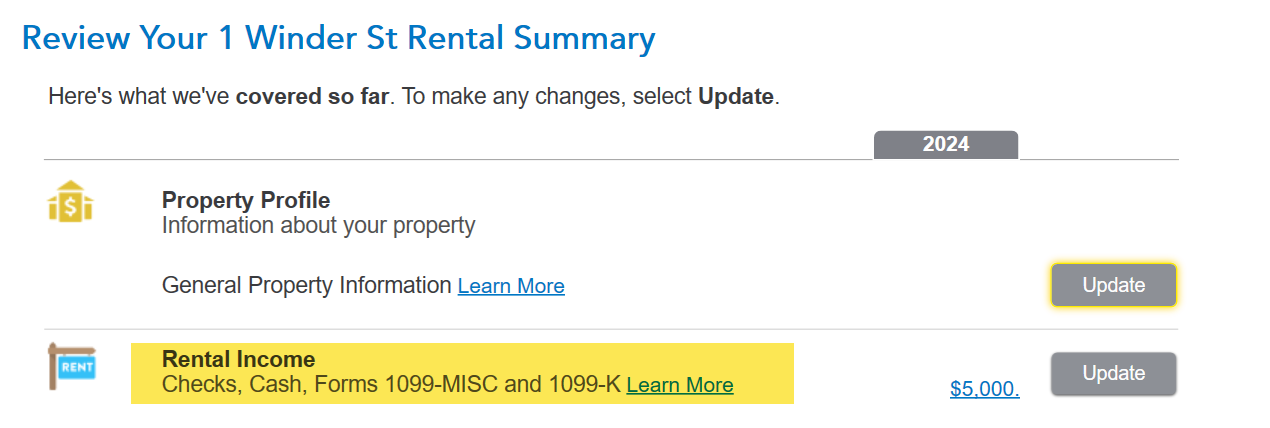

I believe what happened is you deleted the Form 1099-Misc entry then the program just gave you the opportunity to enter another one. Or, you saw the 1099-Misc entry and only saw an option to enter another one. What you need to do is get out of the rental section, then go back in and on the screen that says Review Your (name of rental) Rental Summary update your Rental Income entry and you will see the option to enter rent income not reported on a 1099 form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girishapte

Level 3

jmgretired

New Member

gobedoer

New Member

kristinacyr

New Member

dpa500

Level 2