- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Filled out K-1 partnership but it doesn't show up under my income review. Still says zero and I had -2216.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filled out K-1 partnership but it doesn't show up under my income review. Still says zero and I had -2216.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filled out K-1 partnership but it doesn't show up under my income review. Still says zero and I had -2216.

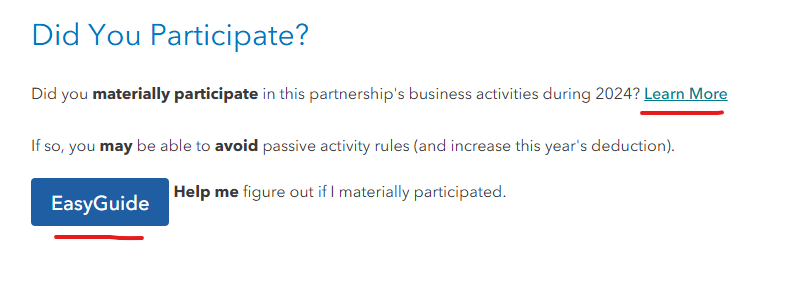

Did you materially participate in the enterprise? If not, you may not have qualified for the passive activity loss.

Review IRS form 8582 Passive Activity Loss Limitations. See Part VIII for Allowed Loss.

In TurboTax Online, you may print or view your full tax returns prior to filing after you have paid for the software.

- View the entries down the left side of the screen at Tax Tools.

- Select Print Center.

- Select Print, save or preview this year's return.

In TurboTax Desktop, select FORMS in the upper right hand corner of the screen.

For more information, select the hyperlink Learn More at the screen Did You Participate?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filled out K-1 partnership but it doesn't show up under my income review. Still says zero and I had -2216.

if this was a publicly traded partnership, by law the loss is not currently deductible. If it was not a PTP, look at form 8582 and the related worksheets. The loss could be passive resulting in it not being currently deductible.

is it rental real estate? always passive except for a real estate professional and the loss is not deductible if your adjusted gross income ia over 150K before the loss, if it's not rental real estate do you materially participate fin the partnership activities for the loss show on line 1

I f the loss is on other lines, we need to know the line number and the letter, if any, associated with the line number

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abarmot

Level 1

sam992116

Level 4

ke-neuner

New Member

HNKDZ

Returning Member

yingmin

Level 1