- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Federal W4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

Hi

I have got a new job and have to fill the Federal W4 for this. Doing this Job only now. My spouse is a graduate student and working on campus. Last year he made approx 25,000 and I made 3000. we have no children and no dependent. Please help me to fill in this form. please guide me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

I can provide you with some advice on how to fill out your W4 for 2021...Given what you stated in the first "scenario" question, if you believe this will not change, you obviously would not want much at all withheld from your taxes as your tax liability will most likely be zero (again, going along with what you say above and assuming you don't have other sources of income).

I suggest you do the following:

Based on your hourly rate and your husband's hourly rate for W2 income ($25k and $3k, respectively), if your hourly rate has not changed with this new job you've taken starting in March, and your hours per week are to be the same (ex.: 25,000/52 weeks/40hrd = $ 2.019/hr.), then you can expect to make the same annually, same goes for your husband. If you are getting a bump up in your hourly rate, for ex. say, to $18.50/hr., then your annual gross income for this new role will be approximately $ 31,820 (18.50*40hr*43 weeks). What ever your hourly rate is for this new role, do that same calculation just by substituting whatever the hourly rate is with the 18.50 I "plugged" in. This will give you your approximate annual gross income (once you add your husband's expected gross income for the year).

Once you've done this calculation for the new rate of pay, use the tax table below to try to figure out what tax rate you and your husband fall into (AFTER the reduction for Standard Deduction for MFJ of $18,650). So, lets just use the above for the example...

$31,820 + 3,000 = 34,820 - 18650 = $ 16,170 - THIS WOULD BE YOUR TAXABLE INCOME

Following the information from the IRS 2020 Tax Table found here 2020 IRS Tax Table , your taxable income would be $1,618.00. Again, this is assuming nothing else existing on your return.

SO, when you fill out the W4, if you need or rely on or just like to have every dollar you make go into your net paycheck, you want to have as little withheld as possible. This is called "breaking even" to your expected taxable income.

Instructions for filling out a "break even" W4:

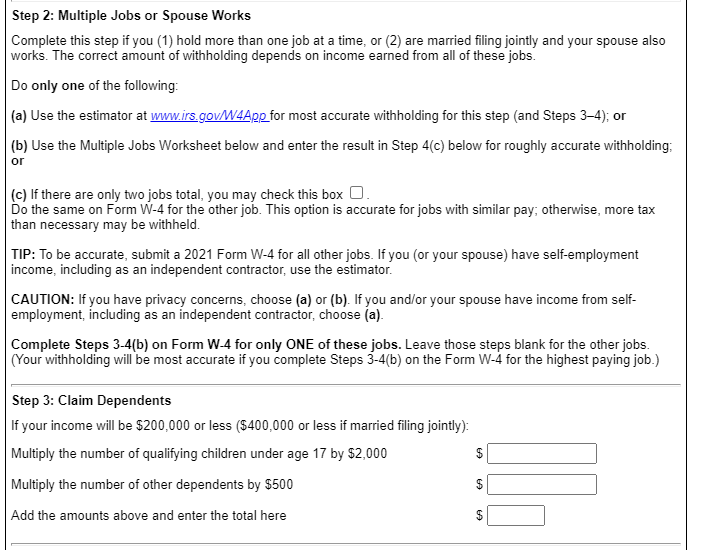

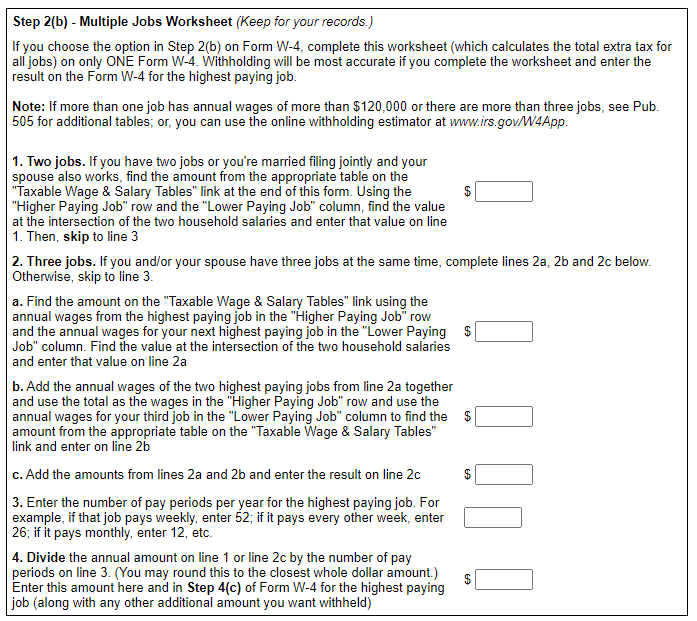

Step 2: Check off Box "C" if you only have these 2 jobs and they are both W2 jobs (ie - he does not get paid via 1099)

Step 3: ZERO on all 3 lines

Step 4: Since your Federal Income Tax plus FICA (SS & Medi) will be a total of approximately $3,666 (calculation from a tax tool found

here Figuring Your Total Tax Federal and FICA ) , you do not need to withhold too much, therefore I would recommend you

do the following:

4(a) - ONLY if both jobs are W2, enter ZERO. If husband's job is 1099, that will be your call on this line.

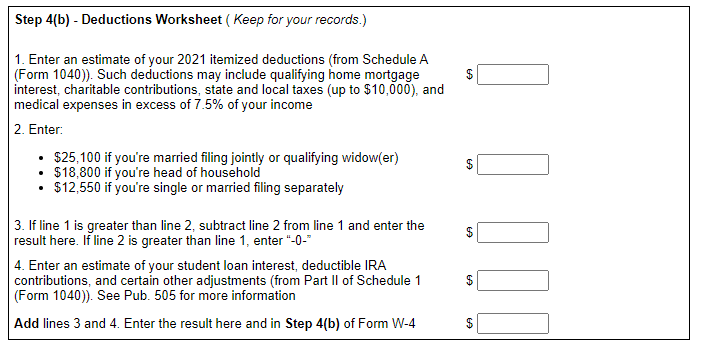

4(b) - THIS LINE IS OPTIONAL AND NOT A "you'd better be exact" as this W4 is yours! So, enter as if you were not

taking the SD but Itemizing, even though you're not, this is only for calculation purposes for your employer's HR

department. For your tax situation, I would recommend you enter $25,000 here and this will give you more in

your paycheck, less of a refund, but still a refund and you won't owe.

4(c) - ZERO

I hope this helps. For your State, if it still allows an actual "allowance" number, I suggest you enter "6". NOW, if during the year, your situation changes - say, you get a huge pay increase - you will want to go to your employer's HR Department and fill out a new W4 to reflect updated pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

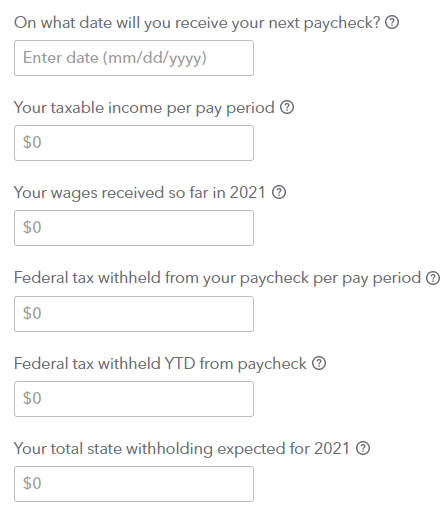

Please click the link below to use the TurboTax W4 calculator:

Link to TurboTax W4 Calculator

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

I can provide you with some advice on how to fill out your W4 for 2021...Given what you stated in the first "scenario" question, if you believe this will not change, you obviously would not want much at all withheld from your taxes as your tax liability will most likely be zero (again, going along with what you say above and assuming you don't have other sources of income).

I suggest you do the following:

Based on your hourly rate and your husband's hourly rate for W2 income ($25k and $3k, respectively), if your hourly rate has not changed with this new job you've taken starting in March, and your hours per week are to be the same (ex.: 25,000/52 weeks/40hrd = $ 2.019/hr.), then you can expect to make the same annually, same goes for your husband. If you are getting a bump up in your hourly rate, for ex. say, to $18.50/hr., then your annual gross income for this new role will be approximately $ 31,820 (18.50*40hr*43 weeks). What ever your hourly rate is for this new role, do that same calculation just by substituting whatever the hourly rate is with the 18.50 I "plugged" in. This will give you your approximate annual gross income (once you add your husband's expected gross income for the year).

Once you've done this calculation for the new rate of pay, use the tax table below to try to figure out what tax rate you and your husband fall into (AFTER the reduction for Standard Deduction for MFJ of $18,650). So, lets just use the above for the example...

$31,820 + 3,000 = 34,820 - 18650 = $ 16,170 - THIS WOULD BE YOUR TAXABLE INCOME

Following the information from the IRS 2020 Tax Table found here 2020 IRS Tax Table , your taxable income would be $1,618.00. Again, this is assuming nothing else existing on your return.

SO, when you fill out the W4, if you need or rely on or just like to have every dollar you make go into your net paycheck, you want to have as little withheld as possible. This is called "breaking even" to your expected taxable income.

Instructions for filling out a "break even" W4:

Step 2: Check off Box "C" if you only have these 2 jobs and they are both W2 jobs (ie - he does not get paid via 1099)

Step 3: ZERO on all 3 lines

Step 4: Since your Federal Income Tax plus FICA (SS & Medi) will be a total of approximately $3,666 (calculation from a tax tool found

here Figuring Your Total Tax Federal and FICA ) , you do not need to withhold too much, therefore I would recommend you

do the following:

4(a) - ONLY if both jobs are W2, enter ZERO. If husband's job is 1099, that will be your call on this line.

4(b) - THIS LINE IS OPTIONAL AND NOT A "you'd better be exact" as this W4 is yours! So, enter as if you were not

taking the SD but Itemizing, even though you're not, this is only for calculation purposes for your employer's HR

department. For your tax situation, I would recommend you enter $25,000 here and this will give you more in

your paycheck, less of a refund, but still a refund and you won't owe.

4(c) - ZERO

I hope this helps. For your State, if it still allows an actual "allowance" number, I suggest you enter "6". NOW, if during the year, your situation changes - say, you get a huge pay increase - you will want to go to your employer's HR Department and fill out a new W4 to reflect updated pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

Hi

Thanks for a detailed answer.

Just to make it clear my husband earned 25000 and I had earned 3000 last year and I have also got the 1099 form from Paypal with $2000 on it.

Will this change how I am going to fill the form W4.

I guess you are interpretation the other way around.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

Yes, exactly!! Same exact details - just the other way around!!! 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

Form 1099-NEC is taxable as income on your tax return when it comes from PayPal or another payer.

Here is a TurboTax article about Form 1099-NEC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

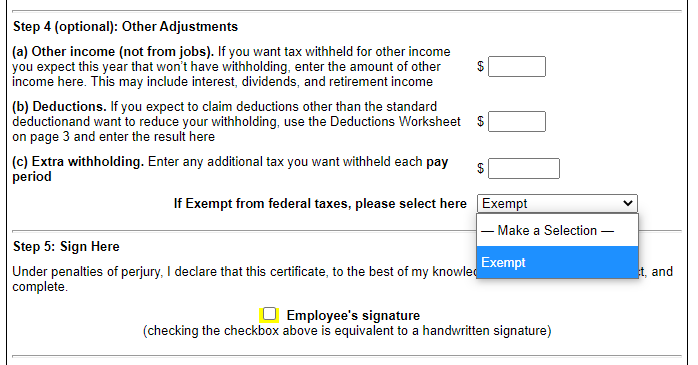

What do I need to select in: If Exempt from federal taxes, please select here" Make a selection or Exempt

Should I select Make a selection or Exempt please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

Delete the entry of "Exempt" (in other words, select "Make a selection" or the blank space) unless it is your desire to have $0 Federal tax withheld, which is (technically) illegal if you are not actually exempt to pay taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

So the below instructions I need to choose to Make a selection

instructions for filling out a "break even" W4:

Step 2: Check off Box "C" if you only have these 2 jobs and they are both W2 jobs (ie - he does not get paid via 1099)

Step 3: ZERO on all 3 lines

Step 4: Since your Federal Income Tax plus FICA (SS & Medi) will be a total of approximately $3,666 (calculation from a tax tool found

here Figuring Your Total Tax Federal and FICA ) , you do not need to withhold too much, therefore I would recommend you

do the following:

4(a) - ONLY if both jobs are W2, enter ZERO. If husband's job is 1099, that will be your call on this line.

4(b) - THIS LINE IS OPTIONAL AND NOT A "you'd better be exact" as this W4 is yours! So, enter as if you were not

taking the SD but Itemizing, even though you're not, this is only for calculation purposes for your employer's HR

department. For your tax situation, I would recommend you enter $25,000 here and this will give you more in

your paycheck, less of a refund, but still a refund and you won't owe.

4(c) - ZERO

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

If you anticipate that your income will be about the same, simply select "Single/Married Filing Separate" and leave the rest blank. Since you are anticipating earning about $3000 (and the "standard deduction" for you if you were filing separately is $12,550 for 2021), it is very likely than $0 in Federal tax will be withheld, and if any is withheld, it will be an appropriate amount compared to your earnings, which could vary. You always want to leave room for a change in circumstances producing more income than anticipated (less income will almost always produce a refund).

The new form was designed to be "less complicated". I'm not sure it actually accomplishes this, but in your case, I would recommend keeping it that simple.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

Thanks

@DanielV01 My spouse is expected to earn the same amount as that of last year $25000 per year, as he is a student and can only work 20 hours per week.

I started my job and had to the left job due to COVID last year and ended up earning only $3000 per year.

This year I am starting the job now and expected to continue for the whole year, I am expected to make $1920 per month.

we have to file our taxes MFJ.

Please let me know if we need to change anything

instructions for filling out a "break even" W4:

Step 2: Check off Box "C" if you only have these 2 jobs and they are both W2 jobs (ie - he does not get paid via 1099)

Step 3: ZERO on all 3 lines

Step 4: Since your Federal Income Tax plus FICA (SS & Medi) will be a total of approximately $3,666 (calculation from a tax tool found

here Figuring Your Total Tax Federal and FICA ) , you do not need to withhold too much, therefore I would recommend you

do the following:

4(a) - ONLY if both jobs are W2, enter ZERO. If husband's job is 1099, that will be your call on this line.

4(b) - THIS LINE IS OPTIONAL AND NOT A "you'd better be exact" as this W4 is yours! So, enter as if you were not

taking the SD but Itemizing, even though you're not, this is only for calculation purposes for your employer's HR

department. For your tax situation, I would recommend you enter $25,000 here and this will give you more in

your paycheck, less of a refund, but still a refund and you won't owe.

4(c) - ZERO

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal W4

Whenever I recommend a client with the W4 form, I try to answer the question: What is the final result? In this case, if your spouse is going to earn about $25000, and you are going to have $1920 per month (for the remaining 9 1/2 months of the year), then you will earn about $1800 yourself, which would be $43000 gross income combined. The standard deduction will be $25100 for a married couple filing joint (as long as there are not additional deductions for being over 65 or blind).

If that information ends up accurate, then your net taxable income would be around $1800, and your tax will be less than $2000. That is the amount you want to have withheld by the end of the year.

Literally, you can fill the form out the way you like. I still recommend filling it out as Single/Married Filing Separate with everything else blank. But if you use what has been suggested to you that is also acceptable. What you don't want is to be under withheld, because that can lead to penalties.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cobralady

New Member

shaypullen

New Member

Mary625

Level 2

ilian

Level 1

jwallace19791123

New Member

in Education