- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Error in TurboTax Deluxe for Delaware Form PIT-RES

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

On the Income Allocation Worksheet, Taxpayer/Spouse Allocation, Married Filing Combined Separate (Form PIT-RES), there is no way to separate out Spouse and Taxpayer for line 15, Other Income. You can only fill in the amount for spouse. When you do that, it does NOT change the value for Taxpayer. to compensate for the spouse value. There is nothing in the Easystep interview process that allows you to enter Other Income. You can only enter the data manually on the form. When can this error get fixed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

There are no columns a and b on my Schedule 1 (Federal Form 1040). There is only a single entry. In fact, I recall no interview question that asked me to split out my other income. Except for the taxpayer (me) and spouse 1099 forms that are entered, Turbotax has no knowledge of what belongs to me and what belongs to my wife on our joint return. On my state return, I have to identify some of the breakouts for the Married Filing Combined Separate (MFCS) interview. Other income is not covered.

I also tried to open a form for Schedule 1 worksheet, but there is only a Schedule 1 form, the one I have in Turbotax Deluxe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

I called TurboTax and spoke to Melanie. She suggested I remove a manual entry in a Federal Form worksheet and provide the value for other income in interview mode. That allowed me to separate the amount between my spouse and myself. Then those values carried over correctly to the Income Allocation Worksheet for Form PIT-RES. Problem solved!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

It should be pulling over from federal Form 1040. Most of the federal income is referenced. What type of income are you trying to correct? Is it properly marked for which spouse it belongs to in the federal?

An error can only be fixed once it is identified so we do appreciate your help if there is an issue. There are no known issues with the spouse allocation form at this time.

For my example, it pulled from Federal Schedule 1, Part I, line 8 Worksheet, column a and column b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

There are no columns a and b on my Schedule 1 (Federal Form 1040). There is only a single entry. In fact, I recall no interview question that asked me to split out my other income. Except for the taxpayer (me) and spouse 1099 forms that are entered, Turbotax has no knowledge of what belongs to me and what belongs to my wife on our joint return. On my state return, I have to identify some of the breakouts for the Married Filing Combined Separate (MFCS) interview. Other income is not covered.

I also tried to open a form for Schedule 1 worksheet, but there is only a Schedule 1 form, the one I have in Turbotax Deluxe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

Let me restate the problem. On the Delaware Form PIT-RES, Income Allocation Worksheet, Taxpayer/Spouse Allocation, Married Filing Combined Separate, line 15 is for Other Income. Turbotax correctly carries the total amount of Other Income over from the federal return and displays it in the Federal column. Let's say it's $209. If you manually enter $100 in the Spouse column, the value in the final column, Taxpayer, does NOT change. With other line items, when you enter the Spouse amount, TurboTax deducts that from the Federal column and displays the difference in the Taxpayer column. Then the sum of the Spouse and Taxpayer columns equal the Federal column. That is not true for Other Income (line 15). That is the crux of the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

TurboTax Online:

Sign into your online account.

Locate the Tax Tools on the left-hand side of the screen.

A drop-down will appear. Select Tools

On the pop-up screen, click on “Share my file with agent.”

This will generate a message that a diagnostic file gets sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

Open your return.

Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent”

This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

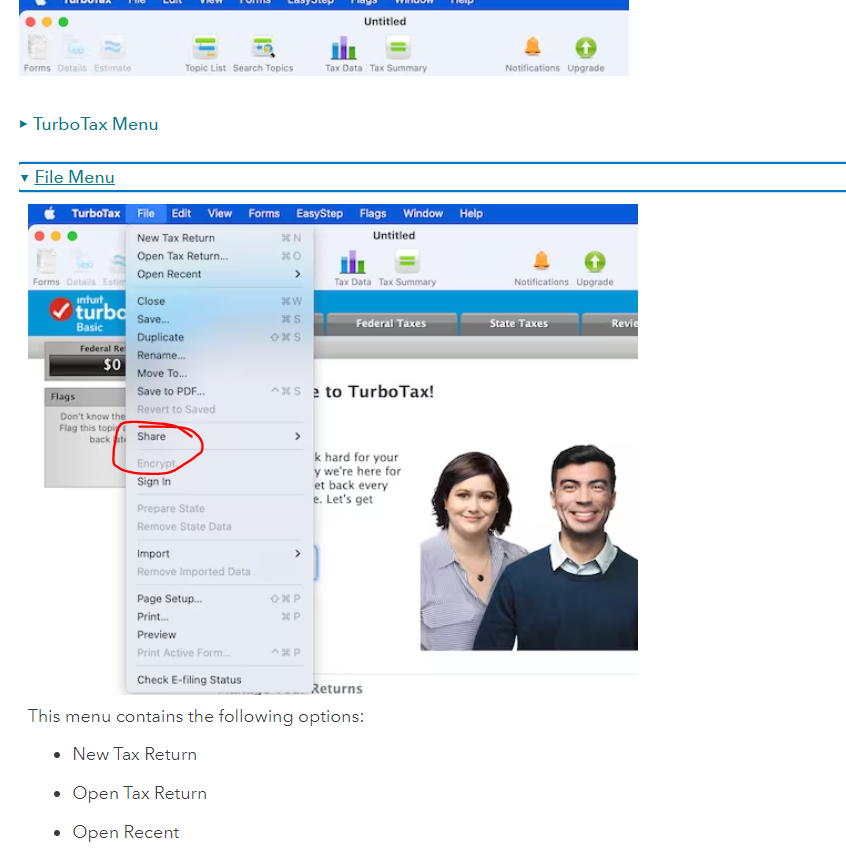

There is no Online tab in the black bar across the top of my version of TurboTax deluxe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

Try clicking on File and then Share to get your token code.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

There is no option in macOS Ventura for TurboTax Deluxe for sharing to get a token code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

If you are unable to get a token code, so we can take a closer look at your specific situation, please reach out to us directly using the Help Article here. This ensures you will get to the correct department as quickly as possible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error in TurboTax Deluxe for Delaware Form PIT-RES

I called TurboTax and spoke to Melanie. She suggested I remove a manual entry in a Federal Form worksheet and provide the value for other income in interview mode. That allowed me to separate the amount between my spouse and myself. Then those values carried over correctly to the Income Allocation Worksheet for Form PIT-RES. Problem solved!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gerald_hwang

New Member

ahkhan99

New Member

jjon12346

New Member

user17550208594

New Member

user17550208594

New Member