- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Don't see line 8a on 1098

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

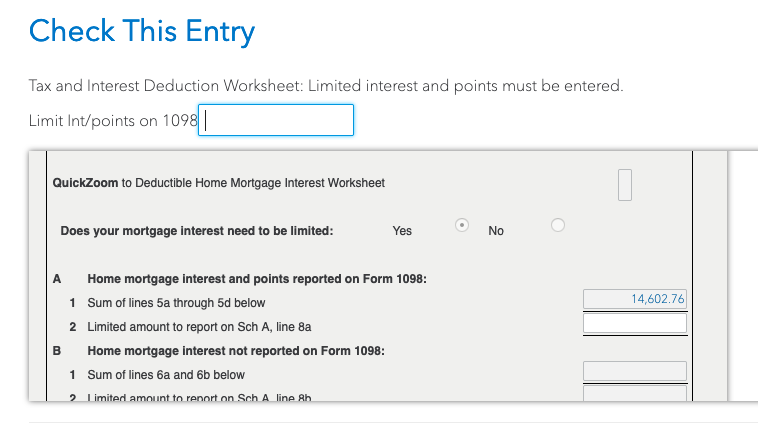

Using the online tool, the check entry comes up on this issue (below). Entering line 1 on line 2 sounds like the fix, but it also seems the way it is worded, line 2 would be subtracted from line 1 as the way to establish the limit and putting the same amount would result in "0". Am I reading that wrong? Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

When I did it, it didn't change my return value, which is what led me to believe it was the correct solution. When I entered 0 suddenly my return values halved (implying my deductions were adding incorrectly).

Definitely not a tax professional - just operating under the powers of deduction! I found this solution earlier in this thread and it was the only of three suggested solutions in different threads that worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Great point. The math should lead to the conclusion even if the wording doesn't make sense. Thanks for the quick responses!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

hey, what else have I got to do on a Friday night during pandemic, eh?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

I have the same concern so I have to really look for what it means. This is what I found:

Is there a limit to the amount I can deduct?

Yes, your deduction is generally limited if all mortgages used to buy, construct, or improve your first home (and second home if applicable) total more than $1 million ($500,000 if you use married filing separately status) for tax years prior to 2018. Beginning in 2018, this limit is lowered to $750,000. Mortgages that existed as of December 14, 2017 will continue to receive the same tax treatment as under the old rules.

So, it means there's a limit 750,000. Any number here lower than it should be able to deductible. I believe most people's mortage is so, thus, copy line 1 to line 2 is ok. But why is it a problem at the first place? Apparently, the system has bug on refinance. It acts like we didn't refinance, instead we have another mortage. If you had 2 houses, each has a 500,000 mortgage and deduct full amount of the first one, then the second one can only deduct 750,000-500,000=250,000.

Anyway, I won't become a hater of turbox tax for just one bug. Please fix it, Turbo!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

So this just happened to me and it was because of the way I had entered in my "outstanding mortgage principal" on one of our 1098 forms for 2020.

We did a refi and there was an outstanding mortgage principal listed in both of them on Line 2 on the 1098. When you do put an outstanding balance in both forms, then the program adds them together and if that number is greater than $750k, then it puts you in the category to "limit interest". To get that to go away, you need to go back to the deductions section and click on "edit" mortgage interest statement. Change the line 2 of the mortgage that you no longer owe on (like the one that you refinanced and paid off) to a 0 (zero) because you have refinanced out of that loan and no longer have an "outstanding mortgage principal". Once I changed one of mine to zero (the one that was paid off by the refinance) then it no longer popped up with that error at the end when I went to file. Happy I paid the little extra to get the real time answers with a CPA from the comfort of my home. I am very confident after filing that I fixed the error correctly. Hope that this answer will help those of you that had a similar scenario to mine!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Is anyone using the online version of Turbo Tax? If so how do you get to line 8a on the 1098 for? I don't see it when I go through the walkthroughs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Just curious if that applies to if your loan was sold to another mortgage company ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Do I put the outstanding balance of the 1st company to zero and report the outstanding balance I have with the current mortgage company ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Did you get a 1098 for both companies??

if so, then the new company would have the original loan amount and the one it was transferred from would be $0 in line 2 when you enter in the 1098. Hope that helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Yes! That is what I did and the error went away. But more importantly I got the advice from a CPA through the online program of TurboTax who is the one who guided me through fixing this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

I had this same error occur and your advice worked. I had a mortgage that was sold/serviced by a new bank and simply needed to enter 0 in Box 2 for the first bank/mortgage company (Box 2 is the amount left to pay off the home, which is 0 since it was paid off by the second bank that took over the mortgage). I dont think its a bug, as just an understanding of when you need to enter (either turbo tax or mortgage company should prompt or fix what is in Box 2 on the 1098)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Yes but for some reason this has not happened in the past when I have filed after a refinance. It definitely makes sense but I imagine it would happen a lot since you enter in the information as it is presented on the 1098. Glad that my input helped you out! 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

The only thing that makes me nervous about that method is that the IRS instructions online are very clear that for box 2 you must: "Enter the amount of outstanding principal on the mortgage as of January 1, 2020." I think putting the same amount for limited interest deduction as interest deduction might be the way to go.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

I had TurboTax so the math but it's still showing up blank and asking me to fill it in.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HeyJT

New Member

alex162

New Member

jennifer_gaul

New Member

jennifer_gaul

New Member

ort11

New Member