- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Don't see line 8a on 1098

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

TurboTax is asking me for the "Limited amount to report on Sch A, line 8a", on the Form 1098 section. But my Form 1098 Mortgage Interest Statement does not have a line 8a. ???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Did the program first say the mortgage interest might be limited and then ask if you wanted TurboTax to figure it or if you were going to calculate it yourself?

If you took out a Home Equity Line Of Credit, or refinanced and took cash out, the interest may need to be adjusted. TurboTax can do the math, but you need to enter how much cash was taken out and what you used it for. TurboTax also gives you the option of calculating it yourself. It SOUNDS like maybe you said you would calculate it yourself, and now the program is asking for the answer.

Try going back through the interview questions for the 1098 and have TurboTax make the calculation for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

No, it didn’t ask me if I would calculate it myself or if I wanted TurboTax to calculate it for me.

I did refinance last year, and used some of the cash to pay off debt. So, is this the amount that I enter on question A2- Limited amount to report on Sch A, line 8a? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Also, TurboTax never asked me any interview questions about this form. It just took me straight to this forum and told me to fill in the amount. How do I prompt it to take me through the interview questions again? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Itemizing TurboTax customers with deductible mortgage insurance premiums were receiving the following error when attempting to e-file their California returns:

Schedule CA:

Part II, Line 8e, Col A must equal the total of column A, line 8a, 8b, and line 8C

Part II, line 10, Col B must equal line 9

Resolved

We are happy to inform you a recent TurboTax update has been released resolving this issue. If you are using TurboTax Online, updates are applied automatically. If you are using TurboTax Desktop, make sure you download and install the latest update. If you need assistance with updating, please refer to the following support article.

How to Update TurboTaxhttps://ttlc.intuit.com/questions/1901183

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

It still isn’t working. Please advise!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Line 8a Form 1098 is the ” Address or description of property securing mortgage". The answer to the question is what is the limited amount, for the property the 1098 is for, that you will report on your Schedule A

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

I have the same error. It's NOT referring to Line 8a on Form 1098 but on Schedule A (itemized deductions).

It reads:

Home mortgage interest and points reported to you on Form 1098.

See instructions if limited

My guess is that the number on the line above the one with error just has to be copied over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Yes, if you have a Form 1098 reporting mortgage interest, you will report that on Schedule A Line 8a.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Let me try to clarify this problem.

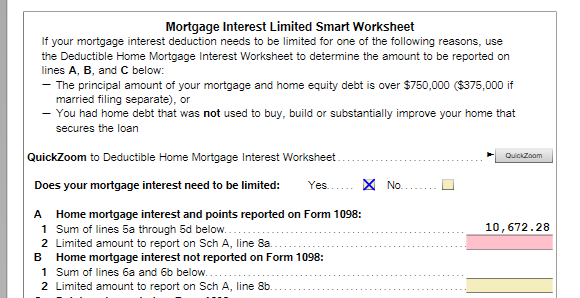

On the "Tax & Int Wks", in the Mortgage Interest Limited Smart Worksheet box, there is Section A.

Section A is the "Home mortgage interest and points reported on Form 1098:"

The question 2 is: "Limited amount to report on Sch A, line 8a" is red. It is an error.

I do not know what to put in that box. Last year that box was empty as well.

I've compared all my 1098 entry forms (the "Home Int Wkst" forms) from last year and this year and other than 2019 vs 2018 data, everything looks the same.

I do not how to resolve this error in Section A.2 of the "Mortgage Interest Limited Smart Worksheet".

Need some help...

(If you copy value from line A.1 to A.2 the error goes away, but this is something I didn't need to do last year and doesn't make sense -- the tool should figure this out).

Here is the section of interest (pun intended):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

I have exactly same issue here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Just found the solution from another thread:

Solution: In Forms View, go to "Tax & Int Wks" and scroll down to "Mortgage Interest Limited Smart Worksheet". Assuming it's correct for your situation, change "Does your mortgage interest need to be limited" from Yes to No.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Yes, if you have TurboTax Desktop, you can go to Forms Mode and change the worksheet.

For the Online products, you need to say No when the screen asks "Does your mortgage interest need to be limited" BUT AT THIS POINT DO NOT CONTINUE

Close out after selecting NO, do not click Continue

After you go back into your account, do not review the 1098 section or the answer will revert back.

Be sure you understand the limits to Home Mortgage Interest you can claim.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

I have the same issue.

Turbotax should include the limit or limited amount calculations. It is supposed to be a tax calculator. The user should not be required to do such hand calculations.

Can Intuit issue an software update, to include this calculation, now?

Another issue is this may come from the fact that I entered 2 mortgage lenders, because these lenders sell mortgages with the mortgage payer packaged, bank to bank. Then 2 lenders show up on my return, as if i had purchased 2 homes for a total of 2x amount. Lenders buying and selling ongoing mortgagees is so common, mine was sold 4 times in 5 years. Turbotax should handle that in the step by step guide.

What the IRS publication says, if I understand it correctly:

If you bought your house before 2017, and your mortgage amount is less than $1M, then you can deduct all the mortgage interest you paid. Meaning the line match with the line above it. For example if you bought it in 2016 with a $1.2M mortgage, then you have to calculate the mortgage interest amount portion of the $1M portion of the $1.2M mortgage, and enter that. For purchased after 2017, the limit is $750k mortgage amount, to qualify for full amount of MI to be deducted.

I'm not a tax expert, not even close.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Don't see line 8a on 1098

Same issue here, did anyone figure out why TurboTax can't make the calculation? they have all the data. I am not a tax advisor and as such I am using TurboTax. I don't want to do this calculation myself.

I have a 850k mortgage, I paid x of interest and points, I understand I should deduct only x *750/850. Does it mean I should insert this value on the question about limited amount to report? this is infuriating that TurboTax doesn't provide any guidance!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HeyJT

New Member

alex162

New Member

jennifer_gaul

New Member

jennifer_gaul

New Member

ort11

New Member