- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Doing personal return on Desktop business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

I purchased desktop business and it includes 5 personal returns. I do not see an option to work on my personal taxes. How do I access this option?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

You cannot prepare a personal tax return (Form 1040) on the TurboTax Business software. I believe it includes 5 federal e-file transmissions, but it does not include a personal tax option. For more information on the business software go to: TurboTax Business. For information on the Desktop Personal Software go to: TurboTax Desktop Software

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

It does include personal filing. It clearly states this in the link that states includes 5 federal e-files. opening the link shows personal returns are included. I just can't figure out how to access this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

Did you buy the Home & Business program? That is for personal returns that need Schedule C for self employment. Or did you buy the separate Business program for LLC, Partnership, Trusts, Estates? What kind of business return did you file?

If you bought the Home & Business program I can help you. I have H&B too.

In the Window's Home & Business Desktop program when you start a new return you get 2 choices. To prepare an Individual Tax Return or to prepare W2s or 1099s to give to your employees and sub contractors.

Click the big blue button to Start a New Return or go up to the top black menu bar first item, File-New Tax Return.

Then on the next screen it asks What would you like to do?

If you get a screen with 2 choices, Pick or Check the one that says Start a New Individual Tax Return or says 2023 US Form 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

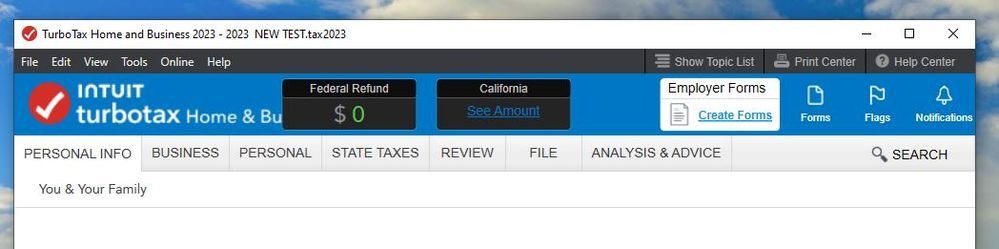

If you have Windows Home & Business I have screenshots to help. What screen do you see?

You want to get to this screen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

I purchased Turbotax business desktop. It includes 5 free returns. If you click the link in the advertisement it will show this to include personal taxes. This is the version you download not the online version.

https://turbotax.intuit.com/small-business-taxes/cd-download/

states "includes 5 federal e-files" clicking that link shows business and personal as options to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

Where does it say it does personal returns? Sorry that is the Business program. The Business program (which is only available for Windows, not Mac or Online) is only for a 1065 Partnership or LLC or a 1120 including a Single Member LLC - S corp or a 1041 Estate/Trust return. IT WILL NOT DO PERSONAL RETURNS.

If you don't need to do one of those business returns then you need to get a refund and buy a personal program like Home & Business or any of the other personal versions. All the personal desktop programs have the same forms. You just get more help in the higher versions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

OK I looked at that link. The link is for both Desktop Business Returns and Desktop Personal Returns. It doesn't mean that the Business program does personal returns. It just lists both kinds of programs. They are listed separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Doing personal return on Desktop business

Go to the Business page, https://turbotax.intuit.com/small-business-taxes/cd-download/#tax-forms And scroll down and click on Tax Forms. There are no personal forms listed like the 1040, only business forms.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Eszee88

Returning Member

user17704325340

New Member

7t9r743V

Returning Member

aaroneis

New Member

cindynr

New Member