- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

A PFD of $1,114 is more than $1,100 (barely, but $14 dollars) but when I enter it as 1099-MISC for child and want to report it on my return Turbotax deletes the Form 8814 saying it does not need to be reported at all. Yes, it's only $14 more than the threshold amount of $1,100 but why is it non-reportable?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

You are correct and you do have the option to add the PFD to your income. To do this click Start/Revisit in the Federal > Wages & Income > Less Common Income > Child's Income section.

Form 8814 has not been finalized yet and may be causing the error. This website shows the estimated availability dates of all federal forms that have not been finalized for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

You are correct and you do have the option to add the PFD to your income. To do this click Start/Revisit in the Federal > Wages & Income > Less Common Income > Child's Income section.

Form 8814 has not been finalized yet and may be causing the error. This website shows the estimated availability dates of all federal forms that have not been finalized for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

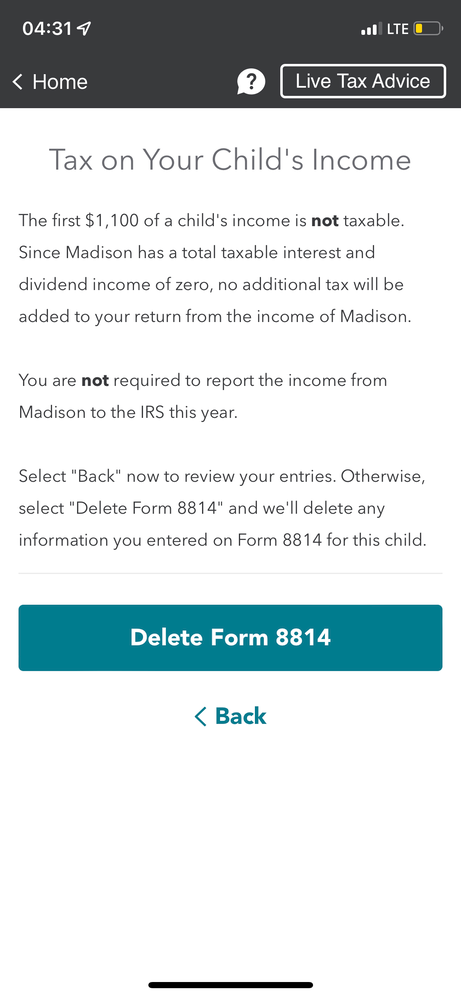

Yes, I follow these steps. It asks for the relevant information - there's even a radio button asking if it's an Alaska Permanent Fund dividend. It creates the form to report the income on my return (rather than a separate child's return (as I want to do - and have always done via TurboTax) then ultimately say the amount is less than the reportable amount threshold (which is $1,100 - correct?) and deletes the form indicating I do not need to report this income. Is it a rounding issue, since it's only $14 of reportable income?

I've tried multiple times, with the same result.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

The website says form 8814 is available on 3/31/2022. Do I really need to wait 8 more weeks to file a return with this minor amount of taxable income? What's the alternative? Separate return for child?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

It seems to work today. Three times the charm. Lots of effort to add $1 of tax to my return. Our Alaska legislators should really consider this $1,110 threshold when issuing the dividend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

Ok someone needs to explain this then! Why won’t it let me add my kid’s stuff?!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

The first $1,100 of a dependent's unearned income from sources like interest and dividends are not taxable and do not need to be included either on their own return or their parents' return. If your child's interest and dividends do not meet this threshold, you do not have to worry about reporting anything in 2021. The reason why so many people are asking about the Alaska PFD is that it is just above that threshold in 2021, causing a filing requirement for everyone who receives it, including dependent children.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

Yes. I understand that. The issue I believe many people are having is that you have to enter the $1114 on two different lines for it to register.

Once you go to Other Income—>child’s income and decide to add to a parents’ return, you need to fill out the dividend information. On the last page, enter the $1114 dividend on the top line AND in the list below enter it on the line that asks for how much of the above is from the Alaska Permanent Fund Dividend.

After that it creates the Form 8814 and transfers any tax to the parents return-in my case it was a $1.00 [taxable income of $14 (amount over $1110) x 10% rate equals $1.40, rounded down to $1).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

how did you get it to work? i'm still trying to finish filing my taxes but this is the only thing holding up the efile

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

In the "Child's Dividend Income" page, the Alaska Permanent Fund Dividends (APFD) are entered in two boxes in TurboTax; the top box "Ordinary Dividends" and the "Alaska Permanent Fund Dividends" box (5th box down). The APFD are a subset of ordinary dividends.

Here are the steps:

- "Income" tab

- Scroll to "Less Common Income"

- "Show More"

- "Start/Revisit" Child's Income"

- "Yes"

- "Yes"

- "Continue"

- "Edit" or "Add another child" as needed

- "Yes"

- "No" to Payments question

- "Yes"

- "Yes"

- Child's information

- Continue through to the "Child's Dividend" page

- Enter amount in top box "Ordinary Dividend" and 5th box "APFD" box

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

Has anyone been able to file with child's PFD on parent's return? Form 8814 is still not available until 3/31. Correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

Form 8615 is for children with investment income and it is available. Unfortunately, you need 8814 for reporting the Alaska Dividend and it is not showing as available. That $14 overage is making you wait.

It may take longer for one form or another to show up in TurboTax for multiple reasons. Our goal is to provide you with the most accurate information possible. As part of this process, we communicate often with the taxing agencies.

- IRS forms availability table for TurboTax individual (personal) tax products

- State forms availability table for TurboTax individual (personal) tax products

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

OK, we're well past the form date and I'm still getting the same response of 'you don't need to file for your child' after going through all the data entry... what gives?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

All forms are now available. If you are trying to include your child's Alaska PFD income on your return, make sure to enter the amount ($1,114) both in the first field titled Ordinary Dividends and the Alaska Permanent Fund Dividends field. Otherwise, the form will error and tell you that you are not required to report the income for your child if you only put it in the Alaska field.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I need to report child's Alaska Permanent Fund Dividend of $1,114?

This is the best advice given on this page. thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

jirahstinson

New Member

mortensondan

New Member

dean_eisel

New Member

lem_ffa

New Member