- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Disaster Distribution

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

Hello,

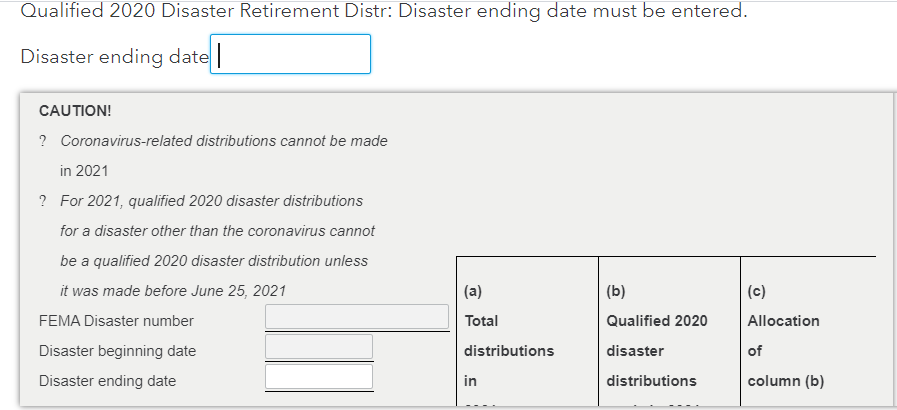

I am trying to finish my taxes and have to complete a form.

I am confused on a few things.

First I see where it says:

Thanks in advance for any help or information.

Lenny

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

Use None for the disaster name and ending date. COVID was never given a FEMA name and ending date, so None works in those fields.

While the law may allow the distribution to have been made in 2021, I don't think TurboTax program is able to handle that. The only way to find out is to try and see what happens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

Thanks Dan, I did put "none" and no date. I can only figure they aren't seeing the Form 8915E so I'll

send that in with the letter. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

Thanks Amy. I appreciate the help. I'll respond to the letter with the Form 8915E attached. It's quite a lot of money they're saying I owe so this is pretty important to me!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

Thank you for the quick response. I will give none a try in those boxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

So I was having the same problem with the end review saying I needed a name. So I went back they reread everything and on the part where you enter your info from the 2020 8915-E it says at the top under the box with check Mark ✅ it says 2020 form 8915E, line 4, column b (do not include coronavirus related distributions). So I took that amount out that I put in. When I first went to do this part it was already filled in per TT. It had 0 on this line and I changed it. Since this was a corona virus distribution should we not be putting an amount in? Even though line 4 on our 2020 has an amount. I feel like when I do it’s picking up that amount as a new distribution which is why it’s asking for a name? Just curious. Once I took that amount out it passed the review and let me move forward. But when I go back to that section under income and expenses it still shows needs review. I’m burnt out trying to figure this out it’s ridiculous. I’m about to file since it has no errors and pray for the best. TT needs to get it together with all this mess. Had to wait for this form, then see price went up $30 for what? Now this form is being stupid! What next? I was on hold for an hour today over a service code to get the price down. It ain’t my fault TT didn’t have the form available and even the code they gave me isn’t near what I could’ve paid had they had their stuff together. Jeez

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

Having the same issue...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

The disaster distribution section is still not working right. Filling out all of the info does not change the "needs review" flag and does not update income information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

I'm trying to report the 1/3 income from the 2020 disaster distribution and as of today, April 7 the software still is not allowing me to do so. It doesn't add the 1/3 amount to my income. Also, when the Turbo Tax software asks the question: "Did You repay any 2020 Qualified Disaster Distribution in 2021?" it doesn't mean the 1/3 income tax that was paid in last year's return, right? It means actual payment? Just wondering what I should do here to finish filing my returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

@apcoulte wrote:

I'm trying to report the 1/3 income from the 2020 disaster distribution and as of today, April 7 the software still is not allowing me to do so. It doesn't add the 1/3 amount to my income. Also, when the Turbo Tax software asks the question: "Did You repay any 2020 Qualified Disaster Distribution in 2021?" it doesn't mean the 1/3 income tax that was paid in last year's return, right? It means actual payment? Just wondering what I should do here to finish filing my returns.

Where asked if you repaid any 2020 Qualified Disaster Distribution in 2021, the question refers to any amount paid in 2021 only. If you did not repay any of the 2020 Coronavirus-related distribution in 2021 then you should answer NO.

Follow this procedure to report your 2nd year of the 2020 distribution -

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R in 2022

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty) or enter a 0

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

You should not receive the "Needs Review" in the Federal Review section if -

You Leave blank or enter a 0 in the box for 2020 Form 8915-E, line 4, column b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

Thank you, @DoninGA . I will try this method now. Regards the question about repayment. Does the amount (the 1/3) added to my 2020 income and taxed count as "repayment."?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

I'm still confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Disaster Distribution

IRS Form 8915-F information can be entered at the screen Did you take a 2020 Qualified Disaster Distribution? Report Qualified 2020 Disaster Distributions from Part II and Part III from the 2020 8915-E by following these steps.

- Go to Federal / Wages & Income / Retirement Plans and Social Security / IRA, 401(k), Pension Plan Withdrawals (1099-R).

- Click Start / Revisit to the right.

- At the screen Did you receive any 1099-R forms? select No.

- At the screen Have you ever taken a disaster distribution before 2021?, Click Yes.

- At the screen Did you take a 2020 Qualified Disaster Distribution?, enter 8915F and 8915E information.

- At the screen Did you take a disaster distribution at any time between 2018 and 2020? you are instructed to select YES if you need to report 1/3 of the amount of your distribution from a prior year. That has already been done. Select No, I didn't.

You may view the distributions on the 2021 Federal 1040 tax return at Tax Tools / Tools / View Tax Summary / Preview my 1040. You may view Form 8915-F at Tax Tools / Print Center / Print, save or preview this year's return / Include government and TurboTax worksheets.

Form 8915-F Part II distributions may be found on line 5b of the 2021 Federal 1040 tax return. The distribution is not reflected in box 5a. See entries for Part II of Form 8915-F on lines 12, 13 and 15.

Form 8915-F Part III distributions may be found on line 4b of the 2021 Federal 1040 tax return. The distribution is not reflected in box 4a. See entries for Part III of Form 8915-F on lines 23, 24 and 26.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cf_kirby

New Member

todi111

Level 2

mdcbk

Level 2

jfarnold50

New Member

sstevenson

New Member