- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: disaster distribution for 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

I took a disaster distribution between 2018 and 2020. I took the option offered to disperse the tax on this over three years. I am trying to claim the second year. Turbo tax will not allow this and tells me "unfortunately changes related to qualified distributions and repayments weren't ready in time for us to include them in this release. Please revisit this area later". when will the turbo tax program be fixed? as of now, there are no current updates regarding this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

Form 8915-F, Qualified Disaster Retirement Plan Distributions and Retirements will be available in TurboTax on 03/24/2022

Go to this TurboTax website for IRS forms availability - https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

Form 8915-F is used to report a disaster-related retirement distribution, and any repayments of those funds. It also allows you to spread the taxable portion of the distribution over three years, if needed and report prior year distribution amounts which are to be taxed in 2021. Form 8915-F replaces Form 8915-E.

Form 8915F won't be available until 03/24/2022.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

I took a large withdrawal from my 401k in 2020 as part of the CARES act. When I logged into TT to put in the info, I get as far as the "Which disaster affected you in 2020?" screen. Coronavirus is not listed there. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

I am having the same issue. Waited seven weeks for this form to be ready and it is still super confusing. I proceeded without it, and it is asking if I want to pay it all now or over the course of the next two years, but I thought I was in in year two of spreading it out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

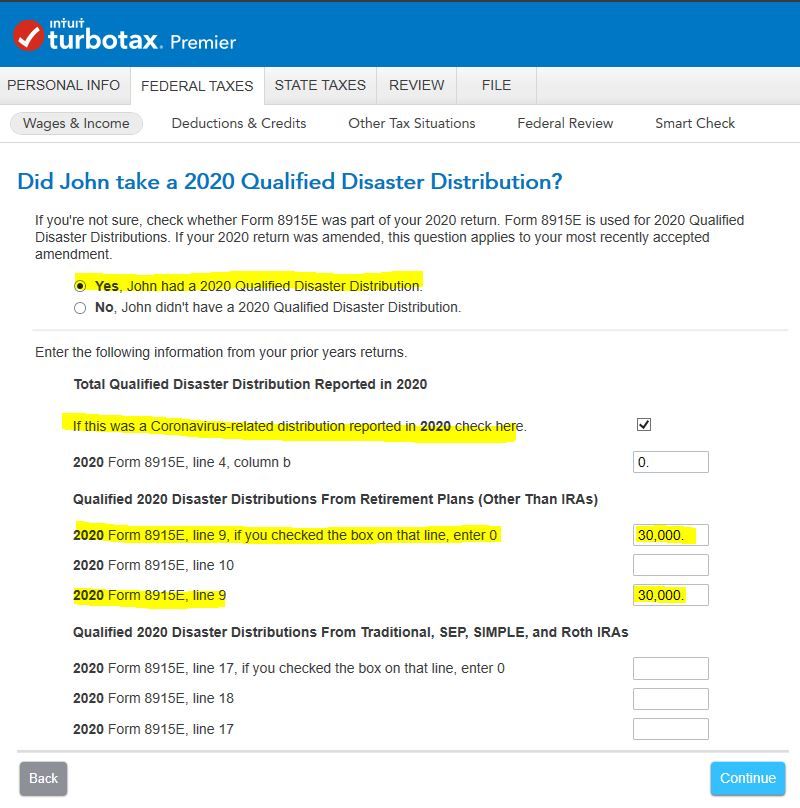

Yes, this is confusing but allow me to list the steps involved so you can report this as a Coronavirus distribution and not some other nasty disaster.

- After you have entered your 1099R, you will reach a screen that asks Was this a withdrawal due to a Qualified Disaster Distribution? You will check the box No, this was not a Qualified 2019, or 2020 Disaster Distribution. This is the screen where you were at initially.

- After you continue, there will be a 1099R summary screen. press continue at the bottom.

- There will be second screen that will now appear that asks Have you ever taken a disaster distribution before 2021? Here you will say yes.

- Next screen Did XXX take a 2020 Qualified Disaster Distribution? Here you will say yes.

- The very next screen will ask about your Coronavirus distribution. Here is where you will record the information.

@GWBancroft

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

I did what you stated and filled the next form in with the total taken and the one third number. When I went forward it did not include the on third number in the income. I am using the desktop deluxe version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

@rghug wrote:

I did what you stated and filled the next form in with the total taken and the one third number. When I went forward it did not include the on third number in the income. I am using the desktop deluxe version.

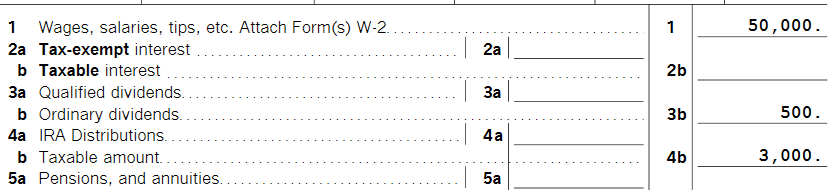

You have to enter the 1/3 of the 2020 distribution in -

Both boxes for Line 9 if the distribution was from a 401(k)

Both boxes for Line 17 if the distribution was from an IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

I entered the one third in 17, and the full amount in/from 4b. I am not sure what you mean by both boxes? I also checked the corona virus box. I tried to place the one third number in both line 17's and it still does not include the one third or any income for that action.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

I have the same issue. I am filling in the form on the desktop website and put in the full amount of the distribution and the 1/3 attributed to 2020. When I move forward it looks like its making/wanting me to pay takes on the full amount and not 1/3 of it as should be the case.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

By putting it in both boxes it changed the amount of taxes that have to be paid, but did not change the income number. Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

It's important to complete the information carefully. If you put the retirement amount in the wrong box or two different boxes then the income will populate the way you describe. I will show you steps and then my example image to assist.

- Wages & Income > Retirement Plans and Social Security >

- IRA, 401(k), Pension Plan Withdrawals (1099-R) > Start, Revisit or Update > Continue

- Answer Yes 'Have you ever taken a disaster distribution before 2021?

- Answer Yes, You had a 2020 Qualified Disaster Distribution

- Complete the Information using your 2020 Tax return > Continue

- Enter any amount you may have repaid in 2021, if applicable

- Finish the entry for your spouse if applicable or just click Continue

- Complete any additional retirement questions as you move through this section

- Continue until you have finished and returned back to the Wages & Income Screen.

- Do NOT stop and change sections without completing it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

disaster distribution for 2020

Going through your example, and making sure to complete the entire section has the PDF filing report looking correct (it added the one third income and used the 8915-f). On the screen it still does not show the one third added to income, but I do not care 😉 Thank you for the assistance!! The way to fill out the form was not clear at all; just some feedback.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cusie05

New Member

G8g

Level 1

user17718157531

Level 1

libralope

New Member

jonathon-hibbard

New Member