- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Date Form 8911 is available for TT 2023?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

Now TT is saying February 28th. What's the deal?????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

Just my opinion when reviewing the facts, but all I see is when the IRS released form 8911 on January 19, 2024 (https://www.irs.gov/newsroom/treasury-irs-issue-guidance-on-the-qualified-alternative-fuel-vehicle-r...)

There have been other times each year when IRS updated forms in January and Intuit TurtleTax updated forms before February 1st (and I had no problems with that understanding the 31st deadline like how companies need to get W-2s out) but the past few years they have been slacking and it seems they keep playing circus games with delaying forms and continued lies like what we see here. The ball is definitely all in their court and has been since January 19. They have had over a month to do one simple task! This form is not complicated.

Last year (2023), TurtleTax kept moving the goal posts.

https://ttlc.intuit.com/community/taxes/discussion/2023-form-8936-availability/00/2804027

It was 1/20, 1/26, 2/02, 2/09, "Available Soon", 2/10 released.

I think for many years they have banked on their prior reputation, but quality is gone rubbish ever since.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

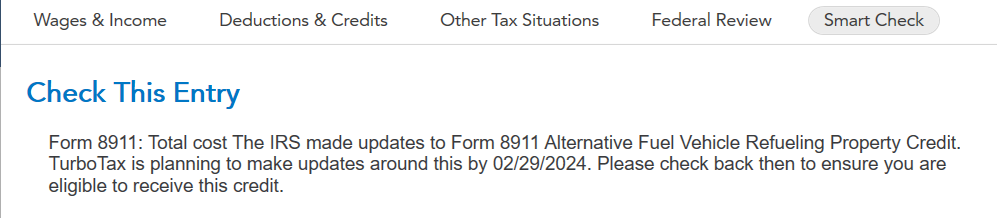

When I try to submit, at first it said that turbotax would update form 8911 by 2/21/2024 but today (2/21/2024) when I tried to file, it says that that turbotax will make changes to the form by 2/28/2024.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

This is a known issue and TurboTax is working to resolve it as soon as possible. The IRS made updates to Form 8911 Alternative Fuel Vehicle Refueling Property Credit. TurboTax is planning to make updates around this by 02/28/2024. Please check back then to be sure you are eligible to receive this credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

This morning, Feb 22, 2024, I started TT Deluxe and it pulled down a new update that says that the next update is scheduled for Feb 29, 2024.

Is that the final update?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

My startup of TurboTax pulled down that update. And yes, it did eventually give a new "now + 1 week" date of February 29.

But what concerned me more is that the form now demands the GEOID (and other information) about the location of the EV charger. Until now, my reading of the tax law was that an EV charger installed in an ordinary single-family home was eligible for a tax credit regardless of location.

Is that not true?🙁 I purchased the charger in the belief that it would be 30% covered by the tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

The new instructions from the IRS (as of January, 2024) is ALL ABOUT the location of the property. I suggest reading just the first few lines of instructions at https://www.irs.gov/instructions/i8911

In a nutshell, we have to enter the GEOID for the census tract corresponding to the property where the alternative fuel device was installed. For example my GEOID is [phone number removed]. To get that GEOID, the instructions provide a link: www.CDFIfund.gov/cims

Given the GEOID, the instructions say to search for the GEOID in the appendix IRS.gov/pub/irs-drop/Appendix-A-List-of-2015-Ce[product key removed]ary-30c-Eligible-Tracts-v2-1-4-2...

If your GEOID is not in the appendix, we do not qualify for the tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

Circus show continues...

When IRS updated Form 8911 on January 19, 2024, the new requirement was the eligibility census tract. I think many of us purchased under the same assumption of the 30% tax credit based on rules from the past.

Property must be located in an eligible census tract.

Refueling property placed in service after 2022 will not be treated as qualified alternative fuel vehicle refueling property unless the property is placed in service in an eligible census tract. For this purpose, an eligible census tract is any population census tract that is described in section 45D(e) or that is not an urban area. See Eligible census tract (https://www.irs.gov/instructions/i8911#en_US_202312_publink[phone number removed]).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

It appears that the 30% tax credit is restricted to poor neighborhoods and rural areas. I live in a working-class suburban neighborhood. As far as I can tell from the lookup and appendices, my census tract does not qualify.

Rather than wait indefinitely for TurboTax to tell me that I don't qualify, I will perhaps just delete the Form 8911 entirely and file my tax return without it.🙁

By the way, I did not qualify for a tax credit on my car purchase either. The car is a 2-year-old plug-in hybrid, but its price was over the $25K limit.🙁

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

I hear you. I think that I will end up filing w/o form 8911 too as the location where I installed the Level 2 charger for our EV is NOT in any census tract defined in that appendix. We live in the middle class burbs. It's just really hard to take as my wife and I are retired and every dime matters to us now. I'm waiting, and hoping that something will change - which seem highly unlikely.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

1 day later and now it says 02/29. This has been happening since 01/20. It is current date + 7 days. This is insanely unprofessional for a PAID service. The TurboTax bots keeps mocking us by copy and pasting the current date into this thread. Pick a date, commit to it, and if you must fail then put an explanation with a new date. Stop using current date + 7 days.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

The IRS recently clarified changes to Form 8911 Alternative Fuel Vehicle Refueling Property Credit. TurboTax is planning to make updates around this by February 29, 2024.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

The IRS recently clarified changes to Form 8911 Alternative Fuel Vehicle Refueling Property Credit. TurboTax is planning to make updates around this by February 29, 2024.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

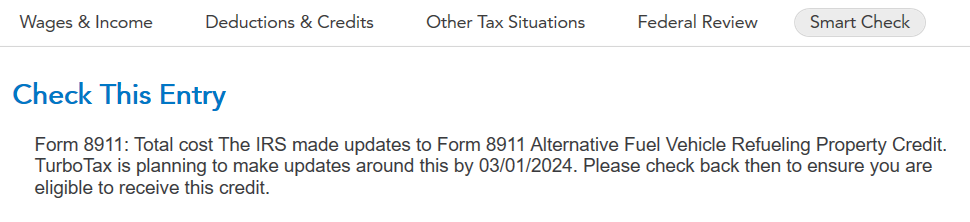

Today (Feb 23), TT estimates that the update will no longer arrive on Feb 28, but will arrive on March 1. I'm losing confidence in the estimated arrival date of the update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Date Form 8911 is available for TT 2023?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thomasjosephmorris

New Member

jmunsell1150

New Member

SimmsQuestions

New Member

jocelyne64

New Member

bklawns2

New Member