- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

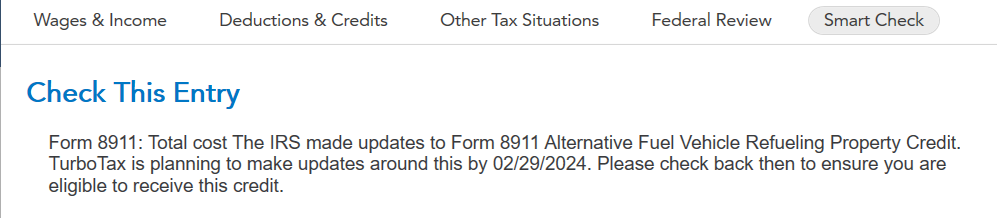

Circus show continues...

When IRS updated Form 8911 on January 19, 2024, the new requirement was the eligibility census tract. I think many of us purchased under the same assumption of the 30% tax credit based on rules from the past.

Property must be located in an eligible census tract.

Refueling property placed in service after 2022 will not be treated as qualified alternative fuel vehicle refueling property unless the property is placed in service in an eligible census tract. For this purpose, an eligible census tract is any population census tract that is described in section 45D(e) or that is not an urban area. See Eligible census tract (https://www.irs.gov/instructions/i8911#en_US_202312_publink[phone number removed]).

February 22, 2024

5:37 AM