- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Crypto cost basis question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto cost basis question

So I was forced to transfer some SOL coins from Binance to Uphold last year. Uphold doesn't list the cost basis on the 1099, so I had to get the date and price from Binance to fill that out. (I did that correctly, right?)

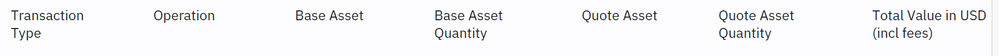

But I'm a little confused by the Binance report that was generated (not a 1099) and the figures that are listed on the purchase date:

It lists 600 under "Base Asset Quantity" (base asset was USD) meaning $600 was originally used to purchase before the fees got to me.

But then it lists $587 under "Total Value in USD (incl fees)".

Which figure would I enter for the cost basis?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto cost basis question

Your cost basis is the original purchase price plus any commissions or fees paid at the time of acquisition. If you paid fees to liquidate your crypto, those fees are deducted from the sales proceeds as "selling fees."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto cost basis question

@PatriciaV I'm still a little confused, sorry. Maybe you could help me determine which fees to report where, or where/how to include them, and what is the cost basis? I'd really appreciate it. I feel like my brain just isn't grasping what type of fee it is and which amount is the cost basis.

2024-01-23 - Buy

Base Asset (USD) Quantity $600.03 <<

Quote Asset (SOL) Quantity 7.16731 <<<<

Total Value in USD (incl fees) $587.41 <<

2024-07-13 - Withdrawal (Transfer)

Base Asset (SOL) Qty 7.09564 <<<<

So, I see a cost difference on the date or purchase (fees in USD?), but then a quantity difference on the date of transfer (fees in SOL coin?). I guess that's two different types of fees to report or include, somewhere, maybe?

And then not sure if cost basis would be 587, 600, or something else...

Thank you 🙏

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto cost basis question

Using that example the cost basis for the SOL is $587.41. That is it's total value including fees at the time of purchase. I would assume the fees were then removed which reduced the quantity of SOL that you had in inventory.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

crosnb

New Member

gmswartz

New Member

Not Making It Easy

Returning Member

kernryan8

New Member

Av74O0OhzB

Returning Member