- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Crypto cost basis question

So I was forced to transfer some SOL coins from Binance to Uphold last year. Uphold doesn't list the cost basis on the 1099, so I had to get the date and price from Binance to fill that out. (I did that correctly, right?)

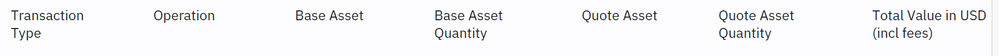

But I'm a little confused by the Binance report that was generated (not a 1099) and the figures that are listed on the purchase date:

It lists 600 under "Base Asset Quantity" (base asset was USD) meaning $600 was originally used to purchase before the fees got to me.

But then it lists $587 under "Total Value in USD (incl fees)".

Which figure would I enter for the cost basis?

Thank you!

Topics:

April 5, 2025

7:26 AM