- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: COVID Relief Withdrawl Year Two not populating correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

COVID Relief Withdrawl Year Two not populating correctly

I am trying to add the second third of the COVID 401k withdrawal and not having any success. I have tried using the 1099 I received for 2020 and entering that but it thinks it's a new disaster and populates the 8915-F like the year one calculation. I have since deleted that and continued through the questions following completion of entering retirement 1099's. At this point it continues with a series of questions and it asks the right questions for a second year COVID/other disasters and even asks for the figures on my last year 8915-E. But once back to the Income screen it does not add the dollars to income. I have even looked at the actual return forms and the 8915-F is not even one of the completed forms. Anyone have suggestions or does anyone know if TurboTax knows this is an issue? Or am I just doing something wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

COVID Relief Withdrawl Year Two not populating correctly

I had the same issue! spent over an hour with TT and still didn't get it fixed. But I went in and deleted everything related to the withdraw and restarted. There is a screen that asks if you have retirement income on a 1099R and you need to answer "no" the next screen asks if you received disaster income in 2020 and I answered yes. then it's just a matter of pulling the numbers from your 8915E from last year. You can also reach the 8915 for this year on the "Forms" clicking in the upper right hand corner of the screen. There are a bunch of answers to this question but I still couldn't get it to work right until I removed all my answers, saved it and then went back in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

COVID Relief Withdrawl Year Two not populating correctly

Please follow these steps to report the 2nd portion of the COVID distribution or any repayment:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2021 1099-R answer "No" to "Did you get a 1099-R in 2021?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2021?" screen

- Follow the instructions on the screen

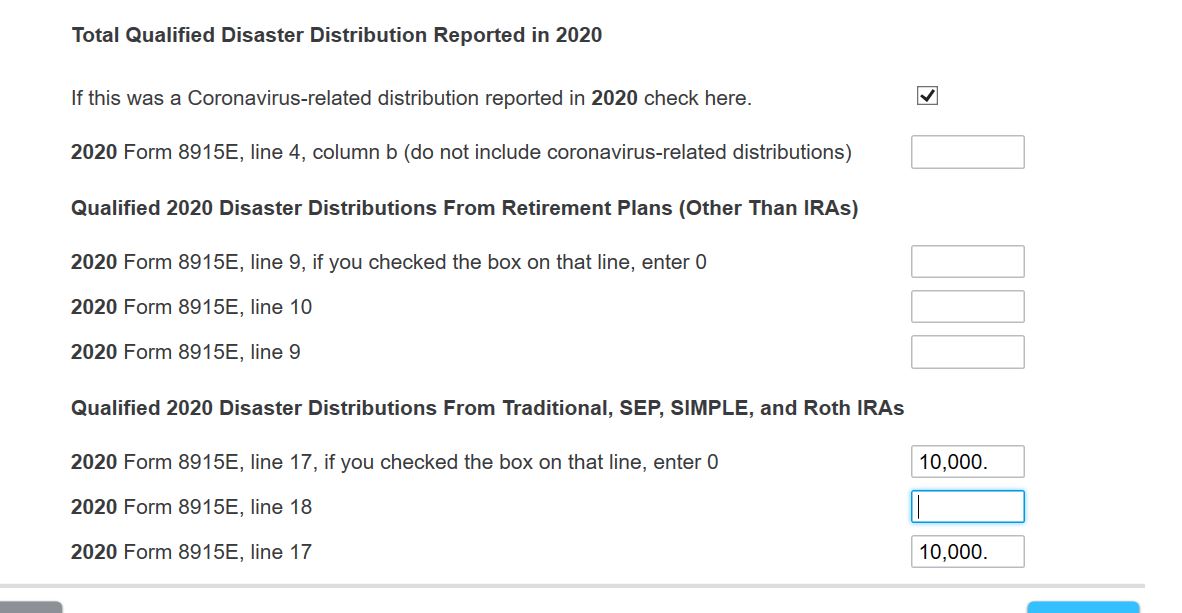

Please verify that you check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here". Also, make sure you enter the amount from Form 8915-E, line 9 twice (if it was not from an IRA) or enter the amount from Form 8915-E, line 17 twice (if it was from an IRA). This amount should be 1/3 of your 2020 COVID distribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

COVID Relief Withdrawl Year Two not populating correctly

I may have misled everyone and my apologies if I have. I have TT Premier download to PC. I don't have TT on-line so your answer while relevant and very understandable doesn't fix my issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

COVID Relief Withdrawl Year Two not populating correctly

Please make sure you enter the 1/3 distribution amount twice on the entry screen.

Please follow these steps to report the 2nd portion of the COVID distribution or any repayment in TurboTax Premier Download:

- Click "Federal Taxes" on the top and select "Wages & Income"

- Click "I'll choose what to work on"

- Scroll down and click "Start" next to "IRA, 401(k), Pension Plan (1099-R)"

- Answer "No" to the question "Did You Have Any of These Types of Income?" if you didn't have a Form 1099-R for 2021 (If you have a Form 1099-R then enter all 1099-Rs and after entering your last 1099-R click "Continue" on the “Your 1099-R Entries” screen)

- Answer "Yes" to the "Did you take a disaster distribution in prior years or any repayment…" screen

- Answer "Yes" on the "Did you take a 2020 Qualified Disaster Distribution" screen

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

Please sure you enter the amount from Form 8915-E, line 9 twice (if it was not from an IRA) or enter the amount from Form 8915-E, line 17 twice (if it was from an IRA). This amount should be 1/3 of your 2020 COVID distribution.

For example, if you had a $30,000 distribution from an IRA:

You should have an entry on line 5b (for none IRA) or 4b (for IRA) to show 1/3 of the COVID distribution as taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17702351396

New Member

HikingTaxGuy

Level 1

christine1

Level 3

Gary97531

Level 2

user17577754113

New Member