- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Please make sure you enter the 1/3 distribution amount twice on the entry screen.

Please follow these steps to report the 2nd portion of the COVID distribution or any repayment in TurboTax Premier Download:

- Click "Federal Taxes" on the top and select "Wages & Income"

- Click "I'll choose what to work on"

- Scroll down and click "Start" next to "IRA, 401(k), Pension Plan (1099-R)"

- Answer "No" to the question "Did You Have Any of These Types of Income?" if you didn't have a Form 1099-R for 2021 (If you have a Form 1099-R then enter all 1099-Rs and after entering your last 1099-R click "Continue" on the “Your 1099-R Entries” screen)

- Answer "Yes" to the "Did you take a disaster distribution in prior years or any repayment…" screen

- Answer "Yes" on the "Did you take a 2020 Qualified Disaster Distribution" screen

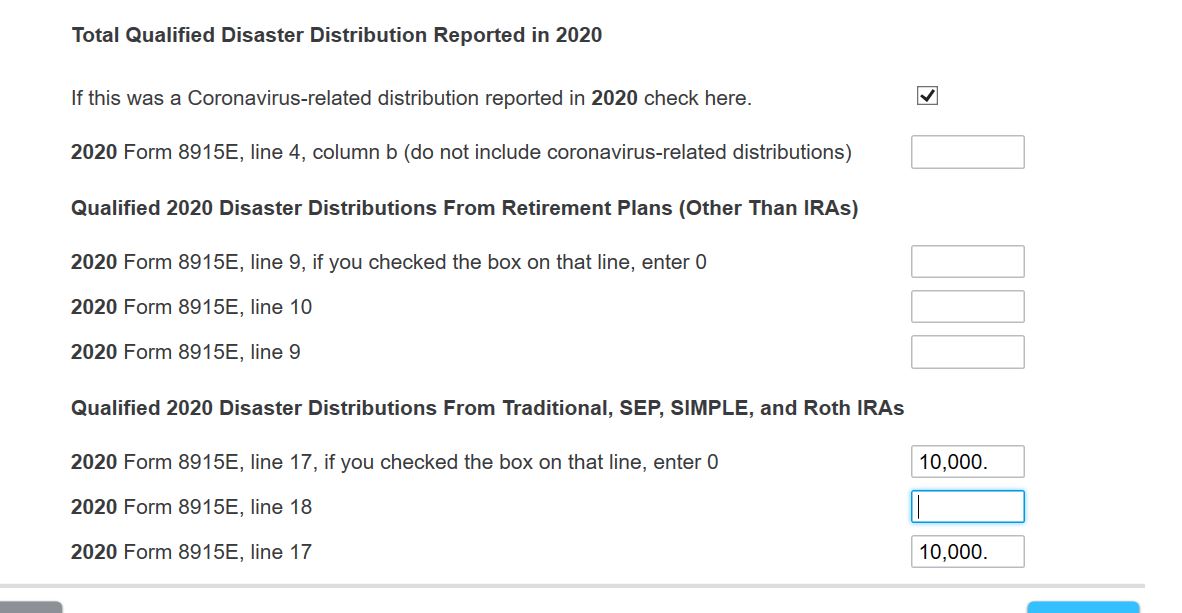

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

Please sure you enter the amount from Form 8915-E, line 9 twice (if it was not from an IRA) or enter the amount from Form 8915-E, line 17 twice (if it was from an IRA). This amount should be 1/3 of your 2020 COVID distribution.

For example, if you had a $30,000 distribution from an IRA:

You should have an entry on line 5b (for none IRA) or 4b (for IRA) to show 1/3 of the COVID distribution as taxable.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 6, 2022

6:04 AM

466 Views