- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Cost of tax prep

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

Can I deduct the cost of tax preparations done for other countries? I have to file in the UK as well as the US. How about for the cost of US tax preparations for years other than the current year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

No. The "miscellaneous expense" deduction for tax preparation was eliminated by the tax laws that changed for 2018 and beyond.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

Even if I itemize deductions? It's still a question being asked in my 2019 version of TurboTax, where it says that if I spent more than 2% of my AGI, it can qualify. Having had to pay nearly $3000 for an accountant to do my (complicated) UK taxes means I'd certainly qualify -- if I can count tax prep for foreign countries. I haven't downloaded the 2020 version yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

Tax year 2017 was the last year that you could use the 2% of AGI floor for deducting tax preparation costs along with a number of other miscellaneous itemized deductions. Quite a few of those deductions were eliminated when the tax laws changed for 2018 and beyond, Please click the link already provided to you and read about some of those changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

Wow! I'm surprised that TurboTax is still including it in 2019's software then! Seems like an easy way to have people make some serious mistakes in filing their taxes!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

Users who are self-employed can enter it on their Schedule C.

And there are some states that still allow certain itemized deductions on state returns, so the software still allows them to be entered so that they can flow to state returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

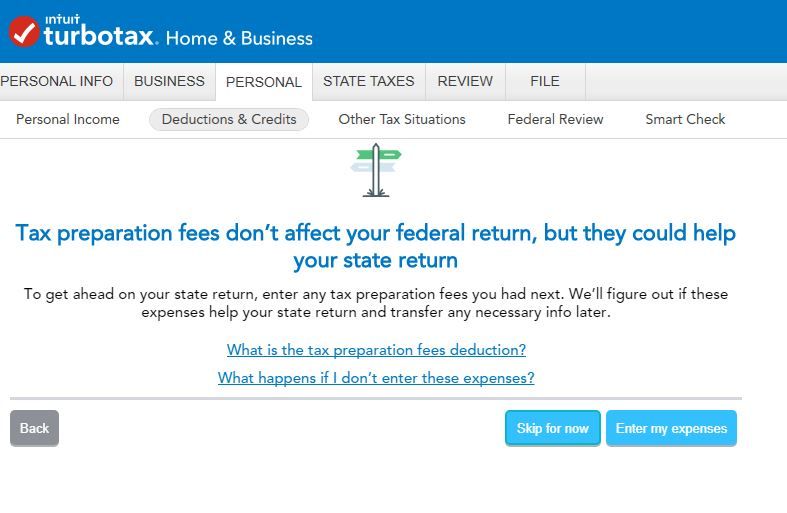

It's still in the program because it can be used for state. If you click on Start by Tax Prep Deduction you should get this screen from my 2019 Desktop program. Did you see this? Is your program updated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

Yes, thanks, I see that on my state screen. (I check updates every time I log on.) I guess I'll just assume it will flow appropriately! My question remains though: can I deduct (if my state is one that allows it) the cost of preparing FOREIGN taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

Yes you can. Tax prep fees are tax prep fees.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

Thanks all for the clarifications.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cost of tax prep

@MeegsC wrote:

Wow! I'm surprised that TurboTax is still including it in 2019's software then! Seems like an easy way to have people make some serious mistakes in filing their taxes!

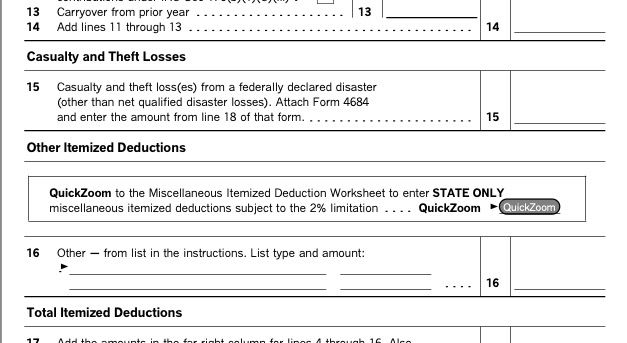

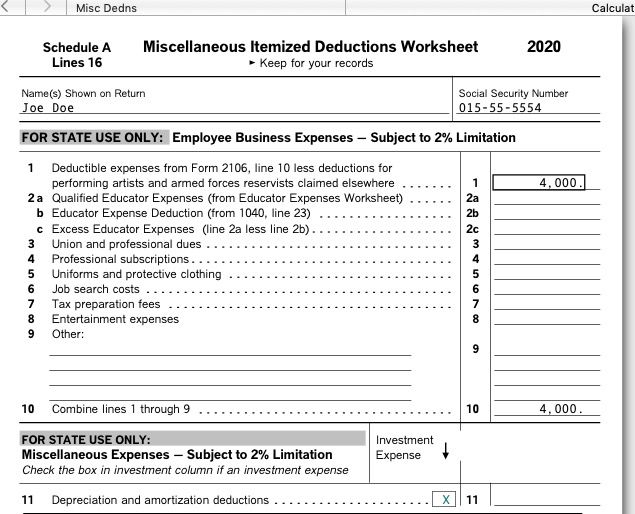

Several states have not adopted the Federal tax laws that eliminated the Federal credit but it is still allowed in those states on the state tax return. Since all state itemized deductions flow from the Federal worksheets, in order to get the state credit, it must be entered in the Federal section .

That is only one of several credits eliminated for 2018-2025 on the Federal return but still allowed for certain states.

The Federal Schedule A (itemized deductions) for line 16 has a state only worksheet.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jays1951-gmail-c

Level 1

chloelancaster97

New Member

c0ach269

Returning Member

SB2013

Level 2

ohjoohyun1969

New Member