- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Correcting prior year unallowed passive loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting prior year unallowed passive loss

I received a form 8986 making a correction to the ordinary income in 2019 for a partnership that to date has only generated passive losses that have been unallowed. The correction reduced (but did not eliminate) the 2019 loss. I have produced form 8978 (and the associated Schedule A and the statement of how I calculated the adjusted tax due, which was 0) to file with my 2022 return. However, I cannot figure out how to correct the prior year carry-forward of my unallowed passive loss on Form 8582 on my 2022 return. Should I be making the correction somewhere else? If so, where / how? Thanks for any help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting prior year unallowed passive loss

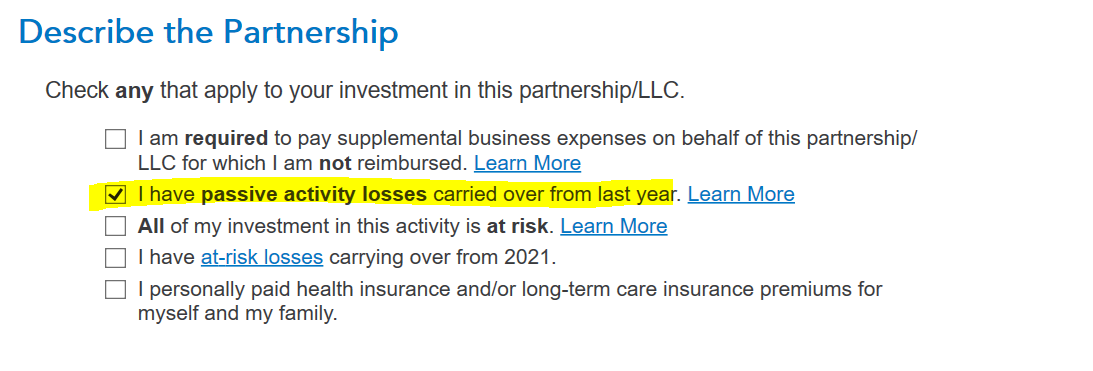

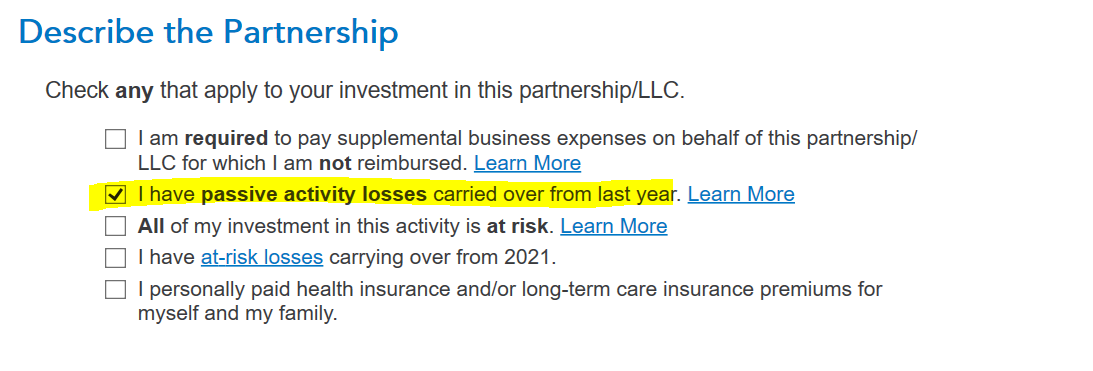

When you enter your K-1 schedule for the partnership in TurboTax, you will come to a screen that says Describe the Partnership and you need to choose the option I have passive activity losses carried over from last year.

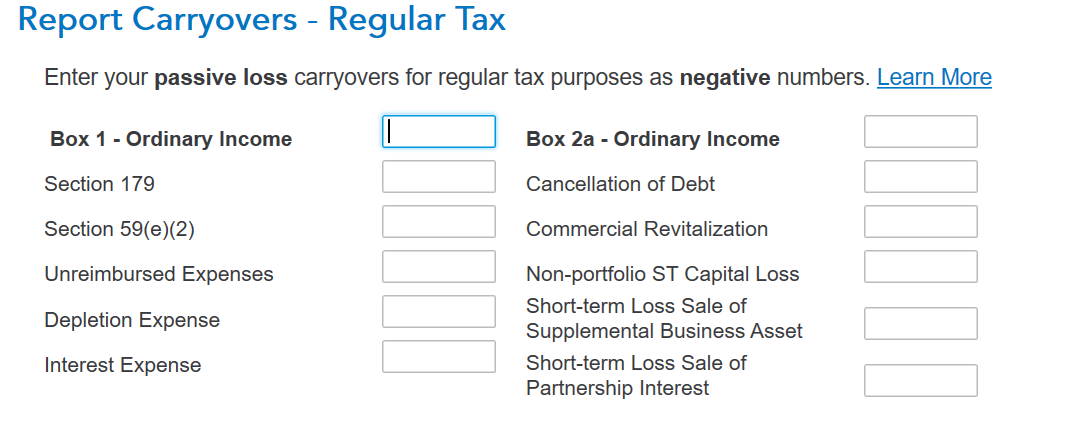

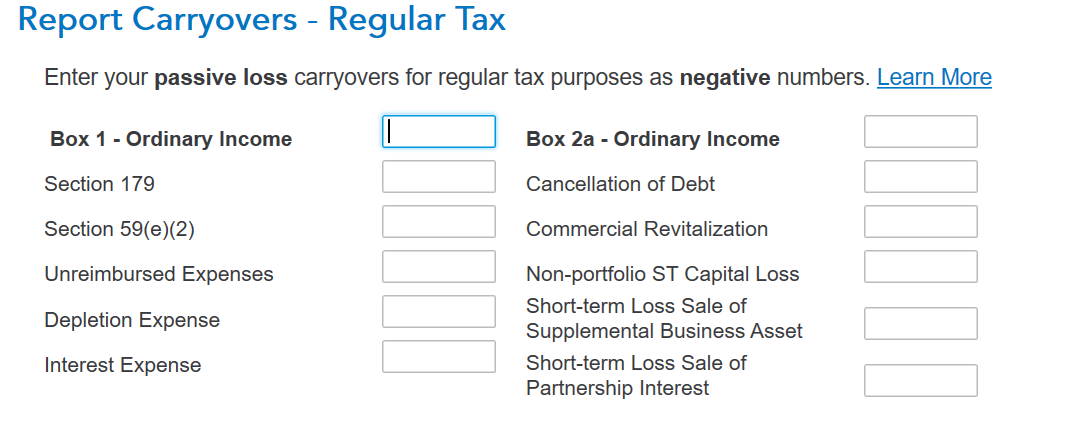

Later, you will see a screen where you can enter or adjust your passive loss carryovers from the prior year. Those entries will transfer to your form 8582.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting prior year unallowed passive loss

When you enter your K-1 schedule for the partnership in TurboTax, you will come to a screen that says Describe the Partnership and you need to choose the option I have passive activity losses carried over from last year.

Later, you will see a screen where you can enter or adjust your passive loss carryovers from the prior year. Those entries will transfer to your form 8582.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting prior year unallowed passive loss

@ThomasM125 - Thank you! That did the trick. Your help is much appreciated.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kgz1

Level 1

kgz1

Level 1

jrbeville13

New Member

xhx831

Level 1

prit

Level 2