- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Correcting prior year unallowed passive loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting prior year unallowed passive loss

I received a form 8986 making a correction to the ordinary income in 2019 for a partnership that to date has only generated passive losses that have been unallowed. The correction reduced (but did not eliminate) the 2019 loss. I have produced form 8978 (and the associated Schedule A and the statement of how I calculated the adjusted tax due, which was 0) to file with my 2022 return. However, I cannot figure out how to correct the prior year carry-forward of my unallowed passive loss on Form 8582 on my 2022 return. Should I be making the correction somewhere else? If so, where / how? Thanks for any help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting prior year unallowed passive loss

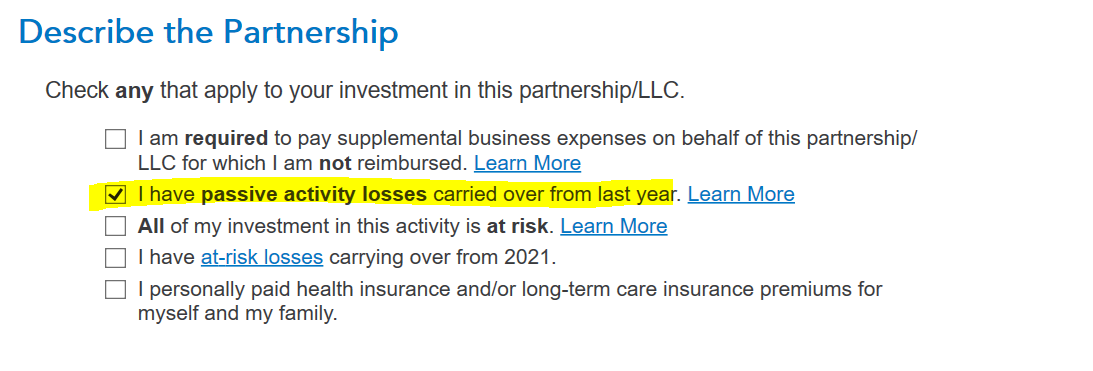

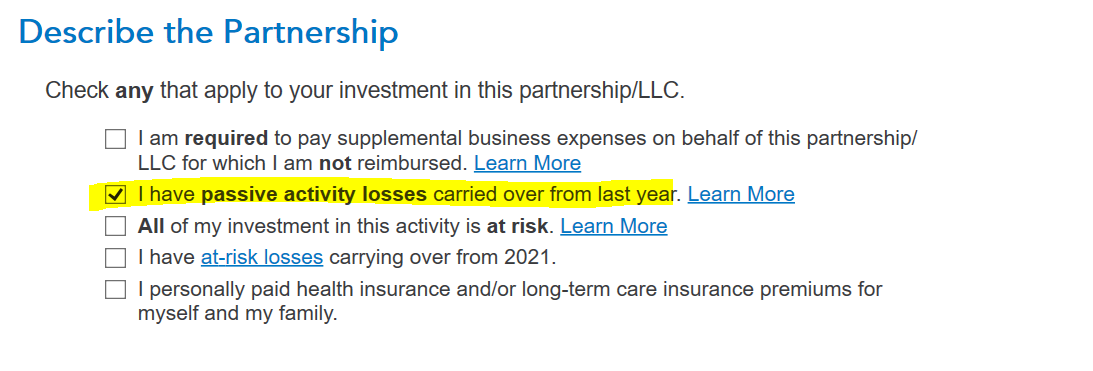

When you enter your K-1 schedule for the partnership in TurboTax, you will come to a screen that says Describe the Partnership and you need to choose the option I have passive activity losses carried over from last year.

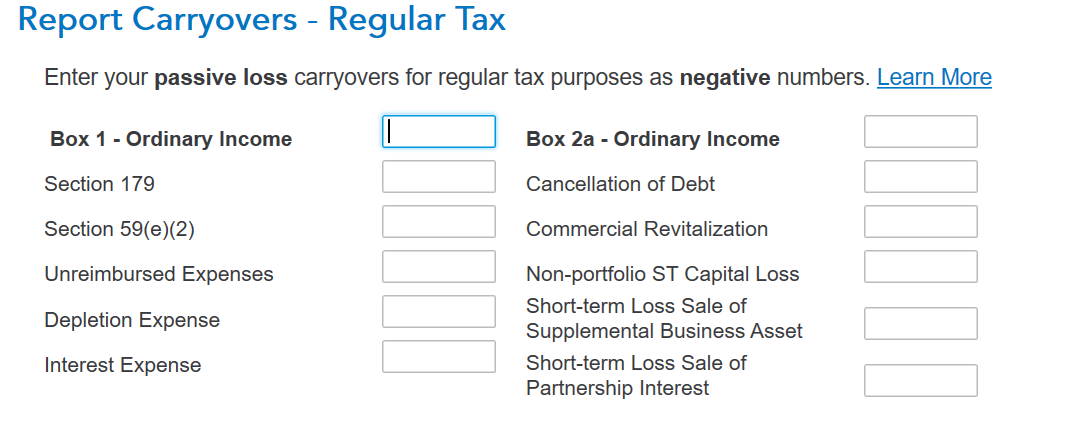

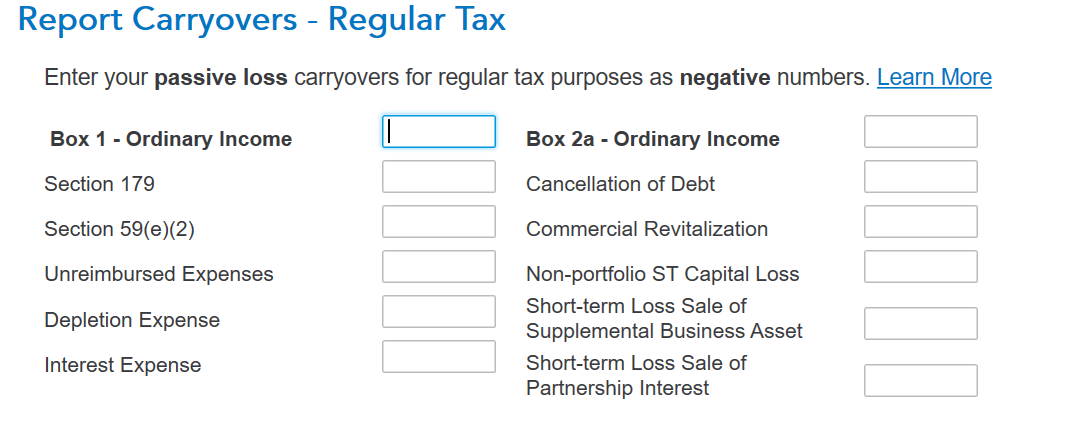

Later, you will see a screen where you can enter or adjust your passive loss carryovers from the prior year. Those entries will transfer to your form 8582.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting prior year unallowed passive loss

When you enter your K-1 schedule for the partnership in TurboTax, you will come to a screen that says Describe the Partnership and you need to choose the option I have passive activity losses carried over from last year.

Later, you will see a screen where you can enter or adjust your passive loss carryovers from the prior year. Those entries will transfer to your form 8582.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correcting prior year unallowed passive loss

@ThomasM125 - Thank you! That did the trick. Your help is much appreciated.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xhx831

Returning Member

prit

Level 2

user17524270358

Level 1

alex1907

Level 2

ABM3

New Member