- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Charitable Contributions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Contributions

I had charitable contributions of $220 entered, however, during a review it shows a potential error for that amount. Does the additional credit only apply to "cash" donations and not "cash value" of items donated to qualified charities?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Contributions

Just cash donations. You can take a deduction of up to $300 for cash donations to charitable organizations even if you are taking the standard deduction. It does not include the "cash value" of items donated to qualified charities

In order to take a deduction for your charitable donations if you are taking the standard deduction, there is an extra step to take in addition to entering the figure in charitable donations. Please follow these steps:

- After entering your deductions, you will see a screen telling you which method is right for you -- standard or itemized deduction.

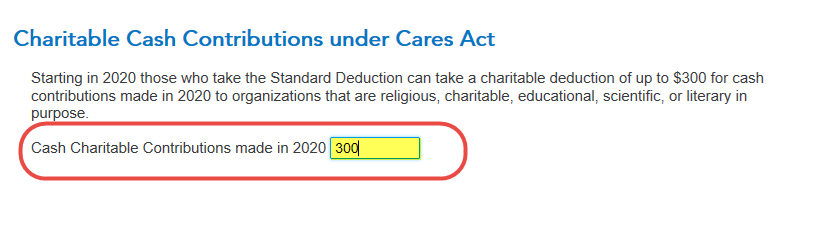

- If you are taking the standard deduction, after that screen you will see a Charitable Cash Contributions under Cares Act. [See screenshot below.] Enter the amount of your charitable contribution in the box (up to $300). Click Continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Contributions

Thank you. A follow-up question - if I made a cash donation as a qualified charitable contribution as part of an RMD, can that be used to qualify for the additional credit even though I am not allowed to itemize it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Contributions

No. You are already getting credit for it by excluding it from your RMD taxable income.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lunna

Returning Member

MarkMcDonough

New Member

Diana23

Level 2

steinerre2020

New Member

CFinAZ

Level 1